Answered step by step

Verified Expert Solution

Question

1 Approved Answer

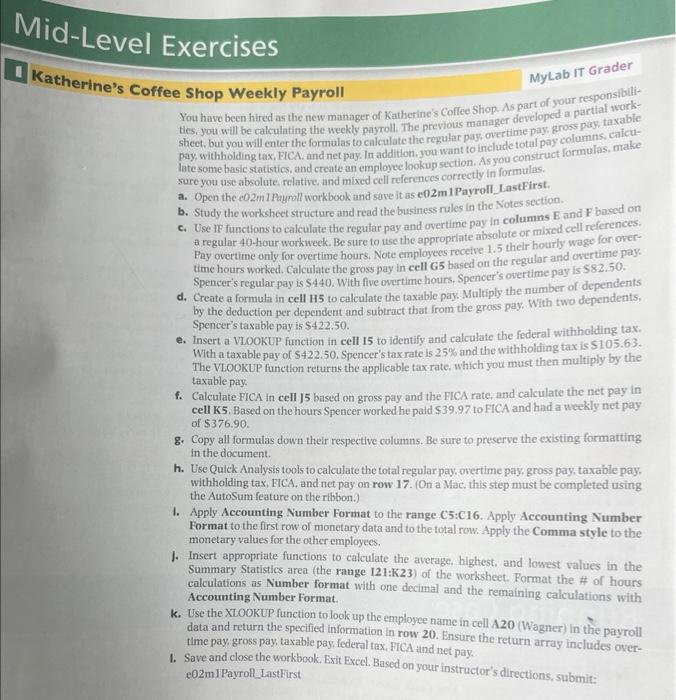

Help please You have been hired as the new manager of Katherine's Coffee Snop. . Seteloped a partial wam ties, you will be calculating the

Help please

You have been hired as the new manager of Katherine's Coffee Snop. . Seteloped a partial wam ties, you will be calculating the weekly payroll. The previous manager devetoped gross pay, taxable sheet, but you will enter the formulas to calculate the regular pay, overtimcpay- grosp columns, calcupay, withholding tax. ElCA. and net pay. In addition. you want to include totat pay conum formulas, make late some basic statistics, and create an employee lookup section. As you senth a sure you use absolute, relative, and mixed cell references correctly in form a. Open the e0 2m1 Pauroll workbook and save it as e0 2m1 Payroll LastFirst. b. Study the worksheet structure and read the business rules in the Notes section. c. Use IF functions to calculate the regular pay and overtime pay in columns E and F based on a regular 40 -hour workweek. Be sure to use the appropriate absolute or mixed cell references. Pay overtime only for overtime hours. Note employees recelve 1.5 thelr hourly wage for overtime hours worked. Calculate the gross pay in cell G5 based on the regular and cwertime pay. Spencer's regular pay is $440. With five overtime hours. Spencer's overtime pay is $82.50. d. Create a formula in cell H5 to calculate the taxable pay. Multiply the number of dependents by the deduction per dependent and subtract that from the gross pay. With two dependents. Spencer's taxable pay is $422:50. e. Insert a VLOOKUP function in cell 15 to identify and calculate the federal withholding tax. With a taxable pay of $422.50. Spencer's tax rate is 25% and the withholding tax is $105.63. The VLOOKUP function returns the applicable tax rate, which you must then multiply by the taxable pay. f. Calculate FICA in cell J5 based on gross pay and the FICA rate, and calculate the net pay in cell K5. Based on the hours Spencer worked he paid $39.97 to FICA and had a weekly net pay of 5376.90. g. Copy all formulas down their respective columns. Be sure to preserve the existing formatting in the document. h. Use Quick Analysis tools to calculate the total regular pay, overtime pay, gross pay, taxable pay, withholding tax, FICA, and net pay on row 17. (On a Mac. this step must be completed using the AutoStam feature on the ribbon.) 1. Apply Accounting Number Format to the range C5:C16. Apply Accounting Number Format to the first row of monetary data and to the total row Apply the Comma style to the monetary values for the other employees. J. Insert appropriate functions to calculate the average, highest, and lowest values in the Summary Statistics area (the range 121:K23) of the worksheet. Format the \# of hours calculations as Number format with one decimal and the remaining calculations with Accounting Number Format. k. Use the XLOOKUP function to look up the employee name in cell A20 (Wagner) in the payroll data and return the specified information in row 20 . Ensure the return array includes overtime pay, gross pay, taxable pay, federal tax, FICA and net pay. 1. Save and close the workbook. Exit Excel. Based on your instructor's directions, submit: e02m1Payroll_LastFirst

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started