Question: Hello, I just need to know how I should tackle this problem. Not necessarily the answers as that would require more research on my end.

Hello, I just need to know how I should tackle this problem. Not necessarily the answers as that would require more research on my end.

It is January 2024. You are married with two small children (6 and 2). You want to save enough money to send your two children to university. Since they are four years apart in age, you need to have a sum of money that will provide $4 000 semiannually for eight years. Your households annual net income is $67 500. The two of you accumulated $67 000 in student loans to be paid back in maximum 15 years at 6.5% interest rate. You have the following fixed monthly expenses (at least):

1. Rent (includes utilities): 1200+

2. Daycare: 650+

3. Two cars (3y & 7y) insurance and maintenance: 450+

4. Phone, TV, internet, etc.: 200+

5. Food, clothing, etc.: 950+

6. Entertainment, holiday, unforeseen expenses etc.: 500+

At the moment you have $10 000 in savings. You are thinking of purchasing a home worth between $350 000 and $400 000 by paying x% down and then taking out a mortgage at j2 = 3.5%. (Typically lenders will require mortgage loan insurance if a borrower has a down payment of less than 20% of the purchase price of the home.) Your (initial) plan is to amortize the mortgage over 25 years with equal monthly payments. (Think about all the additional monthly expenses of owning a house: for example * Utilities: $350+; * Maintenance: $200+; * Property tax: $350+; *Home Insurance: $150+; *$$$ Mortgage loan insurance: depending on down payment)

Your overall goal should be to reduce total interest payment by as much as possible. (at its core this is the basis of the marking scheme)

PART A

a. Determine the ideal/optimal year of buying a house, the total amount you can afford under the above circumstances and the down payment (this might require more than one scenario). b. Determine the monthly payment and create amortization schedules showing the distribution of the payments as to interest and principal.

PART B

For the above problem answer the following questions using your initial data set. For full marks show your calculations (i.e. solve it manually on paper).

A) Determine the monthly rate i12 = ?

B) Determine the monthly payment R = ?

C) How much interest is repaid in the 36th payment? I36 = ?

D) How much principal is repaid in the 142nd payment? Pr142 = ?

E) What is the outstanding balance of the loan after the 187th payment? OB187 = ?

F) Determine your (buyers) equity at the end of 8 years. BEQ = ?

G) Determine the sellers equity at the end of 22 years. SEQ = ?

H) Find the Total Amount Repaid during the lifetime of the loan.

I) Find the Total Amount of Interest during the lifetime of the loan.

See attached Case Studies:

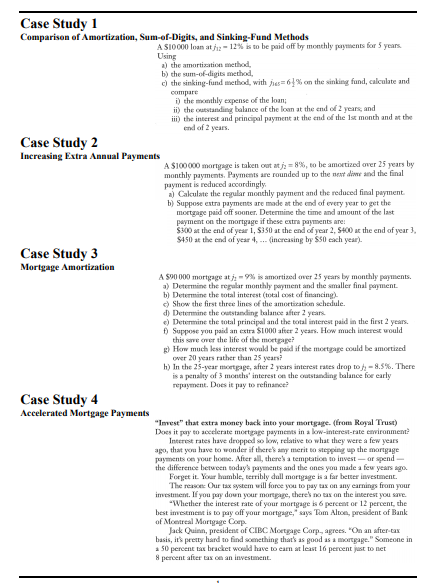

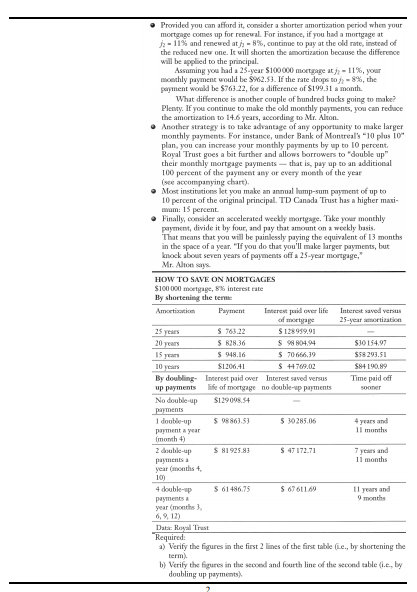

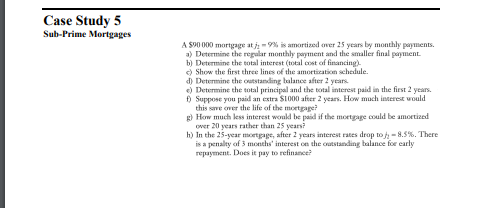

Case Study 1 Comparison of Amerization, Sum-of-Digits, and Sinking Fund Methods A S1000 Lante-125 is to be paid off by m y for 5 years U a) the method b) che method the sinking-fundmethod, with the king fucke d they pense of the lan the winding balance of the the end of years and the interest and principal payment at the end of the month and of 2 years the Case Study 2 Increasing Extra Annual Payments A $100 000 mart is taken to be amortidor 25 years by monthly payments. Payments are rounded up to the m and the final payment is reduced accordingly. a) Calculate the regular monthly payment and the reduced final payment b) Suppose extra payments are made at the end of every year to get the mortuare paid off sooner. Determine the time and amount of the last payment on the mortgage if these extra payments are $300 at the end of year I, S80 at the end of year. $400 at the end of year) $450 at the end of year 4... (increasing by S50 each year) Case Study 3 Mortgage Amortization AS90 000 mortgage th i s amortized over 25 years by monthly payments. a) Determine the regular monthly ment and the smaller finalment b) Determine the total interest (total cost of financing c) Show the first three lines of the motion schedule. d) Determine the coming balance after 2 years c) Determine the total principal and the total interest paid in the first 2 years f) Suppose you paid an extra S1000 her 2 years. How much interest would this server the life of the m age? g) How much less interest would be if the more would be amortized over 20 years rather than 25 years? h) In the 25-year m e , after 2 years interest te drop to 8.5%. There is a penalty of 3 months interest on the outstanding balance for early repayment. Does it pay to refinance Case Study 4 Accelerated Mortgage Payments "Invest" that extra money back into your more from Royal Trust) Does it pay to accelerate payment in a low-interest woment? Interest rates have dropped worlative what they were a few years that you have to wonder if they went up the more payments on your call the m to investopend the difference betwee today and the ones you made a few years Forget it. Your humble, embly ell e r be stimmt The Our te stem will once yoy o years from your Whether the rest of your especto 12 percent, the bestemmistopold you . T he present of Bank of Montreal M are Corpu Jack Oun president of CIBC More Carpees. O ne bas pretty hand so find something that as good as Socce in 50 percent bracket would have to least 16 percent tonet 8 percent after an investment Prowded you can affondit onder a short amor p od when you more comes up for For fyes ada t -11% and renewed to the do the reduced new one. It will shorten the mor e the difference will be applied to the principal As we had a 25-year $100000 m -11 med a t would be 9962.53. If thee drogs , the payment would be 576.22, for a difference of $1931 What difference is another couple of hundred braces going to make Plent. If you continue to make the old monthly payments, you can reduce the motion 146 years, according to Me Alto Another strategy is to take advantage of any opportunity to make larger monthly payments. For instance, under Bank of Montreal 10 plus 10 plan, you can increase your monthly payments by up to 10 percent Royal Trust goes a bit further and allows borrowers to "double up their monthly mortgage payments that is payp to an additional 100 percent of the payment any of every month of the year ( accompanying chart) . Most institutions let you make an annual bump-supayment of up to 10 percent of the original principal. TD Canada Trust has a higher mai mm: 15 percent Finalle, der an accelerated weekly mortgage. Take your monthly payment, divide it by four, and pay that a t an a weekly basis. "That means that you will be painlessly puying the equivalent of 3 months in the space of a year. "If you do that you'll make larger payments, but knock about seven years of payments of a 25-year mortgage." Mr. Altos HOW TO SAVE ON MORTGAGES $100 000 mortgage, % interest rate By shortening the ter Amotion Payment Interest river life interesaved versus of age 25-year on 25 years 763.22 S1294901 20 years S 828. 36 S 04.04 $10154.97 15 years $948.16 S 70666.39 10 years $1206.41 S 44709.02 SNA By doubling Interest paid over Interest saved versus Time paid off up payments of mortge no double-wp payments No double-up S12909854 payments I double-up S 98863.53 5 30285.06 payment a year 2 db-opS 8192583 S4172.71 11 months years 4 double-up 5 61486.75 5 67611.60 1 and 6, 12) Data Rosa Trust Required a) Verify the figures in the first 2 lines of the first table fie, by shortening the 1) Verify the figures in the second and fourth line of the second table , by doubling up payments) Case Study 5 Sub-Prime Mortgages A 590 000 mortgage at 9% is mortized over 25 years by monthly payments. a) Determine the regular monthly payment and the smaller final payment b) Determine the total interest (total cost of financing c) Show the first three lines of the amortization schedule, d) Determine the cutanding balance after 2 years ) Determine the total principal and the total interest paid in the first 2 years + Suppose you paid an extra S1000 after 2 years. How much Imre would this server the life of the mostrare? g) How much less interest would be paid if the more could be amortized over 20 years rather than 25 years? h) In the 25-year m e , after 2 years interest rates drop to 8.5%. There is a penalty of 3 months interest on the outstanding balance for early repayment. Does it pay to refinance Case Study 1 Comparison of Amerization, Sum-of-Digits, and Sinking Fund Methods A S1000 Lante-125 is to be paid off by m y for 5 years U a) the method b) che method the sinking-fundmethod, with the king fucke d they pense of the lan the winding balance of the the end of years and the interest and principal payment at the end of the month and of 2 years the Case Study 2 Increasing Extra Annual Payments A $100 000 mart is taken to be amortidor 25 years by monthly payments. Payments are rounded up to the m and the final payment is reduced accordingly. a) Calculate the regular monthly payment and the reduced final payment b) Suppose extra payments are made at the end of every year to get the mortuare paid off sooner. Determine the time and amount of the last payment on the mortgage if these extra payments are $300 at the end of year I, S80 at the end of year. $400 at the end of year) $450 at the end of year 4... (increasing by S50 each year) Case Study 3 Mortgage Amortization AS90 000 mortgage th i s amortized over 25 years by monthly payments. a) Determine the regular monthly ment and the smaller finalment b) Determine the total interest (total cost of financing c) Show the first three lines of the motion schedule. d) Determine the coming balance after 2 years c) Determine the total principal and the total interest paid in the first 2 years f) Suppose you paid an extra S1000 her 2 years. How much interest would this server the life of the m age? g) How much less interest would be if the more would be amortized over 20 years rather than 25 years? h) In the 25-year m e , after 2 years interest te drop to 8.5%. There is a penalty of 3 months interest on the outstanding balance for early repayment. Does it pay to refinance Case Study 4 Accelerated Mortgage Payments "Invest" that extra money back into your more from Royal Trust) Does it pay to accelerate payment in a low-interest woment? Interest rates have dropped worlative what they were a few years that you have to wonder if they went up the more payments on your call the m to investopend the difference betwee today and the ones you made a few years Forget it. Your humble, embly ell e r be stimmt The Our te stem will once yoy o years from your Whether the rest of your especto 12 percent, the bestemmistopold you . T he present of Bank of Montreal M are Corpu Jack Oun president of CIBC More Carpees. O ne bas pretty hand so find something that as good as Socce in 50 percent bracket would have to least 16 percent tonet 8 percent after an investment Prowded you can affondit onder a short amor p od when you more comes up for For fyes ada t -11% and renewed to the do the reduced new one. It will shorten the mor e the difference will be applied to the principal As we had a 25-year $100000 m -11 med a t would be 9962.53. If thee drogs , the payment would be 576.22, for a difference of $1931 What difference is another couple of hundred braces going to make Plent. If you continue to make the old monthly payments, you can reduce the motion 146 years, according to Me Alto Another strategy is to take advantage of any opportunity to make larger monthly payments. For instance, under Bank of Montreal 10 plus 10 plan, you can increase your monthly payments by up to 10 percent Royal Trust goes a bit further and allows borrowers to "double up their monthly mortgage payments that is payp to an additional 100 percent of the payment any of every month of the year ( accompanying chart) . Most institutions let you make an annual bump-supayment of up to 10 percent of the original principal. TD Canada Trust has a higher mai mm: 15 percent Finalle, der an accelerated weekly mortgage. Take your monthly payment, divide it by four, and pay that a t an a weekly basis. "That means that you will be painlessly puying the equivalent of 3 months in the space of a year. "If you do that you'll make larger payments, but knock about seven years of payments of a 25-year mortgage." Mr. Altos HOW TO SAVE ON MORTGAGES $100 000 mortgage, % interest rate By shortening the ter Amotion Payment Interest river life interesaved versus of age 25-year on 25 years 763.22 S1294901 20 years S 828. 36 S 04.04 $10154.97 15 years $948.16 S 70666.39 10 years $1206.41 S 44709.02 SNA By doubling Interest paid over Interest saved versus Time paid off up payments of mortge no double-wp payments No double-up S12909854 payments I double-up S 98863.53 5 30285.06 payment a year 2 db-opS 8192583 S4172.71 11 months years 4 double-up 5 61486.75 5 67611.60 1 and 6, 12) Data Rosa Trust Required a) Verify the figures in the first 2 lines of the first table fie, by shortening the 1) Verify the figures in the second and fourth line of the second table , by doubling up payments) Case Study 5 Sub-Prime Mortgages A 590 000 mortgage at 9% is mortized over 25 years by monthly payments. a) Determine the regular monthly payment and the smaller final payment b) Determine the total interest (total cost of financing c) Show the first three lines of the amortization schedule, d) Determine the cutanding balance after 2 years ) Determine the total principal and the total interest paid in the first 2 years + Suppose you paid an extra S1000 after 2 years. How much Imre would this server the life of the mostrare? g) How much less interest would be paid if the more could be amortized over 20 years rather than 25 years? h) In the 25-year m e , after 2 years interest rates drop to 8.5%. There is a penalty of 3 months interest on the outstanding balance for early repayment. Does it pay to refinance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts