Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help The amount of federal income taxes that you are required to pay is based on your filing status, your taxable income, and the IRS

help

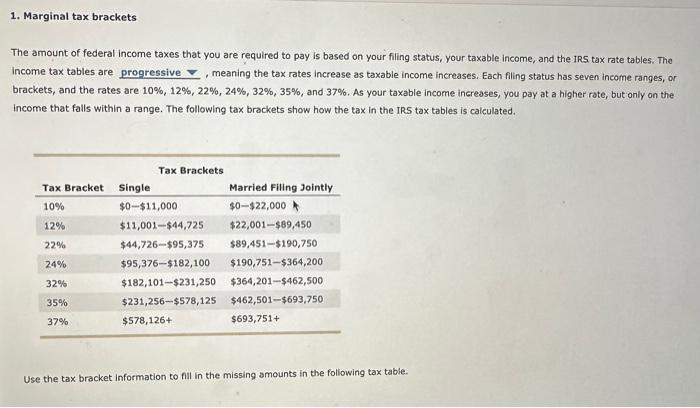

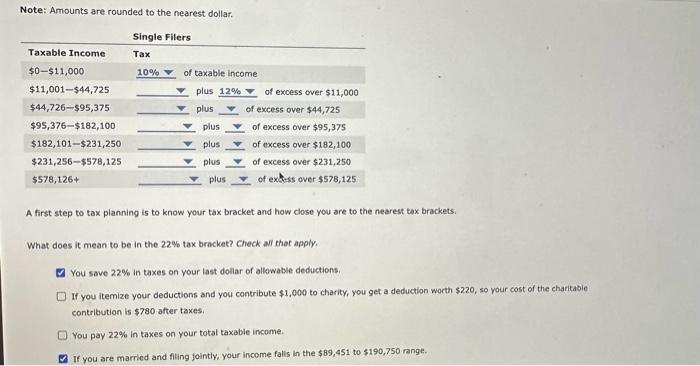

The amount of federal income taxes that you are required to pay is based on your filing status, your taxable income, and the IRS tax rate tables. The income tax tables are , meaning the tax rates increase as taxable income increases. Each filing status has seven income ranges, or brackets, and the rates are 10%,12%,22%,24%,32%,35%, and 37%. As your taxable income increases, you pay at a higher rate, but only on the income that falls within a range. The following tax brackets show how the tax in the IRS tax tables is calculated. Use the tax bracket information to fill in the missing amounts in the following tax table. Note: Amounts are rounded to the nearest dollar. A first step to tax planning is to know your tax bracket and how close you are to the nearest tax brackets. What does it mean to be in the 22% tax bracket? check all that apply. You save 22% in taxes on your last dollar of allewable deductions: If you itemize your deductions and you contribute $1,000 to charity, you get a deduction worth $220, so your cost of the charitabie contribution is $780 after taxes. You pay 22% in taxes on your total taxable income. If you are married and fiting jointly, your income falis in the $89,451 to $190,750 range

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started