HELP

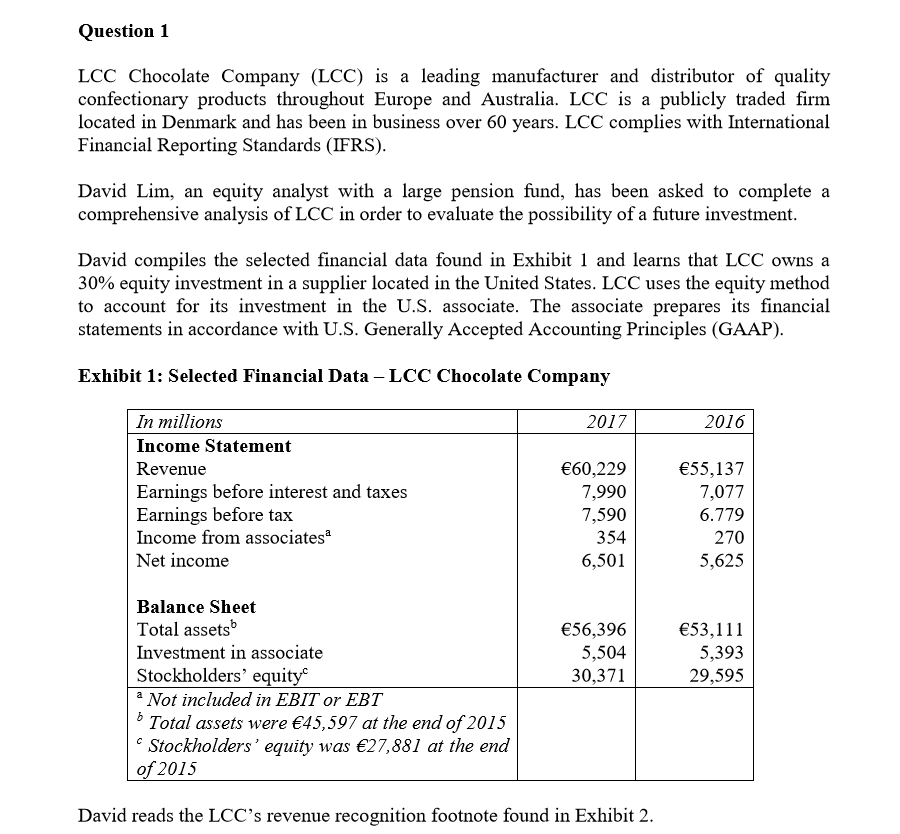

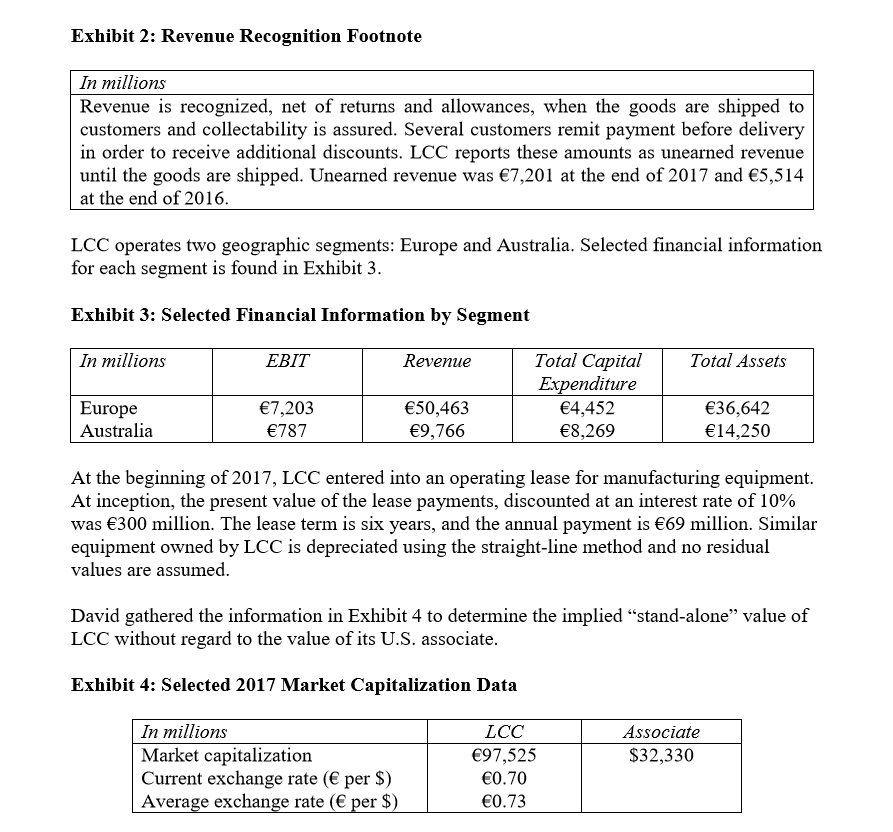

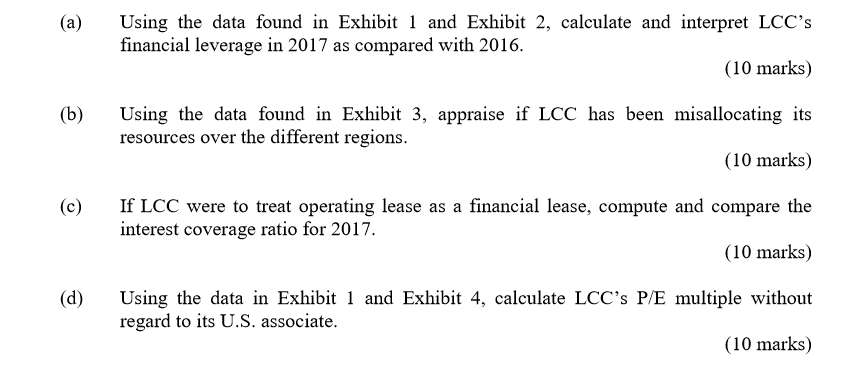

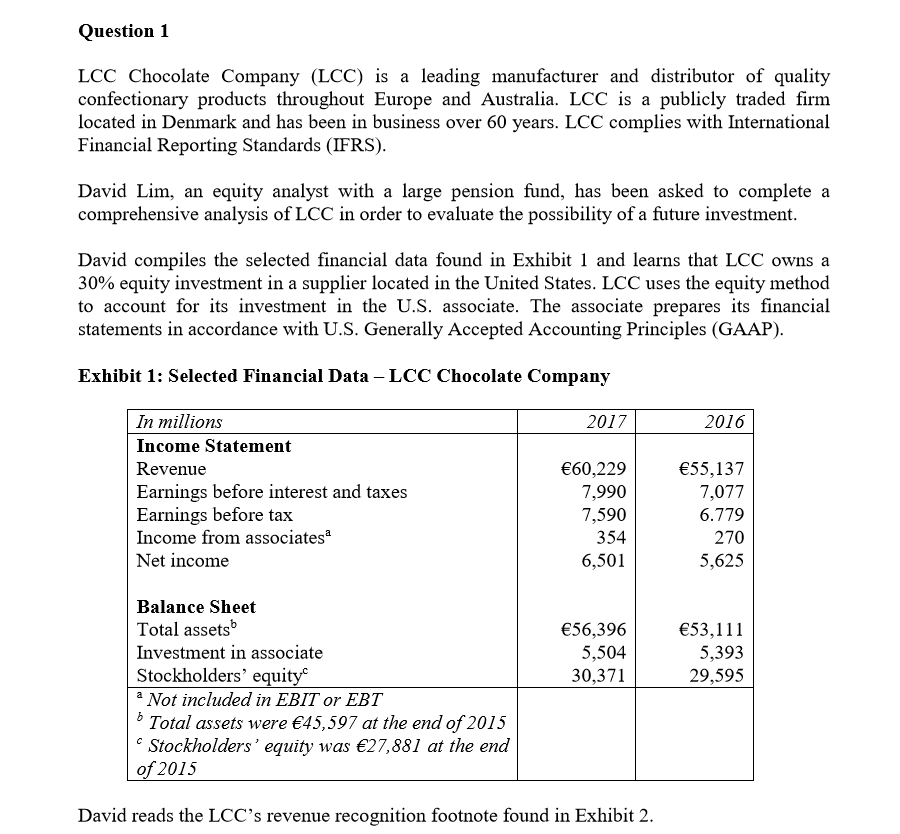

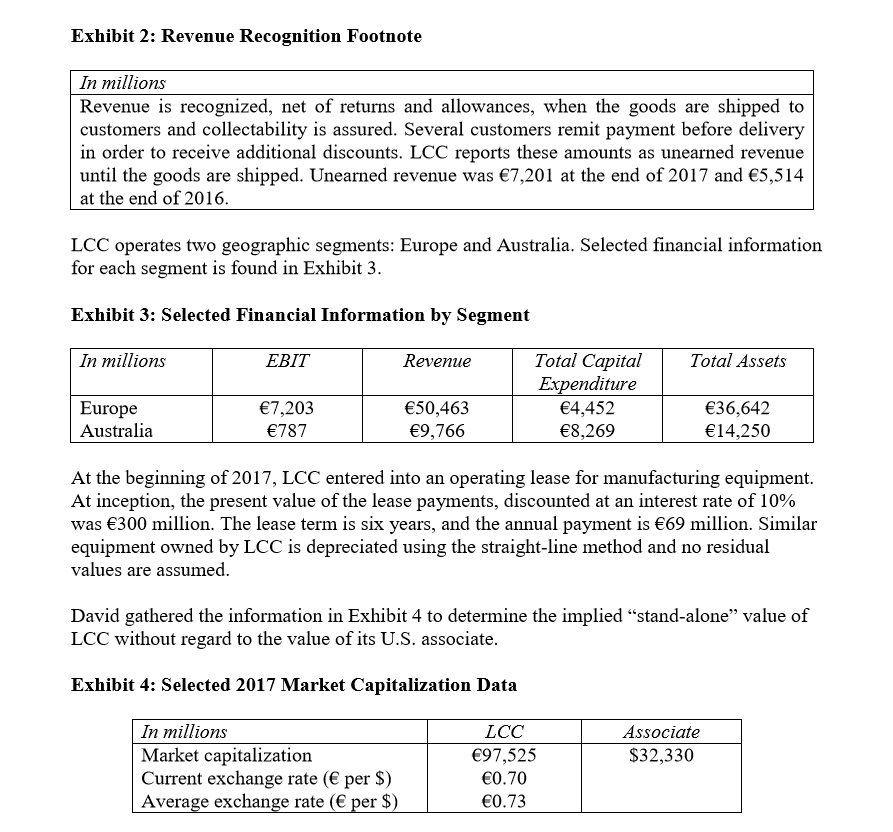

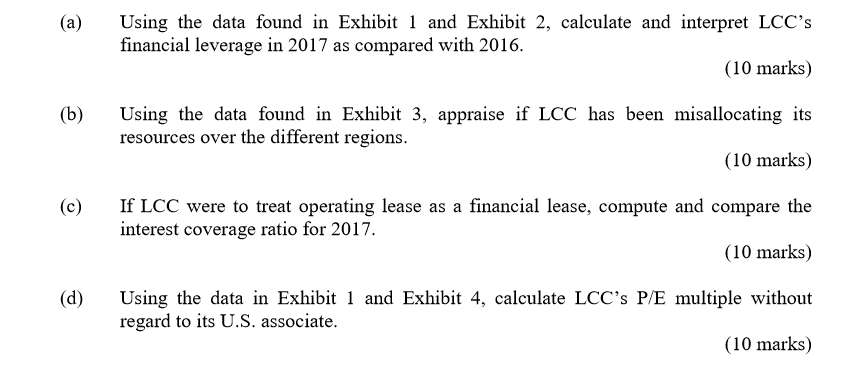

Question 1 LCC Chocolate Company (LCC) is a leading manufacturer and distributor of quality confectionary products throughout Europe and Australia. LCC is a publicly traded firm located in Denmark and has been in business over 60 years. LCC complies with International Financial Reporting Standards (IFRS) David Lim, an equity analyst with a large pension fund, has been asked to complete a comprehensive analysis of LCC in order to evaluate the possibility of a future investment David compiles the selected financial data found in Exhibit 1 and learns that LCC owns a 30% equity investment in a supplier located in the United States. LCC uses the equity method to account for its investment in the U.S. associate. The associate prepares its financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP) Exhibit 1: Selected Financial Data -LCC Chocolate Company In millions Income Statement Revenue Earnings before interest and taxes Earnings before tax Income from associates Net income 2017 2016 60,229 7,990 7,590 354 6,501 55,137 7,077 6.779 270 5,625 Balance Sheet Total assets Investment in associate Stockholders' equit a Not included in EBIT or EBT 56,396 5,504 30,371 53,111 5,393 29,595 Total assets were 45,597 at the end of 2015 Stockholders' equity was 27,881 at the end of 2015 David reads the LCC's revenue recognition footnote found in Exhibit 2. Exhibit 2: Revenue Recognition Footnote In millions Revenue is recognized, net of returns and allowances, when the goods are shipped to customers and collectability is assured. Several customers remit payment before delivery in order to receive additional discounts. LCC reports these amounts as unearned revenue until the goods are shipped. Unearned revenue was 7,201 at the end of 2017 and 5,514 at the end of 2016 LCC operates two geographic segments: Europe and Australia. Selected financial information for each segment is found in Exhibit 3 Exhibit 3: Selected Financial Information by Segment In millions Total Capital Expenditure 4,452 8,269 EBIT Revenue Total Assets Europe Australia 7,203 787 50,463 9,766 36,642 14,250 At the beginning of 2017, LCC entered into an operating lease for manufacturing equipment. At inception, the present value of the lease payments, discounted at an interest rate of 10% was 300 million. The lease term is six years, and the annual payment is 69 million. Similar equipment owned by LCC is depreciated using the straight-line method and no residual values are assumed David gathered the information in Exhibit 4 to determine the implied "stand-alone" value of LCC without regard to the value of its U.S. associate Exhibit 4: Selected 2017 Market Capitalization Data In millions Market capitalization Current exchange rate ( per $) Average exchange rate ( per $ LCC 97,525 0.70 0.73 Associate S32,330 (a) Using the data found in Exhibit 1 and Exhibit 2, calculate and interpret LCC's (10 marks) (b) Using the data found in Exhibit 3, appraise if LCC has been misallocating its (10 marks) (c) If LCC were to treat operating lease as a financial lease, compute and compare the (10 marks) (d Using the data in Exhibit 1 and Exhibit 4, calculate LCC's P/E multiple without (10 marks) financial leverage in 2017 as compared with 2016. resources over the different regions interest coverage ratio for 2017 regard to its U.S. associate. Question 1 LCC Chocolate Company (LCC) is a leading manufacturer and distributor of quality confectionary products throughout Europe and Australia. LCC is a publicly traded firm located in Denmark and has been in business over 60 years. LCC complies with International Financial Reporting Standards (IFRS) David Lim, an equity analyst with a large pension fund, has been asked to complete a comprehensive analysis of LCC in order to evaluate the possibility of a future investment David compiles the selected financial data found in Exhibit 1 and learns that LCC owns a 30% equity investment in a supplier located in the United States. LCC uses the equity method to account for its investment in the U.S. associate. The associate prepares its financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP) Exhibit 1: Selected Financial Data -LCC Chocolate Company In millions Income Statement Revenue Earnings before interest and taxes Earnings before tax Income from associates Net income 2017 2016 60,229 7,990 7,590 354 6,501 55,137 7,077 6.779 270 5,625 Balance Sheet Total assets Investment in associate Stockholders' equit a Not included in EBIT or EBT 56,396 5,504 30,371 53,111 5,393 29,595 Total assets were 45,597 at the end of 2015 Stockholders' equity was 27,881 at the end of 2015 David reads the LCC's revenue recognition footnote found in Exhibit 2. Exhibit 2: Revenue Recognition Footnote In millions Revenue is recognized, net of returns and allowances, when the goods are shipped to customers and collectability is assured. Several customers remit payment before delivery in order to receive additional discounts. LCC reports these amounts as unearned revenue until the goods are shipped. Unearned revenue was 7,201 at the end of 2017 and 5,514 at the end of 2016 LCC operates two geographic segments: Europe and Australia. Selected financial information for each segment is found in Exhibit 3 Exhibit 3: Selected Financial Information by Segment In millions Total Capital Expenditure 4,452 8,269 EBIT Revenue Total Assets Europe Australia 7,203 787 50,463 9,766 36,642 14,250 At the beginning of 2017, LCC entered into an operating lease for manufacturing equipment. At inception, the present value of the lease payments, discounted at an interest rate of 10% was 300 million. The lease term is six years, and the annual payment is 69 million. Similar equipment owned by LCC is depreciated using the straight-line method and no residual values are assumed David gathered the information in Exhibit 4 to determine the implied "stand-alone" value of LCC without regard to the value of its U.S. associate Exhibit 4: Selected 2017 Market Capitalization Data In millions Market capitalization Current exchange rate ( per $) Average exchange rate ( per $ LCC 97,525 0.70 0.73 Associate S32,330 (a) Using the data found in Exhibit 1 and Exhibit 2, calculate and interpret LCC's (10 marks) (b) Using the data found in Exhibit 3, appraise if LCC has been misallocating its (10 marks) (c) If LCC were to treat operating lease as a financial lease, compute and compare the (10 marks) (d Using the data in Exhibit 1 and Exhibit 4, calculate LCC's P/E multiple without (10 marks) financial leverage in 2017 as compared with 2016. resources over the different regions interest coverage ratio for 2017 regard to its U.S. associate