help!!

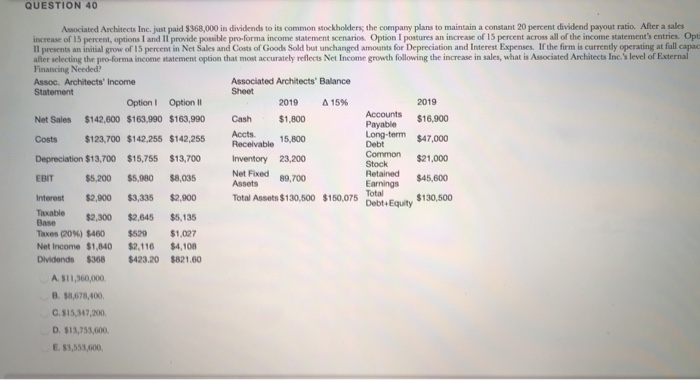

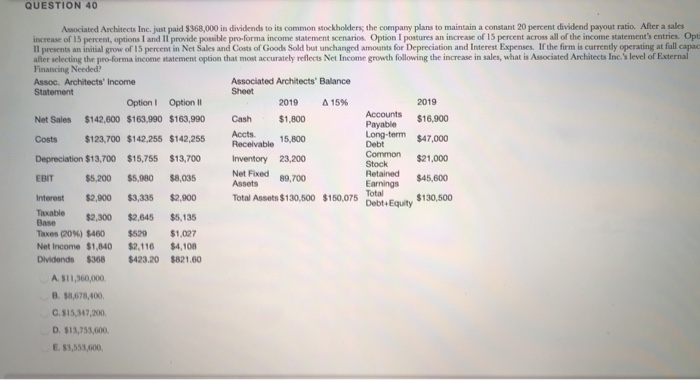

QUESTION 40 Long-term Associated Architects Inc. just paid $368,000 in dividends to its common stockholders, the company plans to maintain a constant 20 percent dividend payout ratio. After a sales increase of 15 percent options and Il provide powepro forma income atment scenarios Option I postures an increase of 15 percent across all of the income statement's entries Opt Il presents an initial grow of 15 percent in Net Sales and Costs of Goods So u nchanged amounts for Depreciation and Interest Expens If the firm is currently operating at full capac her selecting the proforma income atment option that most accurately reflects Net Income growth following the increase in sales, what is Amciated Architects Inc. S level of External Financing Needed? Assoc. Architects' Income Associated Architects' Balance Statement Sheet Option ! Option II 2019 A 15% 2019 Accounts Net Sales $142,600 $163.990 $163,990 Cash $1,800 $16.900 Payable Costs $123,700 $142,255 $142,255 Accts Debt Common Depreciation $13,700 $15,755 $13,700 Inventory 23,200 $21,000 Retained EBIT $5,200 $5,980 $8,035 $45,600 Assets Earnings Total Interest $2,900 $3,335 $2,900 Total Assets $130,500 $150,075 Table $2,300 $2,645 Base $5,135 Taxes (20%) $460 $520 $1,027 Net Income $1,840 $2,116 $4,108 Dividends $368 $423.20 $821.60 47.000 Receivable 15,800 Stock Net Fixed 80,700 Debte Equity $130,500 A. 511,560,000 B. 5,678,400 C.515,347,200 D. 513,753,600 E. 53,553,600 QUESTION 40 Long-term Associated Architects Inc. just paid $368,000 in dividends to its common stockholders, the company plans to maintain a constant 20 percent dividend payout ratio. After a sales increase of 15 percent options and Il provide powepro forma income atment scenarios Option I postures an increase of 15 percent across all of the income statement's entries Opt Il presents an initial grow of 15 percent in Net Sales and Costs of Goods So u nchanged amounts for Depreciation and Interest Expens If the firm is currently operating at full capac her selecting the proforma income atment option that most accurately reflects Net Income growth following the increase in sales, what is Amciated Architects Inc. S level of External Financing Needed? Assoc. Architects' Income Associated Architects' Balance Statement Sheet Option ! Option II 2019 A 15% 2019 Accounts Net Sales $142,600 $163.990 $163,990 Cash $1,800 $16.900 Payable Costs $123,700 $142,255 $142,255 Accts Debt Common Depreciation $13,700 $15,755 $13,700 Inventory 23,200 $21,000 Retained EBIT $5,200 $5,980 $8,035 $45,600 Assets Earnings Total Interest $2,900 $3,335 $2,900 Total Assets $130,500 $150,075 Table $2,300 $2,645 Base $5,135 Taxes (20%) $460 $520 $1,027 Net Income $1,840 $2,116 $4,108 Dividends $368 $423.20 $821.60 47.000 Receivable 15,800 Stock Net Fixed 80,700 Debte Equity $130,500 A. 511,560,000 B. 5,678,400 C.515,347,200 D. 513,753,600 E. 53,553,600

help!!

help!!