Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harrod's Sporting Goods Jim Harrod knew that service, above all, was important to his customers. Jim and Becky Harrod had opened their first store in

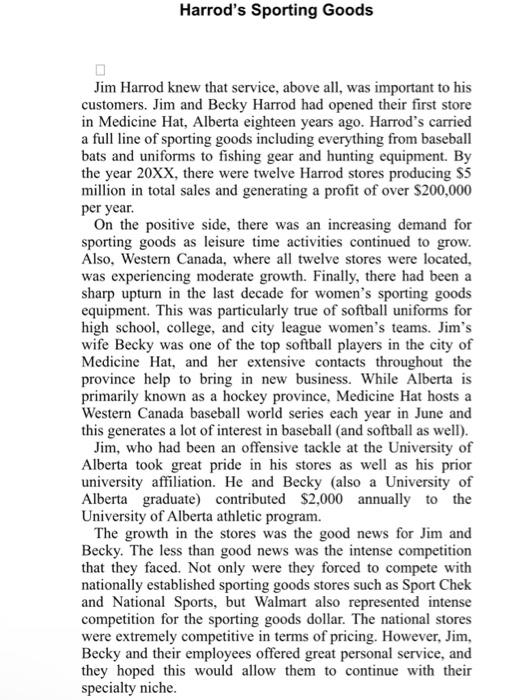

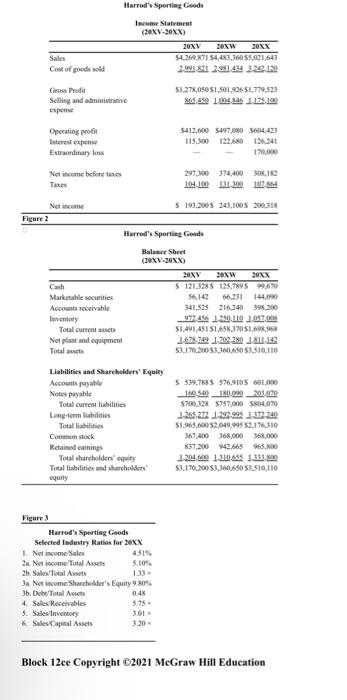

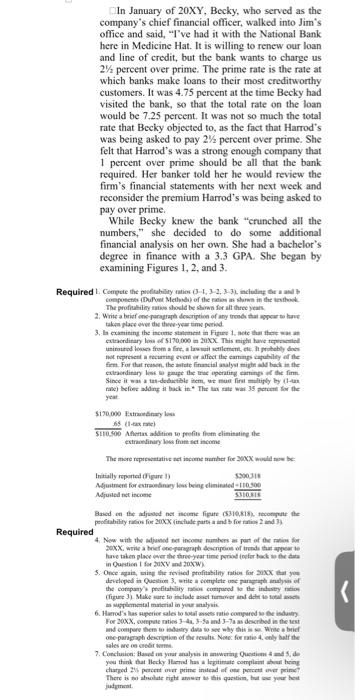

Harrod's Sporting Goods Jim Harrod knew that service, above all, was important to his customers. Jim and Becky Harrod had opened their first store in Medicine Hat, Alberta eighteen years ago. Harrod's carried a full line of sporting goods including everything from baseball bats and uniforms to fishing gear and hunting equipment. By the year 20XX, there were twelve Harrod stores producing $5 million in total sales and generating a profit of over $200,000 per year. On the positive side, there was an increasing demand for sporting goods as leisure time activities continued to grow. Also, Western Canada, where all twelve stores were located, was experiencing moderate growth. Finally, there had been a sharp upturn in the last decade for women's sporting goods equipment. This was particularly true of softball uniforms for high school, college, and city league women's teams. Jim's wife Becky was one of the top softball players in the city of Medicine Hat, and her extensive contacts throughout the province help to bring in new business. While Alberta is primarily known as a hockey province, Medicine Hat hosts a Western Canada baseball world series each year in June and this generates a lot of interest in baseball (and softball as well). Jim, who had been an offensive tackle at the University of Alberta took great pride in his stores as well as his prior university affiliation. He and Becky (also a University of Alberta graduate) contributed $2,000 annually to the University of Alberta athletic program. The growth in the stores was the good news for Jim and Becky. The less than good news was the intense competition that they faced. Not only were they forced to compete with nationally established sporting goods stores such as Sport Chek and National Sports, but Walmart also represented intense competition for the sporting goods dollar. The national stores were extremely competitive in terms of pricing. However, Jim, Becky and their employees offered great personal service, and they hoped this would allow them to continue with their specialty niche.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started