Help me solve these questions, thank you. I appreciate you a lot for the help.

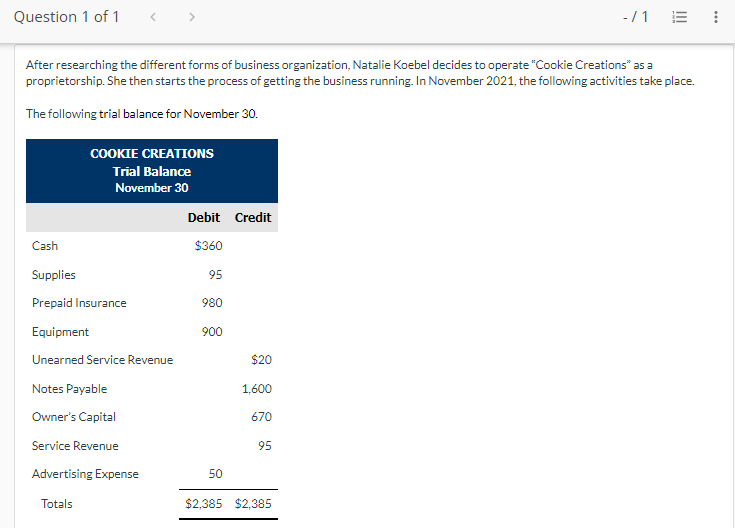

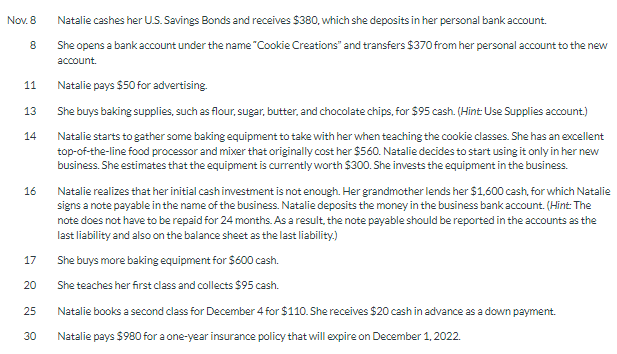

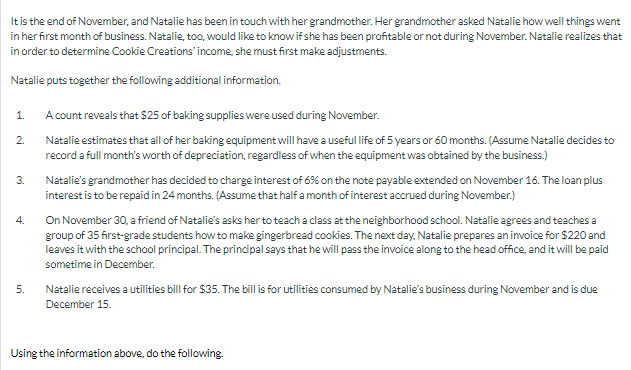

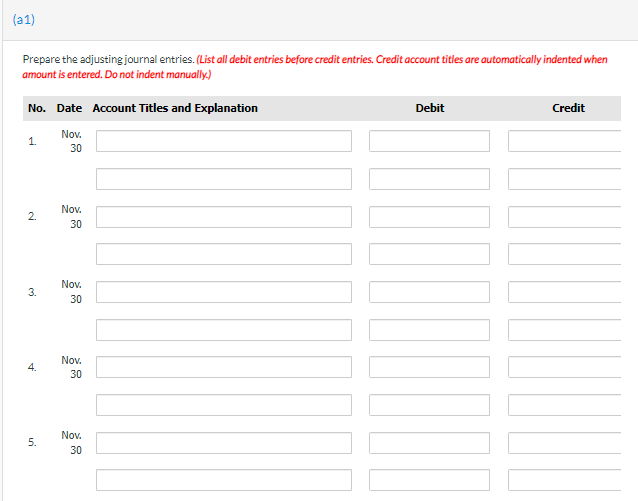

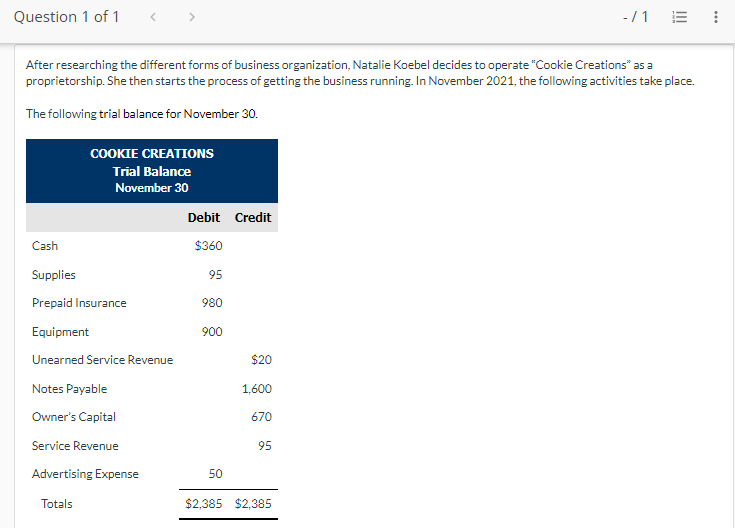

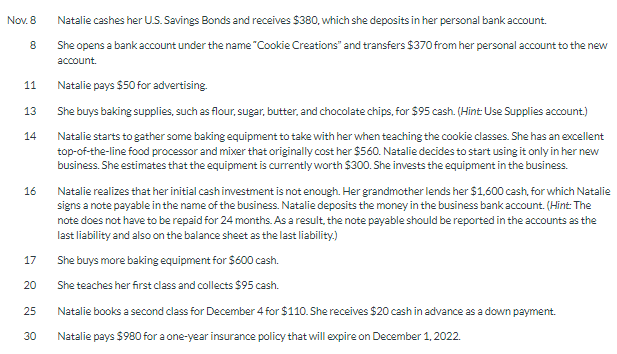

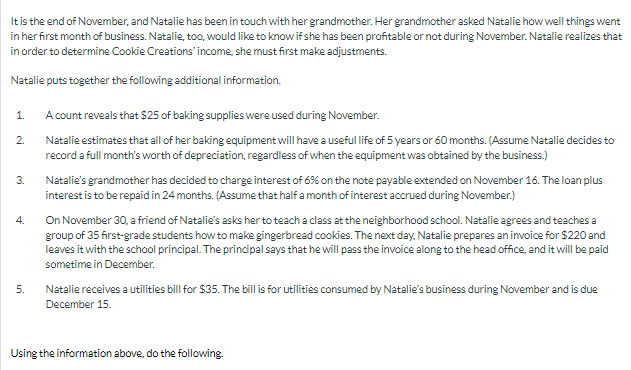

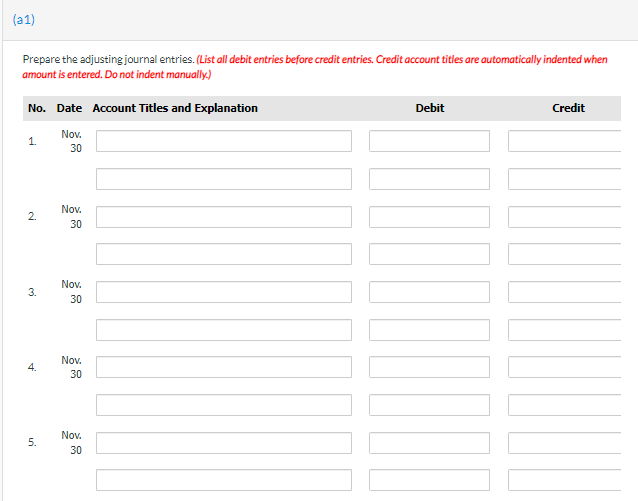

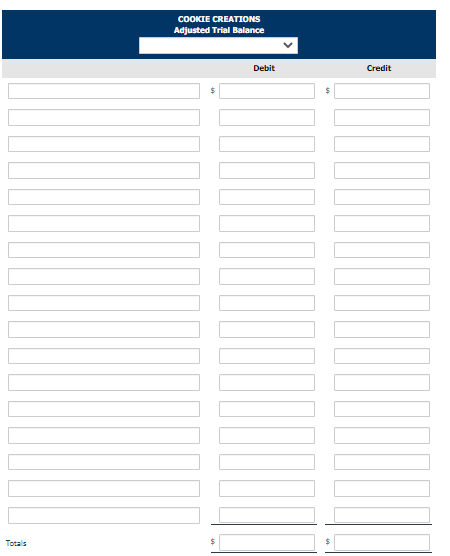

After researching the different forms of business organization, Natalie Koebel decides to operate "Cookie Creations" as a proprietorship. She then starts the process of getting the business running. In November 2021 , the following activities take place. The following trial balance for November 30 . Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $380, which she deposits in her personal bank account. 8 She opens a bank account under the name "Cookie Creations" and transfers $370 from her personal account to the new account. 11 Natalie pays $50 for advertising. 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $95 cash. (Hint: Use Supplies account.) 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer that originally cost her $560. Natalie decides to start using it only in her new business. She estimates that the equipment is currently worth $300. She invest the equipment in the business. 16 Natalie realizes that her initial cash imvestment is not enough. Her grandmother lends her $1,600 cash, for which Natalie signs a note payable in the name of the business. Natalie deposits the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and also on the balance sheet as the last liability.) 17 She buys more baking equipment for $600 cash. 20 She teaches her first class and collects $95 cash. 25 Natalie books a second class for December 4 for $110. She receives $20 cash in advance as a down payment. 30 Natalie pays $980 for a one-year insurance policy that will expire on December 1,2022. It is the end of November, and Natalie has been in touch with her grandmother. Her grandmother asked Natalie how well things went in her first month of business. Natalie, too, would like to know if she has been profitable or not during November. Natalie realizes that in order to determine Cookie Creations' income, she must first make adjustments. Natalie puts together the following additional information. 1. A count reveals that $25 of baking supplies were used during November. 2. Natalie estimates that all of her baking equipment will have a useful life of 5 years or 60 months. (Assume Natalie decides to record a full month's worth of depreciation, regardless of when the equipment was obtained by the business.) 3. Natalie's grandmother has decided to charge interest of 6% on the note payable extended on November 16 . The loan plus interest is to be repaid in 24 months. (Assume that half a month of interest accrued during November.) 4. On November 30, a friend of Natalie's asks her to teach a class at the neighborhood school. Natalie agrees and teaches a group of 35 first-grade students how to make gingerbread cookies. The next day, Natalie prepares an invoice for $220 and leaves it with the school principal. The principal says that he will pass the invoice along to the head office, and it will be paid sometime in December. 5. Natalie receives a utilities bill for $35. The bill is for utilities consumed by Natalie's business during November and is due December 15. Prepare the adjusting journal entries. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Poat the adjusting journal sntries. (Post entries in the order of journal entries presented in the previous question.) Interest Payeble \begin{tabular}{|l|l|} \hline Date Explanation Ref. & Debit \\ \hline Nov. 30 & 12 \end{tabular} COONIE CREATIONS Adjusted Trial Ealance Totals 5 5