Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello could you please explain me t accounts on statements. why cash 56000 is debited, shouldn't cash be credited and purchase debited. don't understand this

hello could you please explain me t accounts on statements. why cash 56000 is debited, shouldn't cash be credited and purchase debited. don't understand this illustration at all, so confused about how to use t accounts on statements. I would really appreciate, if someone would take time to explain me.

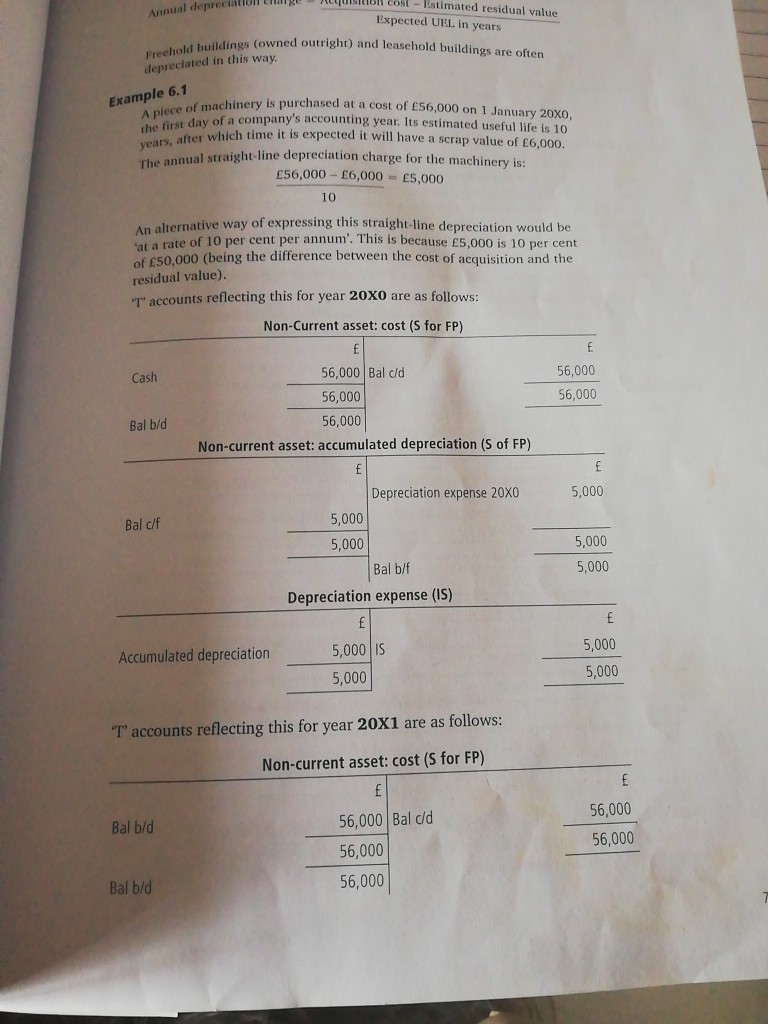

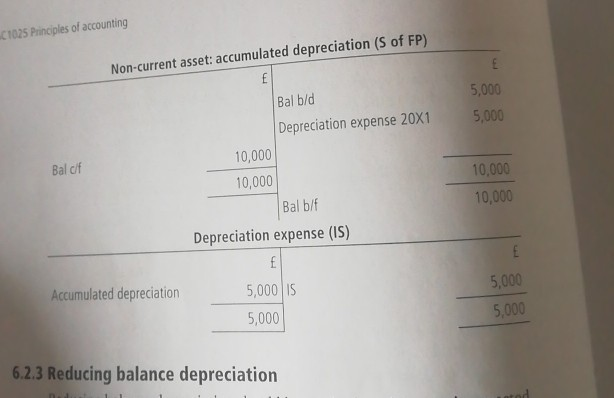

UN UM Annual depreciation CUSTO COSE - l'stimated residual value Expected UEL in years ildings (owned outright) and leasehold buildings are often Freehold buildings (owne depreciated in this way. Example 6.1 A piece of machine the first day of a compan years, after which tim The annual straight-line depreci machinery is purchased at a cost of 56,000 on 1 January 20X0. day of a company's accounting year. Its estimated useful life is 10 er which time it is expected it will have a scrap value of 6,000. al straight line depreciation charge for the machinery is: 56,000 - 6,000 - 5,000 10 ornative way of expressing this straight-line depreciation would be at a rate of 10 per cent per annum. This is because 5,000 is 10 per cent 250.000 (being the difference between the cost of acquisition and the residual value). Taccounts reflecting this for year 20X0 are as follows: Non-Current asset: cost (S for FP) Cash 56,000 56,000 56,000 Balod 56,000 56,000 Non-current asset: accumulated depreciation (s of FP) Bal b/d 5,000 Bal c/f Depreciation expense 20X0 5,000 5,000 Balb/f Depreciation expense (IS) 5,000 5,000 Accumulated depreciation 5,000 IS 5,000 5,000 5,000 T accounts reflecting this for year 20X1 are as follows: Non-current asset: cost (S for FP) 56,000 Bal b/d 56,000 56,000 Bal c/d 56,000 56,000 Bal b/d C1025 Principles of accounting Non-current asset: accumulated depreciation (s of FP) 5,000 5,000 Balb/d Depreciation expense 20X1 10,000 Bal of 10,000 10,000 10,000 Balb/f Depreciation expense (IS) Accumulated depreciation 5,000 IS 5,000 5,000 5,000 6.2.3 Reducing balance depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started