Question

20- The XYZ Company's bonds have a face value of $1,000, will mature in ten years, and carry a coupon rate of 12 percent.

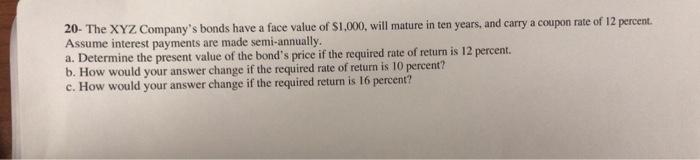

20- The XYZ Company's bonds have a face value of $1,000, will mature in ten years, and carry a coupon rate of 12 percent. Assume interest payments are made semi-annually. a. Determine the present value of the bond's price if the required rate of return is 12 percent. b. How would your answer change if the required rate of return is 10 percent? c. How would your answer change if the required return is 16 percent?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Determine the present value of the bonds price if the required rate of return is 12 percent ANSWER ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Finance Markets Investments and Financial Management

Authors: Melicher Ronald, Norton Edgar

15th edition

9781118800720, 1118492676, 1118800729, 978-1118492673

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App