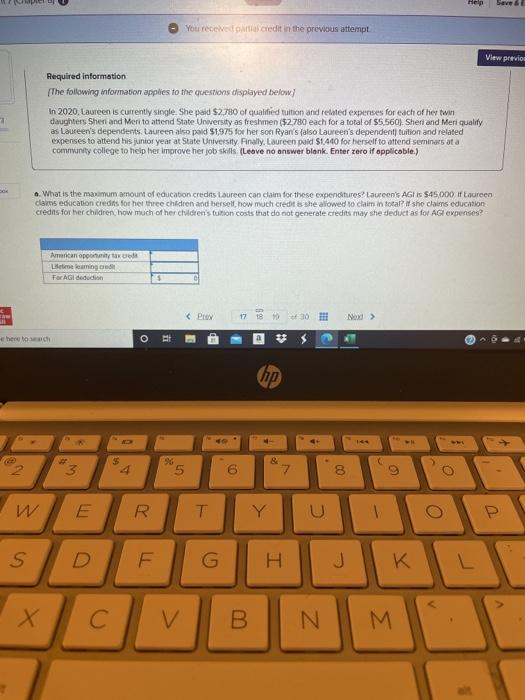

Help Save You received to credit in the previous attempt View previou Required information (The following information applies to the questions displayed below) In 2020. Laureen is currently single She paid $2,780 of qualified tuition and related expenses for each of her twin daughters Sheni and Merito attend State University as freshmen ($2.780 each for a total of $5,560. Sheri and Meri quality as Laureen's dependents. Laureen also paid $1,975 for her son Ryan's falso Laureen's dependent tuition and related expenses to attend his junior year at State University Finally, Laureen paid $1.440 for herself to attend seminars at a community college to help her improve her job skills (Leave no answer blank. Enter zero if applicable) 6. What is the mamum amount of education credits Laureen can claim for these expenditures? Laureen's AGH is $45,000. If Laureen dams education credits for her three children and herself how much credits she allowed to claim in total she claims education credits for her children, how much of her children's tuition costs that do not generate credits may she deduct as for AG expenses Amman opport Lemming For Gidededin 17 18 19 30 Nad > here to O BE hp 8 of 3 5 4 6 00 9 W E R T Y U P S D ol F G H J K X C V B N M M Help Save You received to credit in the previous attempt View previou Required information (The following information applies to the questions displayed below) In 2020. Laureen is currently single She paid $2,780 of qualified tuition and related expenses for each of her twin daughters Sheni and Merito attend State University as freshmen ($2.780 each for a total of $5,560. Sheri and Meri quality as Laureen's dependents. Laureen also paid $1,975 for her son Ryan's falso Laureen's dependent tuition and related expenses to attend his junior year at State University Finally, Laureen paid $1.440 for herself to attend seminars at a community college to help her improve her job skills (Leave no answer blank. Enter zero if applicable) 6. What is the mamum amount of education credits Laureen can claim for these expenditures? Laureen's AGH is $45,000. If Laureen dams education credits for her three children and herself how much credits she allowed to claim in total she claims education credits for her children, how much of her children's tuition costs that do not generate credits may she deduct as for AG expenses Amman opport Lemming For Gidededin 17 18 19 30 Nad > here to O BE hp 8 of 3 5 4 6 00 9 W E R T Y U P S D ol F G H J K X C V B N M M