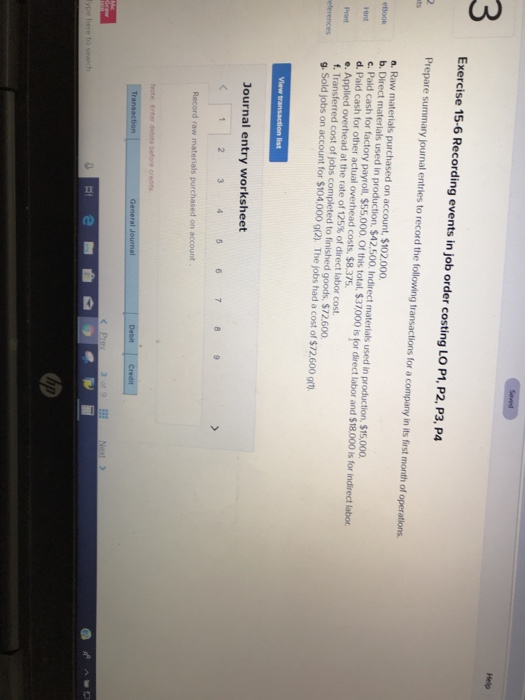

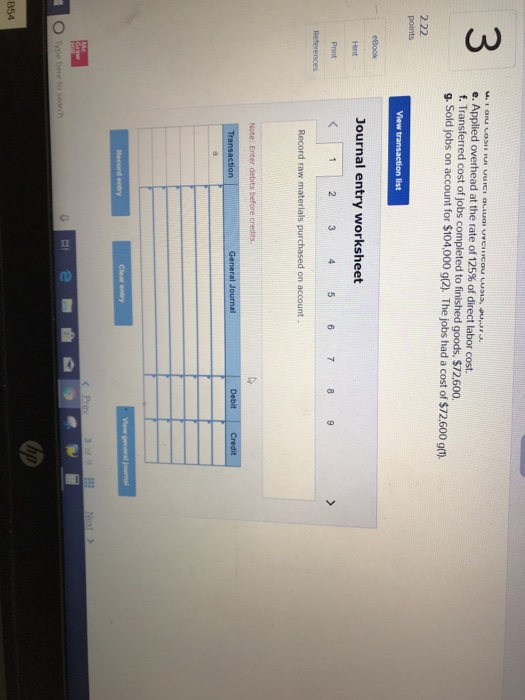

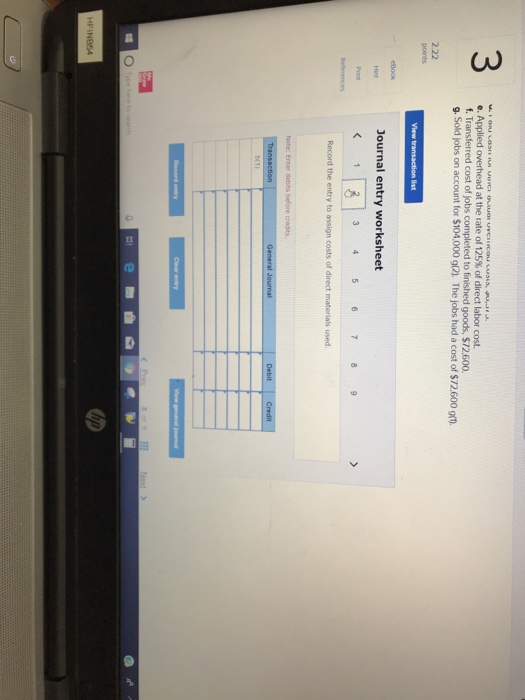

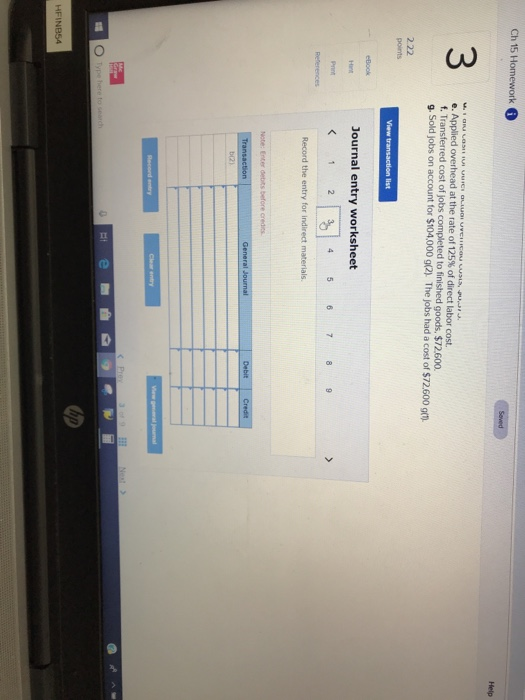

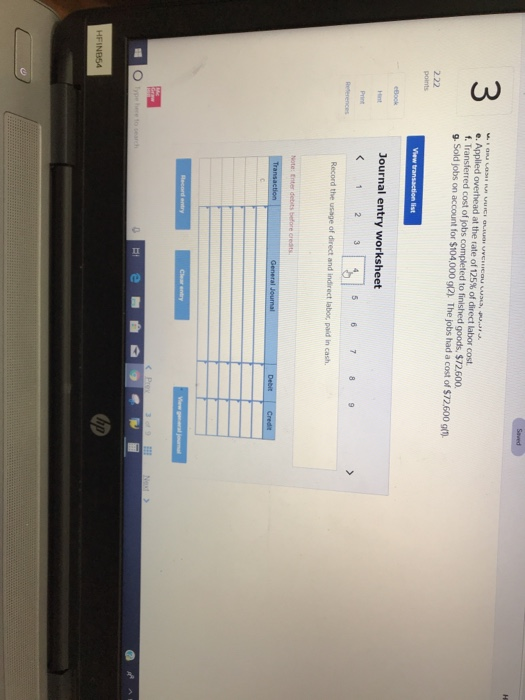

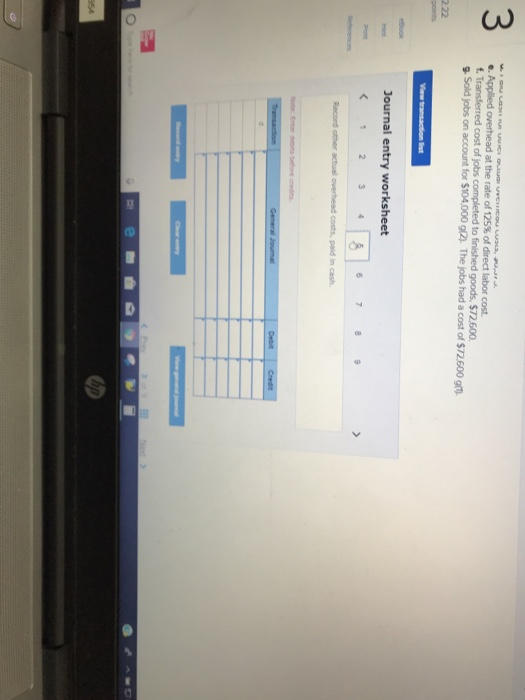

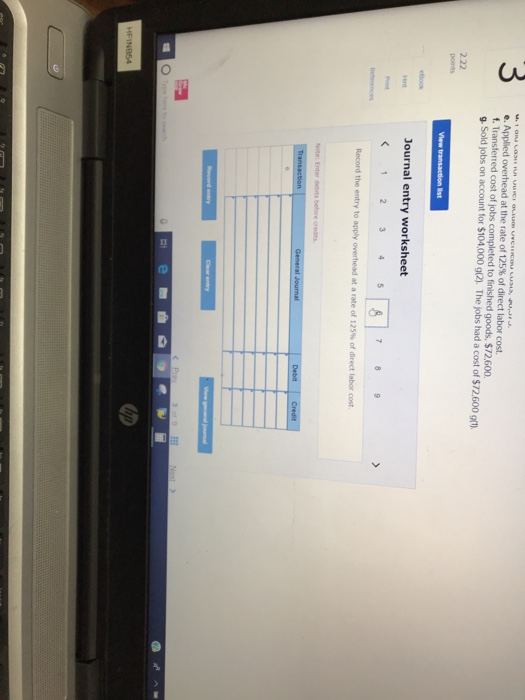

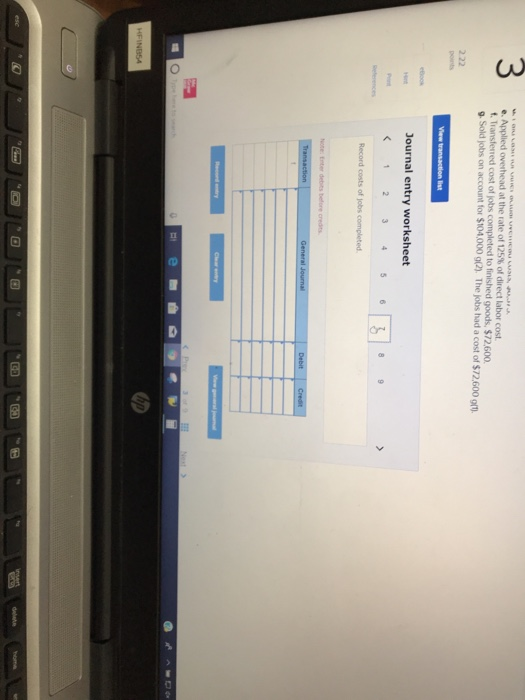

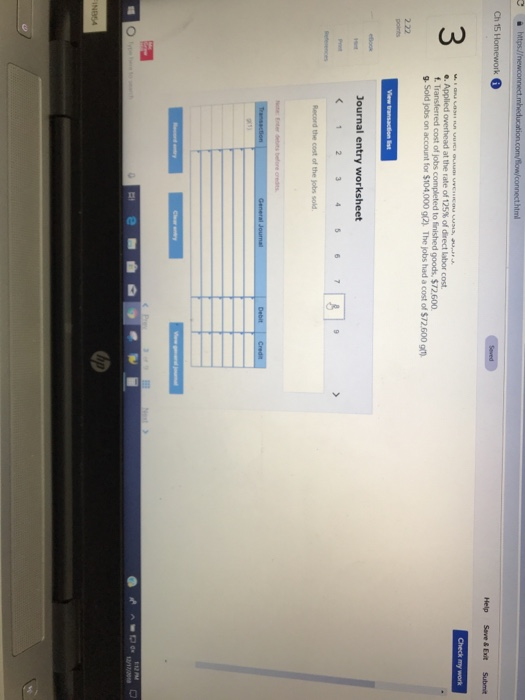

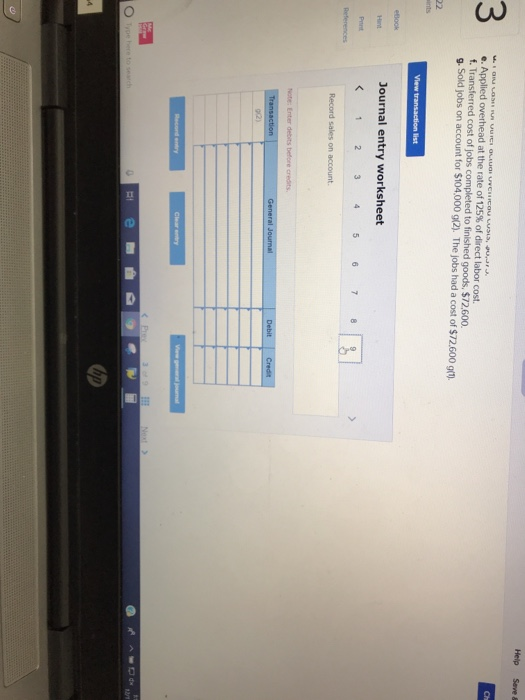

Help 3 Exercise 15-6 Recording events in job order costing LO P1, P2, P3, P4 Prepare summary journal entries to record the following transactions for a company in its first month of operations n. Raw materials purchased on account, $102.000 b. Direct materials used in production, $42,500. Indirect materials used in production, $15,000 c. Pald cash for factory payroll, $55,000. Of this total, $37000 is for direct labor and $18,000 is for indirect labor d. Paid cash for other actual overhead costs, $8,375 e. Applied overhead at the rate of 125% of direct labor cost. Print f. Transferred cost of jobs completed to finished goods, $72600 eferencesg. Sold jobs on account for $104,000 g(2). The jobs had a cost of $72.600 gt). Journal entry worksheet Record raw materials purchased on account e. Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $72.600. g. Sold jobs on account for $104,000 g2). The jobs had a cost of $72.600 g). 2.22 Journal entry worksheet Hint Record raw materials purchased on accou General Journal Clear entry ype here to search 854 overhead at the rate of 125% of direct labor cost. e. Applied f. Transferred cost of jobs completed to finished goods, $72.600. g. Sold jobs on account for $104,000 g2). The jobs had a cost of $72.600 g). 2.22 points Journal entry worksheet Record the entry to assign costs of direct materials used HFINB54 Help 8 e. Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $72600 9. Sold jobs on account for $104,000 g The jobs had a cost of $72.600 gm points Journal entry worksheet Print Record the entry for indirect materials. HFINBS4 3 e. Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $72,600 g. Sold jobs on account for $104,000 g2). The jobs had a cost of $72,600 g) 2.22 points Journal entry worksheet HFINB54 f. Transferred cost of jobs completed to finished goods, $72.60o s Sold jobs on account for $104,000 g/2). The jobs had a cost of $72,600 g) Journal entry worksheet He . Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $72,600. g. Sold jobs on account for $104,000 g(2). The jobs had a cost of $72,600 gt. points Journal entry worksheet e, Applied overhead at the rate of 125% of direct labor cost. t. Transferred cost of jobs completed to finished goods, $72.600 g Sold jobs on account for $104,000 g2) The jobs had a cost of $72.600 g points ournal entry worksheet 8 Record costs of jobs completed rl Ch15 Help Save & Exit Submit e, Applied overhead at the rate of 125% of direct Labor cost. f. Transferred cost of jobs completed to finished goods, $72.600 g. Sold jobs on account for $104,000 g2) The jobs had a cost of $72.600 g Journal entry worksheet Record the cost of the jobs sold a e Help Save & e. Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $72.600. g. Sold jobs on account for $104,000 g(2). The jobs had a cost of $72.600 gt) ournal entry worksheet Record sales on account