Answered step by step

Verified Expert Solution

Question

1 Approved Answer

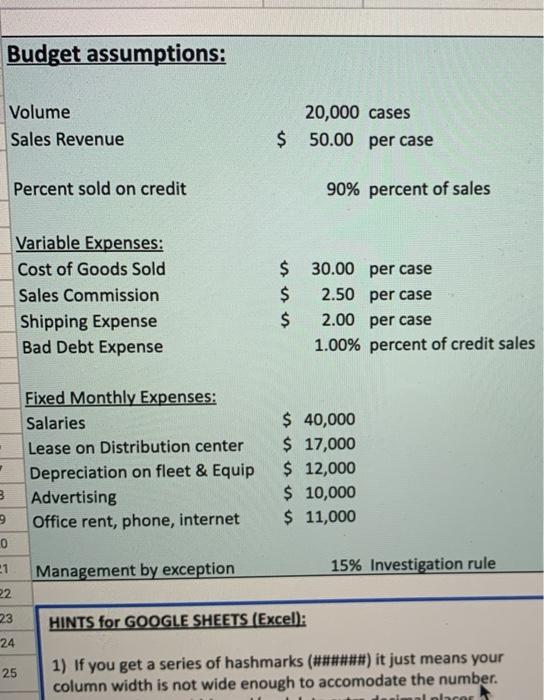

HELP ASAP Budget assumptions: Volume Sales Revenue 20,000 cases $ 50.00 per case Percent sold on credit 90% percent of sales Variable Expenses: Cost of

HELP ASAP

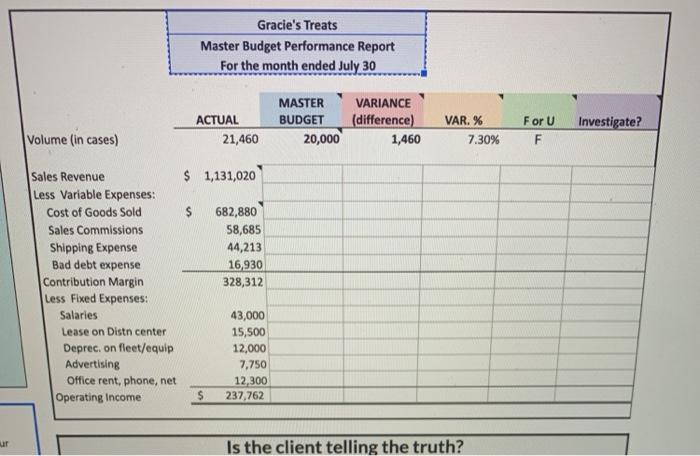

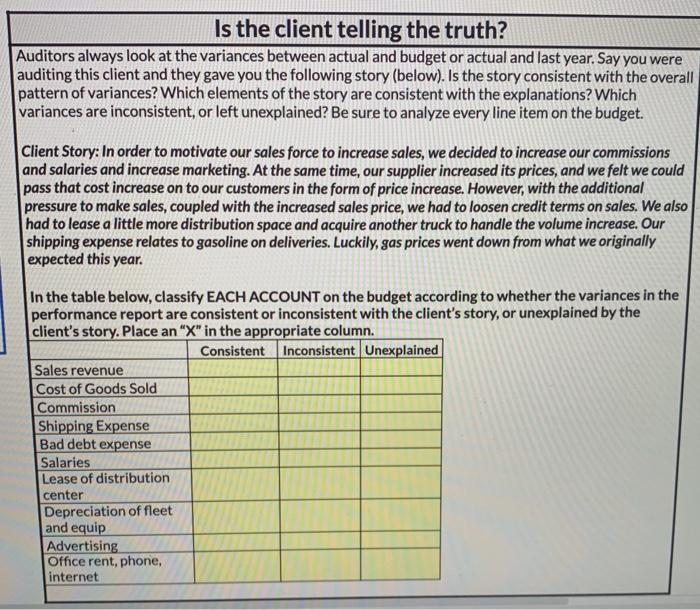

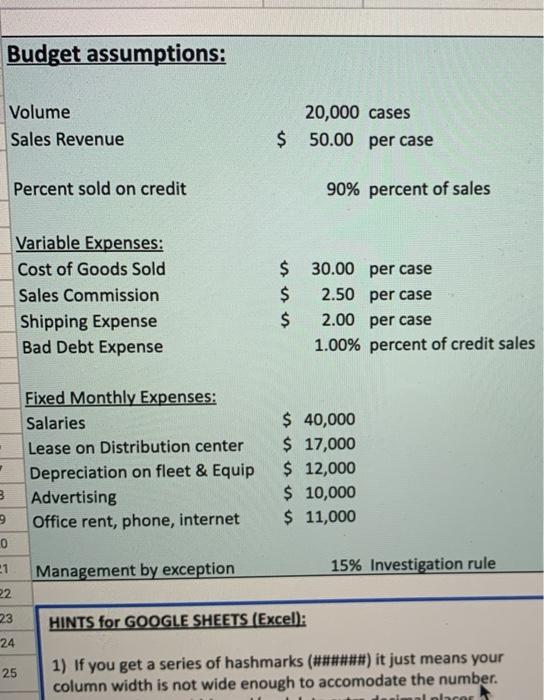

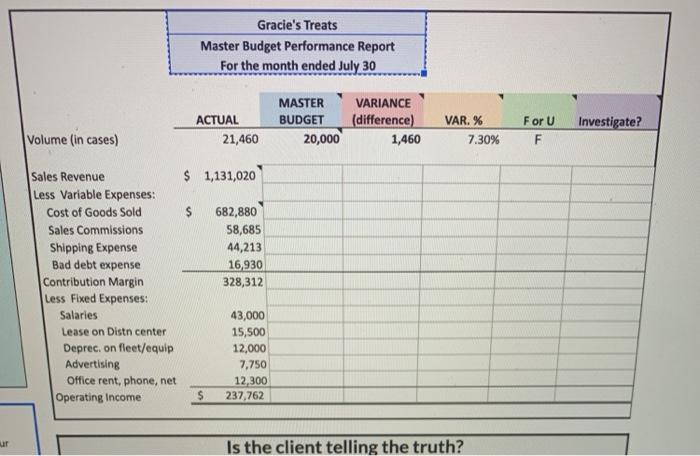

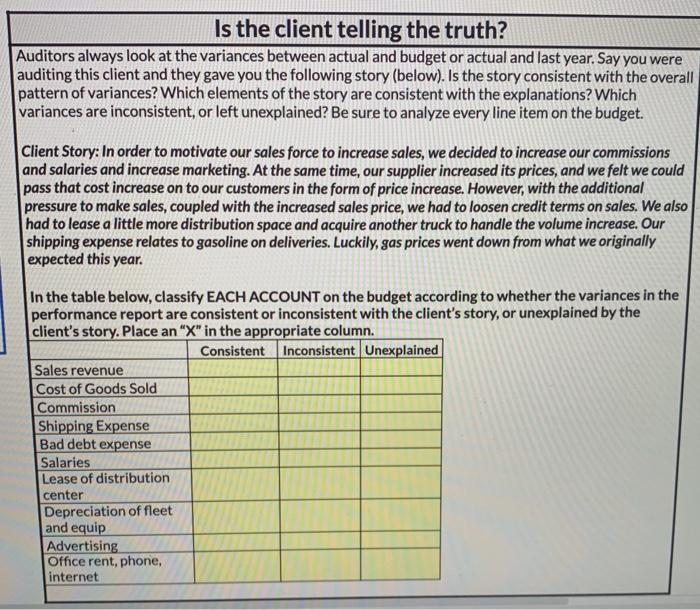

Budget assumptions: Volume Sales Revenue 20,000 cases $ 50.00 per case Percent sold on credit 90% percent of sales Variable Expenses: Cost of Goods Sold Sales Commission Shipping Expense Bad Debt Expense $ 30.00 per case $ 2.50 per case $ 2.00 per case 1.00% percent of credit sales Fixed Monthly Expenses: Salaries Lease on Distribution center Depreciation on fleet & Equip Advertising Office rent, phone, internet $ 40,000 $ 17,000 $ 12,000 $ 10,000 $ 11,000 3 9 Management by exception 15% Investigation rule 0 21 22 23 24 HINTS for GOOGLE SHEETS (Excel): 25 1) If you get a series of hashmarks (######) it just means your column width is not wide enough to accomodate the number. allacan Gracie's Treats Master Budget Performance Report For the month ended July 30 ACTUAL 21,460 MASTER BUDGET 20,000 VARIANCE (difference) 1,460 VAR. % 7.30% For U F Investigate? Volume (in cases) $ 1,131,020 $ Sales Revenue Less Variable Expenses: Cost of Goods Sold Sales Commissions Shipping Expense Bad debt expense Contribution Margin Less Fixed Expenses: Salaries Lease on Distn center Deprec. on fleet/equip Advertising Office rent, phone, net Operating Income 682,880 58,685 44,213 16,930 328,312 43,000 15,500 12,000 7,750 12,300 237,762 $ ur Is the client telling the truth? Is the client telling the truth? Auditors always look at the variances between actual and budget or actual and last year. Say you were auditing this client and they gave you the following story (below). Is the story consistent with the overall pattern of variances? Which elements of the story are consistent with the explanations? Which variances are inconsistent, or left unexplained? Be sure to analyze every line item on the budget. Client Story: In order to motivate our sales force to increase sales, we decided to increase our commissions and salaries and increase marketing. At the same time, our supplier increased its prices, and we felt we could pass that cost increase on to our customers in the form of price increase. However, with the additional pressure to make sales, coupled with the increased sales price, we had to loosen credit terms on sales. We also had to lease a little more distribution space and acquire another truck to handle the volume increase. Our shipping expense relates to gasoline on deliveries. Luckily, gas prices went down from what we originally expected this year. In the table below, classify EACH ACCOUNT on the budget according to whether the variances in the performance report are consistent or inconsistent with the client's story, or unexplained by the client's story. Place an "X" in the appropriate column. Consistent Inconsistent Unexplained Sales revenue Cost of Goods Sold Commission Shipping Expense Bad debt expense Salaries Lease of distribution center Depreciation of fleet and equip Advertising Office rent, phone, internet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started