Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hawk's Seeds Inc. sells bulk grass seed to local garden stores and landscapers. Hawk's Seeds Inc. produces financial statements semi-annually, uses the perpetual method of

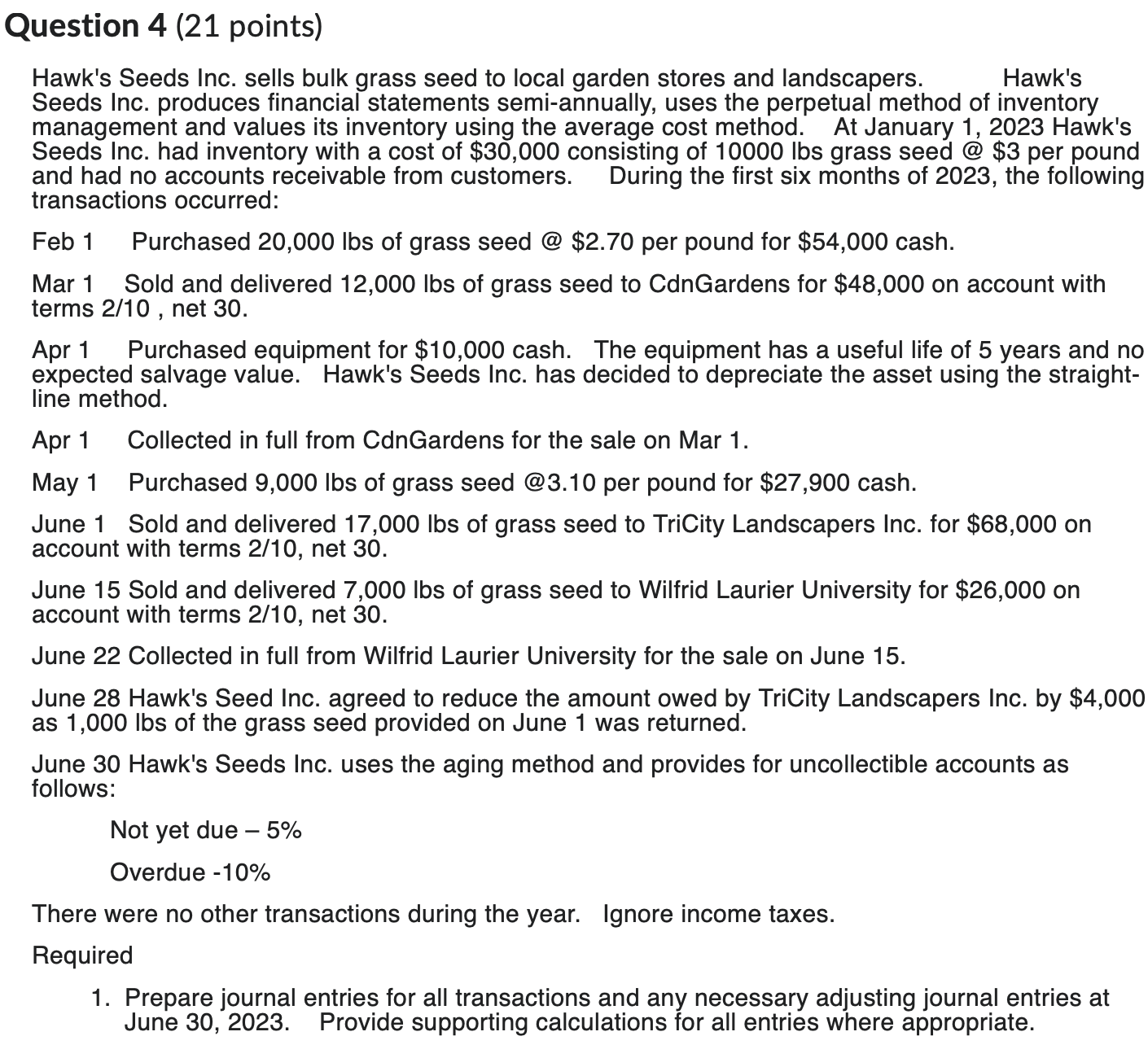

Hawk's Seeds Inc. sells bulk grass seed to local garden stores and landscapers. Hawk's Seeds Inc. produces financial statements semi-annually, uses the perpetual method of inventory management and values its inventory using the average cost method. At January 1, 2023 Hawk's Seeds Inc. had inventory with a cost of $30,000 consisting of 10000 lbs grass seed @ $3 per pound and had no accounts receivable from customers. During the first six months of 2023 , the following transactions occurred: Feb 1 Purchased 20,000 lbs of grass seed @ \$2.70 per pound for $54,000 cash. Mar 1 Sold and delivered 12,000 lbs of grass seed to CdnGardens for $48,000 on account with terms 2/10, net 30 . Apr 1 Purchased equipment for $10,000 cash. The equipment has a useful life of 5 years and no expected salvage value. Hawk's Seeds Inc. has decided to depreciate the asset using the straightline method. Apr 1 Collected in full from CdnGardens for the sale on Mar 1. May 1 Purchased 9,000 lbs of grass seed @3.10 per pound for $27,900 cash. June 1 Sold and delivered 17,000 lbs of grass seed to TriCity Landscapers Inc. for $68,000 on account with terms 2/10, net 30 . June 15 Sold and delivered 7,000 lbs of grass seed to Wilfrid Laurier University for $26,000 on account with terms 2/10, net 30 . June 22 Collected in full from Wilfrid Laurier University for the sale on June 15. June 28 Hawk's Seed Inc. agreed to reduce the amount owed by TriCity Landscapers Inc. by $4,000 as 1,000 lbs of the grass seed provided on June 1 was returned. June 30 Hawk's Seeds Inc. uses the aging method and provides for uncollectible accounts as follows: Not yet due 5% Overdue 10% There were no other transactions during the year. Ignore income taxes. Required 1. Prepare journal entries for all transactions and any necessary adjusting journal entries at June 30, 2023. Provide supporting calculations for all entries where appropriate

Hawk's Seeds Inc. sells bulk grass seed to local garden stores and landscapers. Hawk's Seeds Inc. produces financial statements semi-annually, uses the perpetual method of inventory management and values its inventory using the average cost method. At January 1, 2023 Hawk's Seeds Inc. had inventory with a cost of $30,000 consisting of 10000 lbs grass seed @ $3 per pound and had no accounts receivable from customers. During the first six months of 2023 , the following transactions occurred: Feb 1 Purchased 20,000 lbs of grass seed @ \$2.70 per pound for $54,000 cash. Mar 1 Sold and delivered 12,000 lbs of grass seed to CdnGardens for $48,000 on account with terms 2/10, net 30 . Apr 1 Purchased equipment for $10,000 cash. The equipment has a useful life of 5 years and no expected salvage value. Hawk's Seeds Inc. has decided to depreciate the asset using the straightline method. Apr 1 Collected in full from CdnGardens for the sale on Mar 1. May 1 Purchased 9,000 lbs of grass seed @3.10 per pound for $27,900 cash. June 1 Sold and delivered 17,000 lbs of grass seed to TriCity Landscapers Inc. for $68,000 on account with terms 2/10, net 30 . June 15 Sold and delivered 7,000 lbs of grass seed to Wilfrid Laurier University for $26,000 on account with terms 2/10, net 30 . June 22 Collected in full from Wilfrid Laurier University for the sale on June 15. June 28 Hawk's Seed Inc. agreed to reduce the amount owed by TriCity Landscapers Inc. by $4,000 as 1,000 lbs of the grass seed provided on June 1 was returned. June 30 Hawk's Seeds Inc. uses the aging method and provides for uncollectible accounts as follows: Not yet due 5% Overdue 10% There were no other transactions during the year. Ignore income taxes. Required 1. Prepare journal entries for all transactions and any necessary adjusting journal entries at June 30, 2023. Provide supporting calculations for all entries where appropriate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started