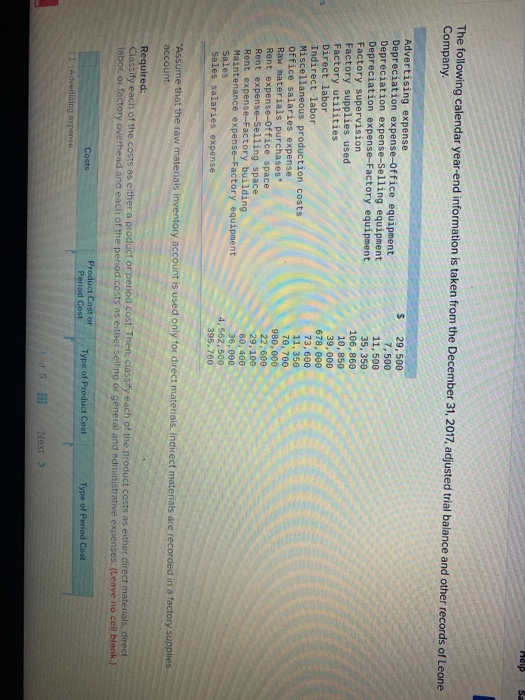

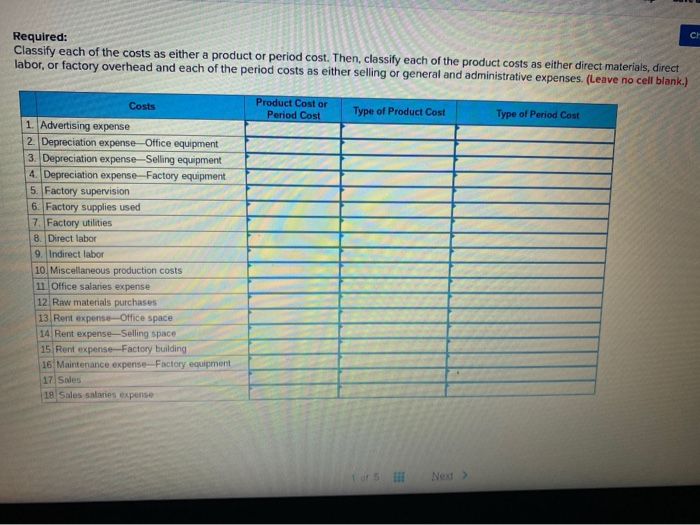

Help The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Direct labor Indirect labor Miscellaneous production costs office salaries expense Raw materials purchases" Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Maintenance expense-Factory equipment Sales Sales salaries expense $ 29,500 7,500 11,500 35, 350 106,860 10,850 39,000 678,000 73,600 11, 350 70, 700 980,000 22,600 29, 100 80, 400 36,000 4,562,500 395,760 "Assume that the raw materials inventory account is used only for direct materials. Indirect materials are recorded in a factory supplies account Required: Classify each of the costs as either a product or period cost. Then: classify each of the product costs as either direct materials, direct labor or factory overhead and each of the period costs as either selling or general and administrative expenses. (Leave no cell blank.) Costs Product Cost or Period Cost Type of Product Cost Type of Period Cost 1 Advertising expense of 5 il Next > CH Required: Classify each of the costs as either a product or period cost. Then, classify each of the product costs as either direct materials, direct labor, or factory overhead and each of the period costs as either selling or general and administrative expenses. (Leave no cell blank.) Product Cost or Period Cost Type of Product Cost Type of Period Cost Costs 1. Advertising expense 2 Depreciation expense-Office equipment 3. Depreciation expense-Selling equipment 4. Depreciation expense-Factory equipment 5. Factory supervision 6. Factory supplies used 7. Factory utilities 8. Direct labor 9. Indirect labor 10. Miscellaneous production costs 11. Office salaries expense 12 Raw materials purchases 13 Rent expense-Office space 14 Rent expense-Selling space 15. Rent expense-Factory building 16 Maintenance expense-Factory equipment 17 Sales 18 Sales salaries expense Next >