help

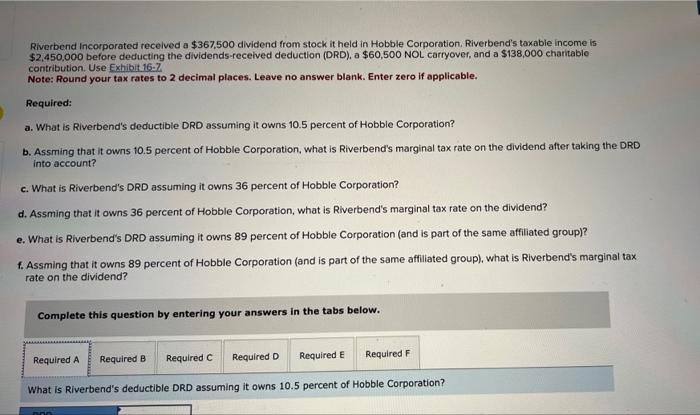

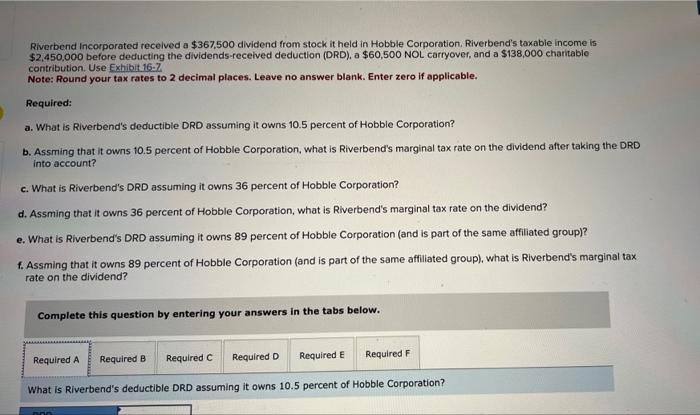

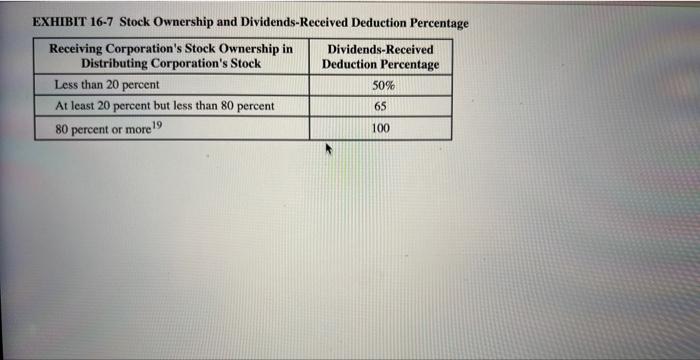

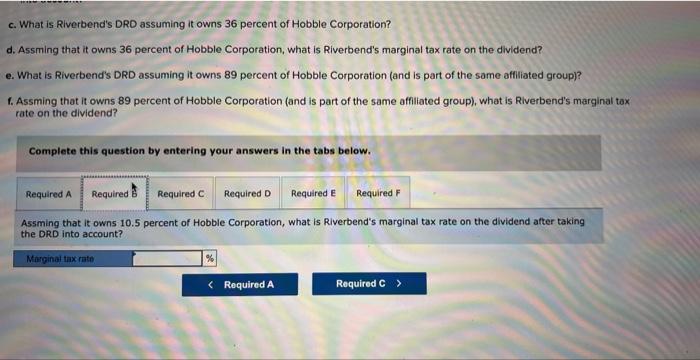

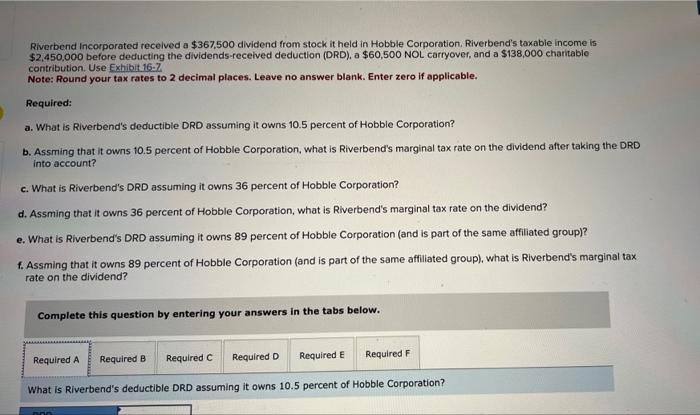

Riverbond incorporated recelved a $367,500 dividend from stock it held in Hobble Corporation, Riverbend's taxable income is $2,450,000 before deducting the dividends-received deduction (DRD), a $60,500 NOL carryover, and a $138,000 charitable contribution. Use Exhibit 16.7 Note: Round your tax rates to 2 decimal places. Leave no answer blank. Enter zero if applicable. Required: a. What is Riverbend's deductible DRD assuming it owns 10.5 percent of Hobble Corporation? b. Assming that it owns 10.5 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend after taking the DRD into account? c. What is Rrverbend's DRD assuming it owns 36 percent of Hobble Corporation? d. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? e. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affiliated group)? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affiliated group), what is. Riverbends marginal tax rate on the dividend? Complete this question by entering your answers in the tabs below. What is Riverbend's deductible DRD assuming it owns 10.5 percent of Hobble Corporation? EXHIBIT 16-7 Stock Ownership and Dividends-Received Deduction Percentage c. What is Riverbend's DRD assuming it owns 36 percent of Hobble Corporation? d. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affliated group)? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affiliated group), what is Riverbend's marginal tax rate on the dividend? Complete this question by entering your answers in the tabs below. Assming that it owns 10.5 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend after taking the DRD into account? c. What is Riverbend's DRD assuming it owns 36 percent of Hobble Corporation? d. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividena? e. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affiliated group)? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affiliated group), what is Rlverbend's marginal te rate on the dividend? Complete this question by entering your answers in the tabs below. What is Riverbend's DRD assuming it owns 36 percent of Hobble Corporation? into account? c. What is Riverbends DRD assuming it owns 36 percent of Hobble Corporation? d. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? e. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affitiated group)? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affilated group), what is Riverbend's marginal tax rate on the dividend? Complete this question by entering your answers in the tabs below. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? c. What is Riverbend's DRD assuming it owns 36 percent of Hobble Corporation? d. Assming that it owns 36 percent of Hobble Corporation, what is Riverberid's marginal tax rate on the dividend? e. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affliated group)? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affiliated group), what is Riverbend's marginal ti rate on the dividend? Complete this question by entering your answers in the tabs below. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affiliated group)? c. What is Riverbend's DRD assuming it owns 36 percent of Hobble Corporation? di. Assming that it owns 36 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? e. What is Riverbend's DRD assuming it owns 89 percent of Hobble Corporation (and is part of the same affiliated groupl? f. Assming that it owns 89 percent of Hobble Corporation (and is part of the same afiliated group), what is Riverbend's marginal ti rate on the dividend? Complete this question by entering your answers in the tabs below. Assming that it owns 89 percent of Hobble Corporation (and is part of the same affiliated group), what is Riverbend's marginal tax rate on the dividend