Answered step by step

Verified Expert Solution

Question

1 Approved Answer

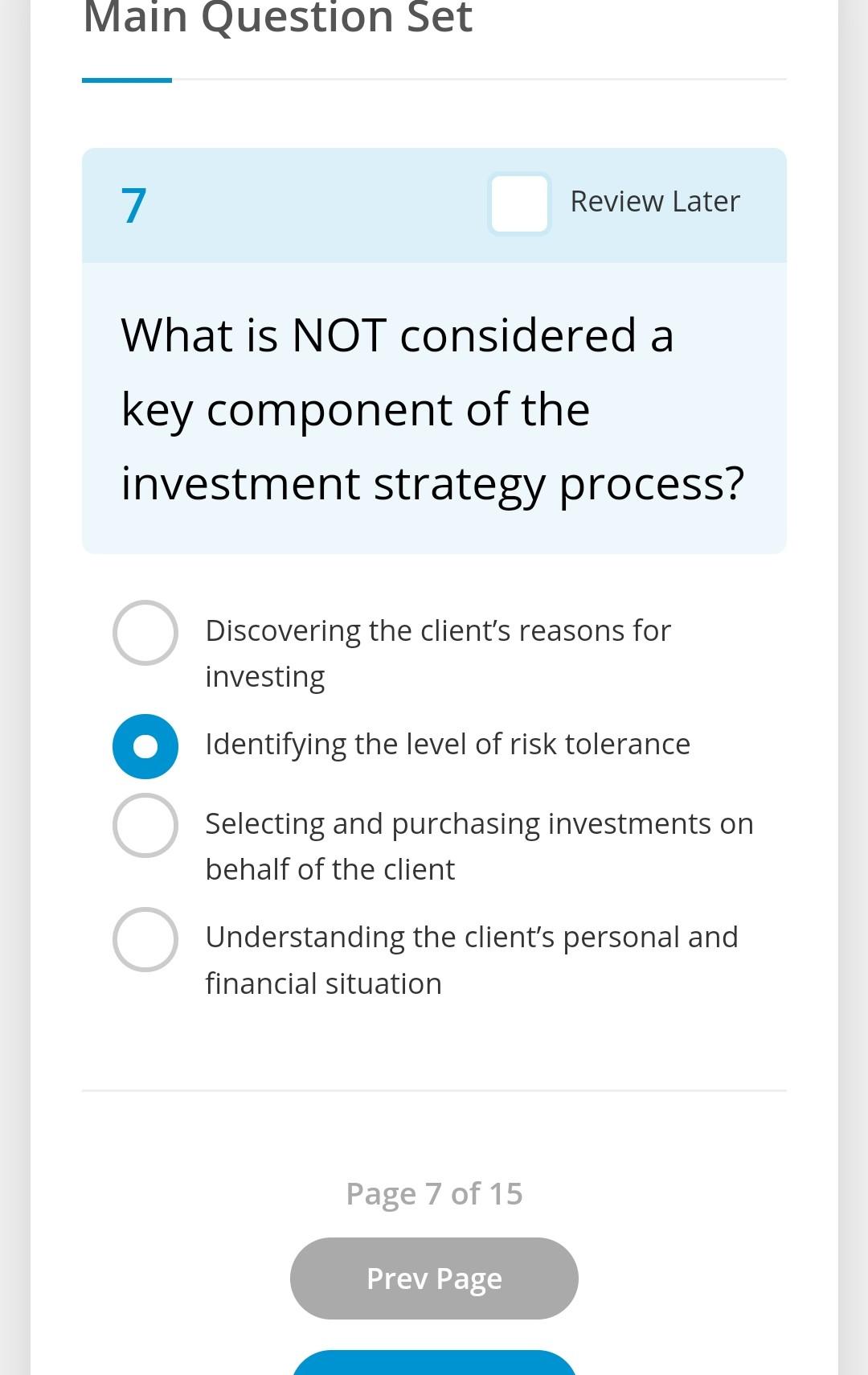

help me please Main Question Set 7 What is NOT considered a key component of the investment strategy process? Review Later O Discovering the client's

help me please

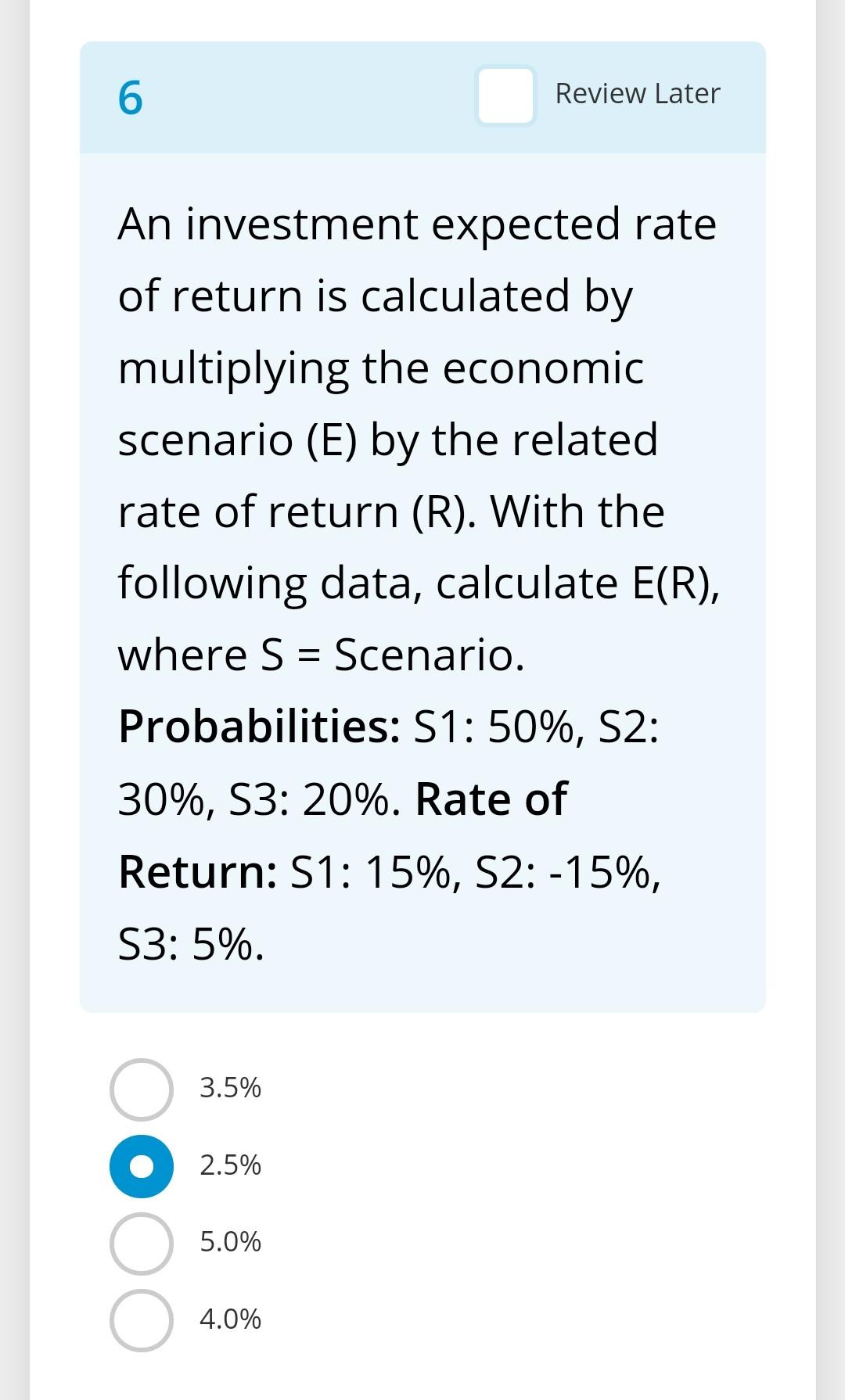

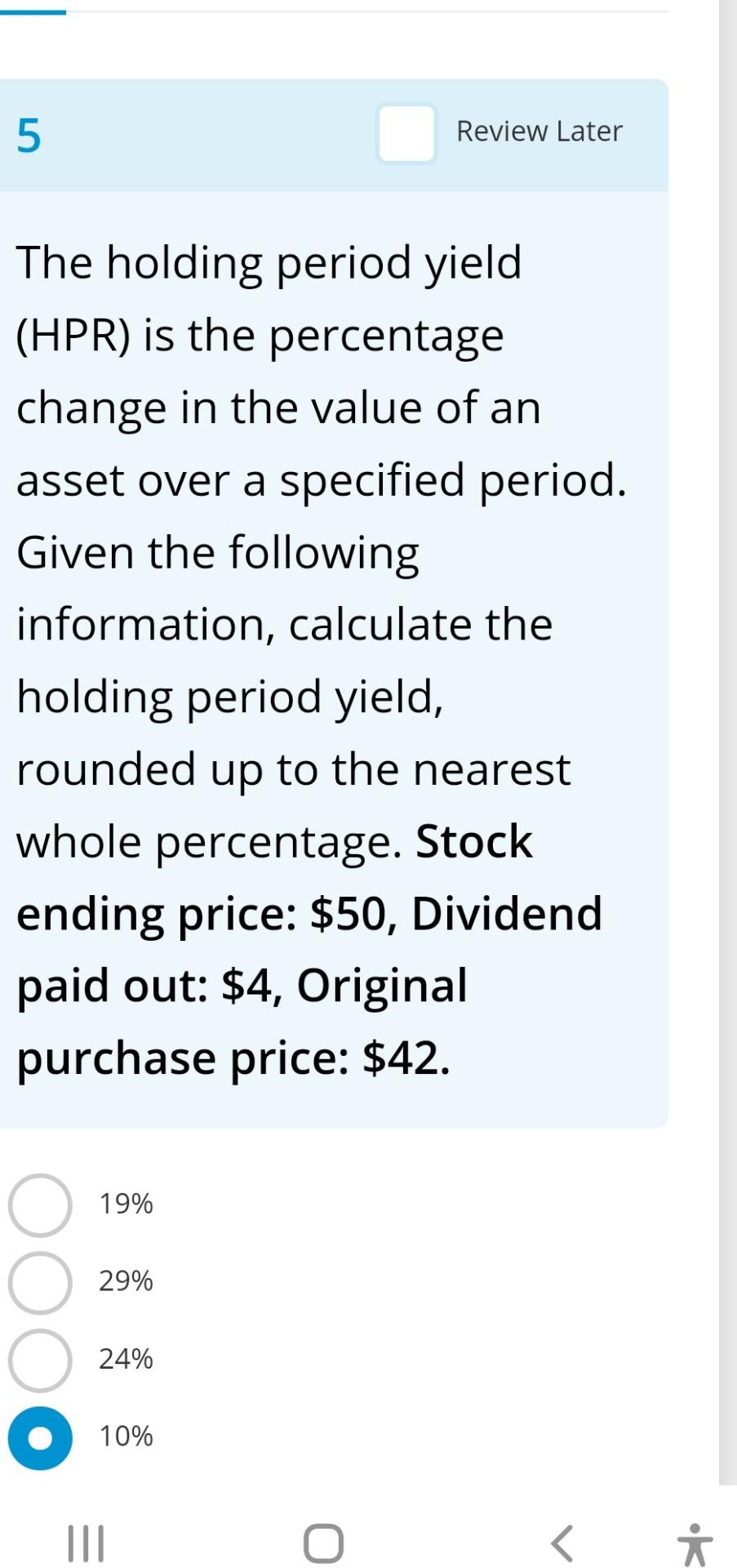

Main Question Set 7 What is NOT considered a key component of the investment strategy process? Review Later O Discovering the client's reasons for investing Identifying the level of risk tolerance Selecting and purchasing investments on behalf of the client Understanding the client's personal and financial situation Page 7 of 15 Prev Page 6 An investment expected rate of return is calculated by multiplying the economic scenario (E) by the related rate of return (R). With the following data, calculate E(R), where S = Scenario. Probabilities: S1: 50%, S2: 30%, S3: 20%. Rate of Return: S1: 15%, S2: -15%, S3: 5%. 3.5% 2.5% 5.0% Review Later 4.0% 5 The holding period yield (HPR) is the percentage change in the value of an asset over a specified period. Given the following information, calculate the holding period yield, rounded up to the nearest whole percentage. Stock ending price: $50, Dividend paid out: $4, Original purchase price: $42. OC O 19% 29% 24% 10% Review Later |||Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started