Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me with the chart and questions under COMPLETE THE FOLLOWING ANALYSIS please! Se CASE NOTES: This spreadsheet contains yearly operating fixed costs & per

help me with the chart and questions under COMPLETE THE FOLLOWING ANALYSIS please!

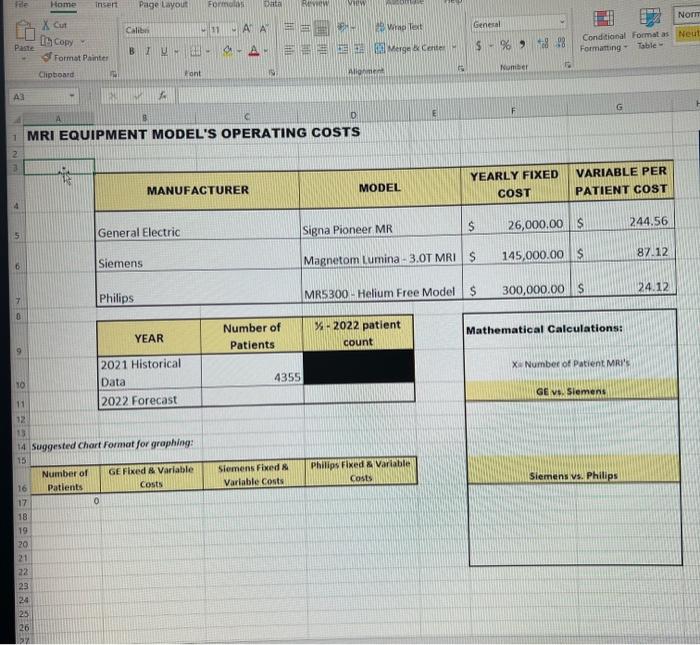

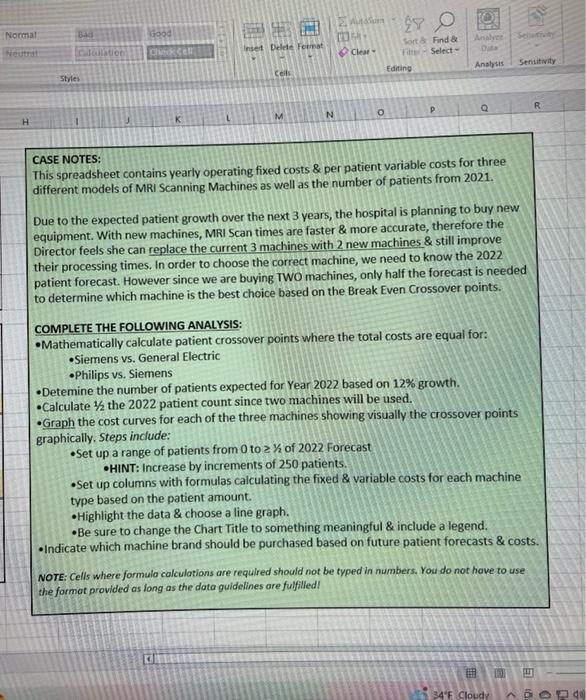

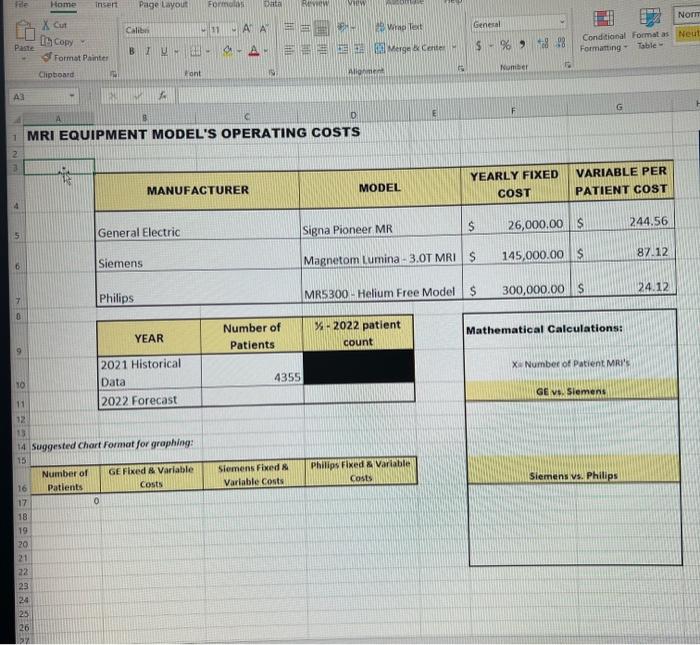

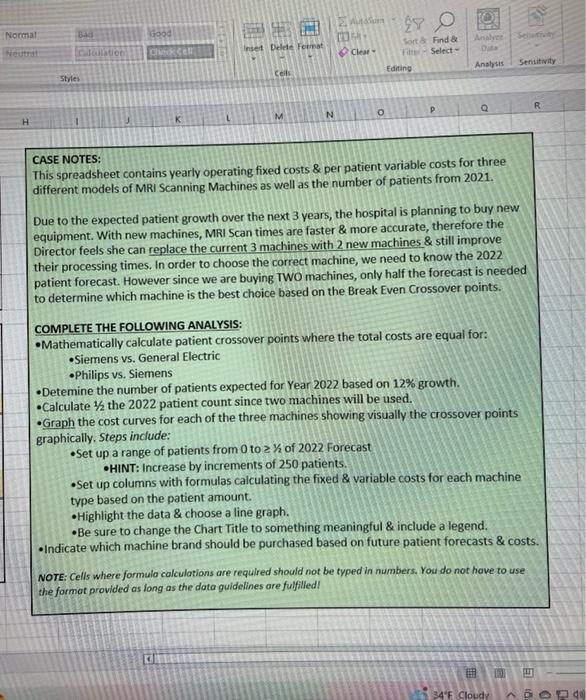

Se CASE NOTES: This spreadsheet contains yearly operating fixed costs \& per patient variable costs for three different models of MRI Scanning Machines as well as the number of patients from 2021. Due to the expected patient growth over the next 3 years, the hospital is planning to buy new equipment. With new machines, MRI Scan times are faster \& more accurate, therefore the Director feels she can replace the current 3 machines with 2 new machines \& still improve their processing times. In order to choose the correct machine, we need to know the 2022 patient forecast. However since we are buying TWO machines, only half the forecast is needed to determine which machine is the best choice based on the Break Even Crossover points. COMPLETE THE FOLLOWING ANALYSIS: - Mathematically calculate patient crossover points where the total costs are equal for: - Siemens vs. General Electric -Philips vs. Siemens -Detemine the number of patients expected for Year 2022 based on 12% growth. -Calculate 1/2 the 2022 patient count since two machines will be used. - Graph the cost curves for each of the three machines showing visually the crossover points graphically. Steps include: - Set up a range of patients from 0 to 1/2 of 2022 Forecast -HINT: Increase by increments of 250 patients. - Set up columns with formulas calculating the fixed \& variable costs for each machine type based on the patient amount. -Highlight the data \& choose a line graph. - Be sure to change the Chart Title to something meaningful & include a legend. - Indicate which machine brand should be purchased based on future patient forecasts \& costs. NOTE: Cells where formula calculations are required should not be typed in numbers, You do not have to use the format provided as long as the data guidelines are fulfilled! Se CASE NOTES: This spreadsheet contains yearly operating fixed costs \& per patient variable costs for three different models of MRI Scanning Machines as well as the number of patients from 2021. Due to the expected patient growth over the next 3 years, the hospital is planning to buy new equipment. With new machines, MRI Scan times are faster \& more accurate, therefore the Director feels she can replace the current 3 machines with 2 new machines \& still improve their processing times. In order to choose the correct machine, we need to know the 2022 patient forecast. However since we are buying TWO machines, only half the forecast is needed to determine which machine is the best choice based on the Break Even Crossover points. COMPLETE THE FOLLOWING ANALYSIS: - Mathematically calculate patient crossover points where the total costs are equal for: - Siemens vs. General Electric -Philips vs. Siemens -Detemine the number of patients expected for Year 2022 based on 12% growth. -Calculate 1/2 the 2022 patient count since two machines will be used. - Graph the cost curves for each of the three machines showing visually the crossover points graphically. Steps include: - Set up a range of patients from 0 to 1/2 of 2022 Forecast -HINT: Increase by increments of 250 patients. - Set up columns with formulas calculating the fixed \& variable costs for each machine type based on the patient amount. -Highlight the data \& choose a line graph. - Be sure to change the Chart Title to something meaningful & include a legend. - Indicate which machine brand should be purchased based on future patient forecasts \& costs. NOTE: Cells where formula calculations are required should not be typed in numbers, You do not have to use the format provided as long as the data guidelines are fulfilled

Se CASE NOTES: This spreadsheet contains yearly operating fixed costs \& per patient variable costs for three different models of MRI Scanning Machines as well as the number of patients from 2021. Due to the expected patient growth over the next 3 years, the hospital is planning to buy new equipment. With new machines, MRI Scan times are faster \& more accurate, therefore the Director feels she can replace the current 3 machines with 2 new machines \& still improve their processing times. In order to choose the correct machine, we need to know the 2022 patient forecast. However since we are buying TWO machines, only half the forecast is needed to determine which machine is the best choice based on the Break Even Crossover points. COMPLETE THE FOLLOWING ANALYSIS: - Mathematically calculate patient crossover points where the total costs are equal for: - Siemens vs. General Electric -Philips vs. Siemens -Detemine the number of patients expected for Year 2022 based on 12% growth. -Calculate 1/2 the 2022 patient count since two machines will be used. - Graph the cost curves for each of the three machines showing visually the crossover points graphically. Steps include: - Set up a range of patients from 0 to 1/2 of 2022 Forecast -HINT: Increase by increments of 250 patients. - Set up columns with formulas calculating the fixed \& variable costs for each machine type based on the patient amount. -Highlight the data \& choose a line graph. - Be sure to change the Chart Title to something meaningful & include a legend. - Indicate which machine brand should be purchased based on future patient forecasts \& costs. NOTE: Cells where formula calculations are required should not be typed in numbers, You do not have to use the format provided as long as the data guidelines are fulfilled! Se CASE NOTES: This spreadsheet contains yearly operating fixed costs \& per patient variable costs for three different models of MRI Scanning Machines as well as the number of patients from 2021. Due to the expected patient growth over the next 3 years, the hospital is planning to buy new equipment. With new machines, MRI Scan times are faster \& more accurate, therefore the Director feels she can replace the current 3 machines with 2 new machines \& still improve their processing times. In order to choose the correct machine, we need to know the 2022 patient forecast. However since we are buying TWO machines, only half the forecast is needed to determine which machine is the best choice based on the Break Even Crossover points. COMPLETE THE FOLLOWING ANALYSIS: - Mathematically calculate patient crossover points where the total costs are equal for: - Siemens vs. General Electric -Philips vs. Siemens -Detemine the number of patients expected for Year 2022 based on 12% growth. -Calculate 1/2 the 2022 patient count since two machines will be used. - Graph the cost curves for each of the three machines showing visually the crossover points graphically. Steps include: - Set up a range of patients from 0 to 1/2 of 2022 Forecast -HINT: Increase by increments of 250 patients. - Set up columns with formulas calculating the fixed \& variable costs for each machine type based on the patient amount. -Highlight the data \& choose a line graph. - Be sure to change the Chart Title to something meaningful & include a legend. - Indicate which machine brand should be purchased based on future patient forecasts \& costs. NOTE: Cells where formula calculations are required should not be typed in numbers, You do not have to use the format provided as long as the data guidelines are fulfilled

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started