Answered step by step

Verified Expert Solution

Question

1 Approved Answer

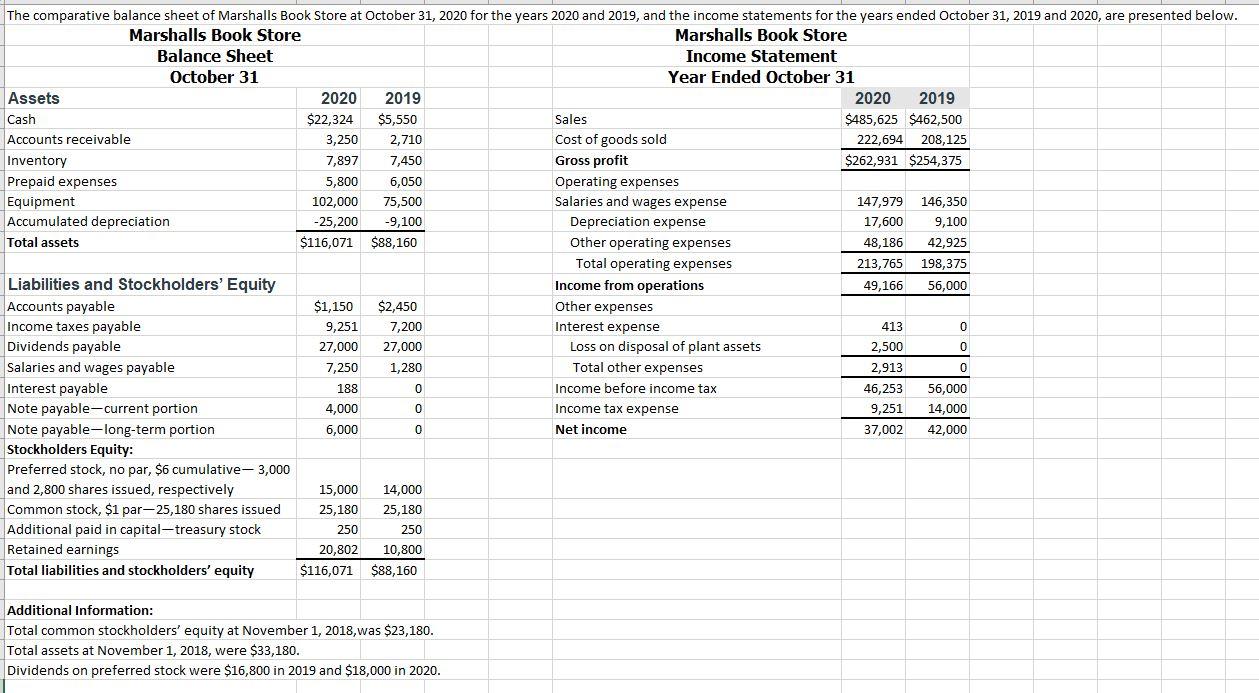

PLEASE SHOW THE WORK ! The comparative balance sheet of Marshalls Book Store at October 31, 2020 for the years 2020 and 2019, and the

PLEASE SHOW THE WORK !

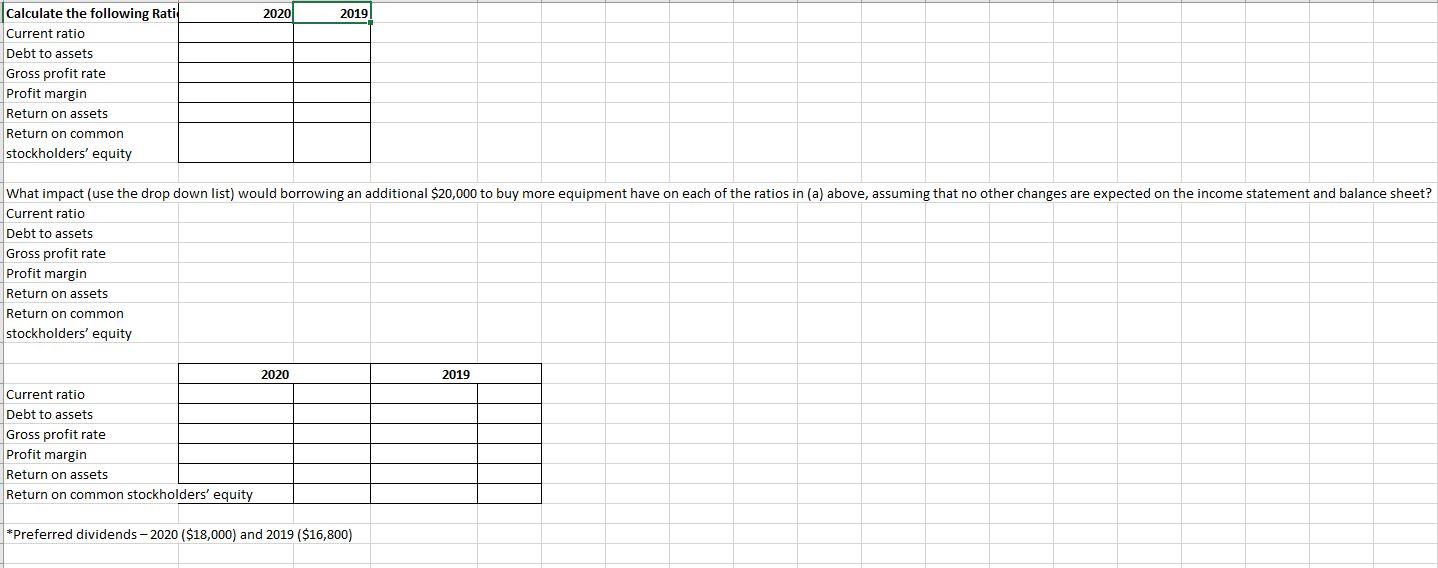

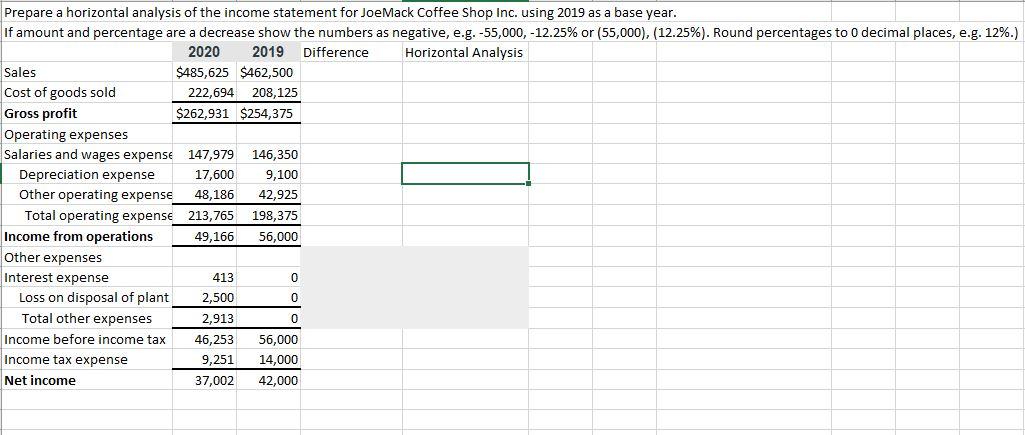

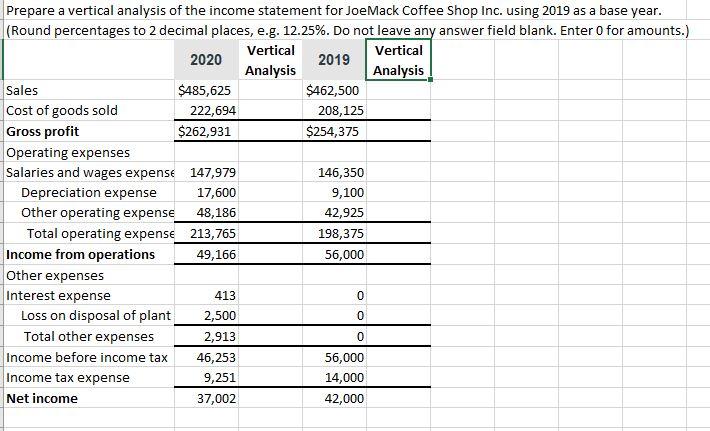

The comparative balance sheet of Marshalls Book Store at October 31, 2020 for the years 2020 and 2019, and the income statements for the years ended October 31, 2019 and 2020, are presented below. Marshalls Book Store Marshalls Book Store Balance Sheet Income Statement October 31 Year Ended October 31 Assets 2020 2019 2020 2019 Cash $22,324 $5,550 Sales $485,625 $462,500 Accounts receivable 3,250 2,710 Cost of goods sold 222,694 208,125 Inventory 7,897 7,450 Gross profit $262,931 $254,375 Prepaid expenses 5,800 6,050 Operating expenses Equipment 102,000 75,500 Salaries and wages expense 147,979 146,350 Accumulated depreciation -25, 200 -9,100 Depreciation expense 17,600 9,100 Total assets $116,071 $88,160 Other operating expenses 48,186 42,925 Total operating expenses 213,765 198,375 Liabilities and Stockholders' Equity Income from operations 49,166 56,000 Accounts payable $1,150 $2,450 Other expenses Income taxes payable 9,251 7,200 Interest expense 413 0 Dividends payable 27,000 27,000 Loss on disposal of plant assets 2,500 0 Salaries and wages payable 7,250 1,280 Total other expenses 2,913 0 Interest payable 188 0 Income before income tax 46,253 56,000 Note payable-current portion 0 Income tax expense 9,251 14,000 Note payable-long-term portion 6,000 0 Net income 37,002 42,000 Stockholders Equity: Preferred stock, no par, $6 cumulative- 3,000 and 2,800 shares issued, respectively 15,000 14,000 Common stock, $1 par-25,180 shares issued 25,180 25,180 Additional paid in capital-treasury stock 250 250 Retained earnings 20,802 10,800 Total liabilities and stockholders' equity $116,071 $88,160 4,000 Additional Information: Total common stockholders' equity at November 1, 2018, was $23,180. Total assets at November 1, 2018, were $33,180. Dividends on preferred stock were $16,800 in 2019 and $18,000 in 2020. Calculate the following Rati 2020 2019 Current ratio Debt to assets Gross profit rate Profit margin Return on assets Return on common stockholders' equity What impact (use the drop down list) would borrowing an additional $20,000 to buy more equipment have on each of the ratios in (a) above, assuming that no other changes are expected on the income statement and balance sheet? Current ratio Debt to assets Gross profit rate Profit margin Return on assets Return on common stockholders' equity 2020 2019 Current ratio Debt to assets Gross profit rate Profit margin Return on assets Return on common stockholders' equity *Preferred dividends - 2020 ($18,000) and 2019 ($16,800) Prepare a horizontal analysis of the income statement for JoeMack Coffee Shop Inc. using 2019 as a base year. If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -12.25% or (55,000), (12.25%). Round percentages to o decimal places, e.g. 12%.) 2020 2019 Difference Horizontal Analysis Sales $485,625 $462,500 Cost of goods sold 222,694 208,125 Gross profit $262,931 $254,375 Operating expenses Salaries and wages expense 147,979 146,350 Depreciation expense 17,600 9,100 Other operating expense 48,186 42,925 Total operating expense 213,765 198,375 Income from operations 49,166 56,000 Other expenses Interest expense 413 Loss on disposal of plant 2,500 0 Total other expenses 2,913 Income before income tax 46,253 56,000 Income tax expense 9,251 14,000 Net income 37,002 42,000 0 0 Prepare a vertical analysis of the income statement for JoeMack Coffee Shop Inc. using 2019 as a base year. (Round percentages to 2 decimal places, e.g. 12.25%. Do not leave any answer field blank. Enter o for amounts.) Vertical Vertical 2020 2019 Analysis Analysis Sales $485,625 $462,500 Cost of goods sold 222,694 208,125 Gross profit $262,931 $254,375 Operating expenses Salaries and wages expense 147,979 146,350 Depreciation expense 17,600 9,100 Other operating expense 48,186 42,925 Total operating expense 213,765 198,375 Income from operations 49,166 56,000 Other expenses Interest expense 413 Loss on disposal of plant 2,500 Total other expenses 2,913 0 Income before income tax 46,253 56,000 Income tax expense 9,251 14,000 Net income 37,002 42,000 0 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started