Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me please!Im not sure if I did #1 correct. Please help me Liam and Katano formed a partnership to open a sushi restaurant by

Help me please!Im not sure if I did #1 correct. Please help me

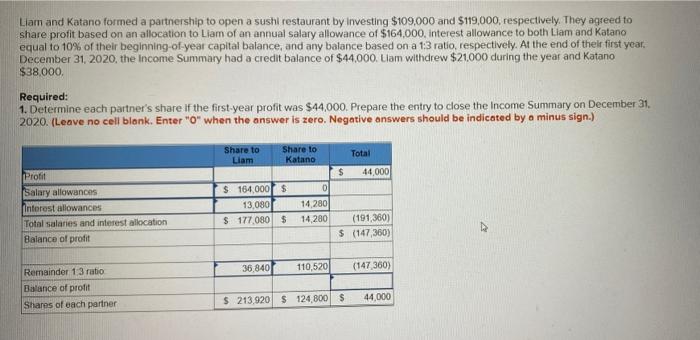

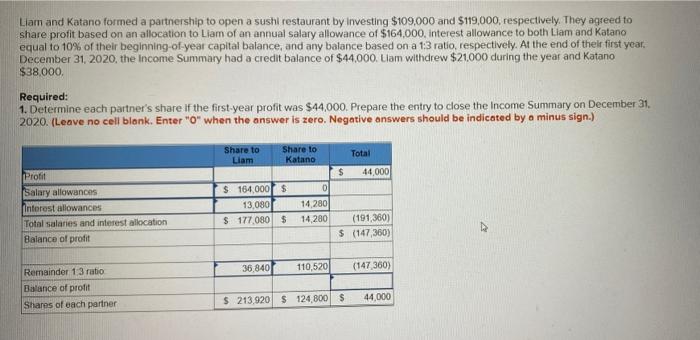

Liam and Katano formed a partnership to open a sushi restaurant by investing $109,000 and $119,000, respectively. They agreed to share profit based on an allocation to Liam of an annual salary allowance of $164,000, interest allowance to both Liam and Katano equal to 10% of their beginning-of-year capital balance, and any balance based on a 1:3 ratio, respectively. At the end of their first year, December 31, 2020, the Income Summary had a credit balance of $44,000. Liam withdrew $21,000 during the year and Katano $38,000.

Required:

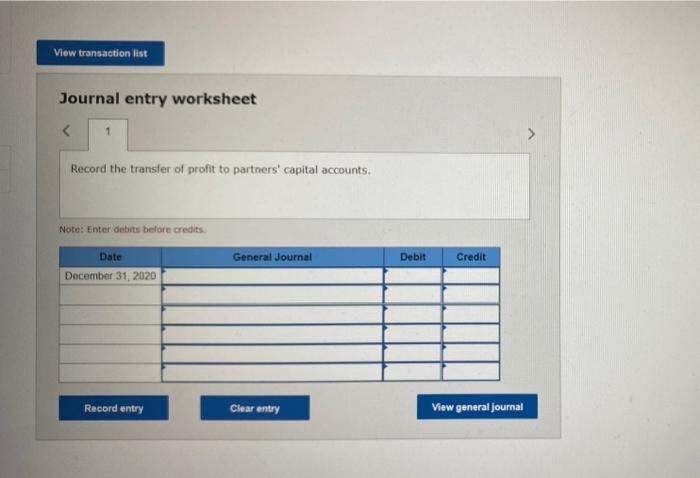

1. Determine each partners share if the first-year profit was $44,000. Prepare the entry to close the Income Summary on December 31, 2020. (Leave no cell blank. Enter "0" when the answer is zero. Negative answers should be indicated by a minus sign.)

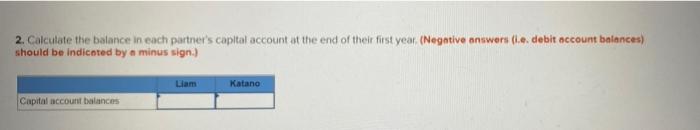

2. Calculate the balance in each partners capital account at the end of their first year. (Negative answers (i.e. debit account balances) should be indicated by a minus sign.)

Please, help meI will like your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started