Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Trumponics maker of the Trump Bottle Head has made a review of its accounts receivable and allowance for doubtful accounts.. The business was a

Help

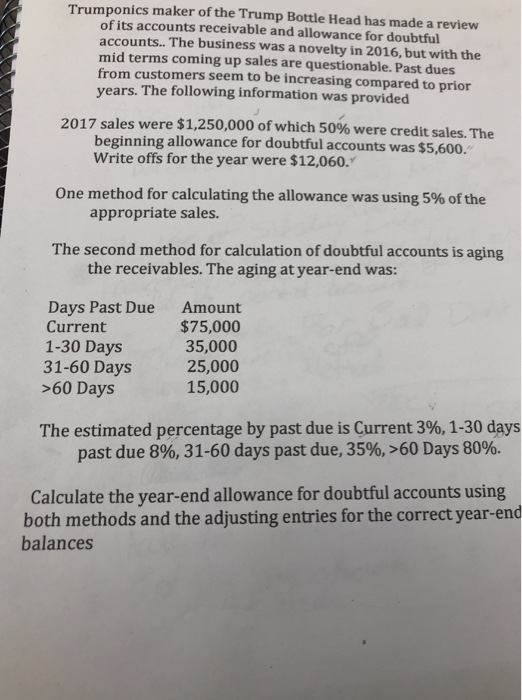

Trumponics maker of the Trump Bottle Head has made a review of its accounts receivable and allowance for doubtful accounts.. The business was a novelty in 2016, but with the mid terms coming up sales are questionable. Past dues from customers seem to be increasing compared to prior years. The following information was provided 2017 sales were $1,250,000 of which 50% were credit sales. The beginning allowance for doubtful accounts was $5,600. Write offs for the year were $12,060. One method for calculating the allowance was using 5% of the appropriate sales. The second method for calculation of doubtful accounts is aging the receivables. The aging at year-end was: Days Past Due Current 1-30 Days 31-60 Days >60 Days Amount $75,000 35,000 25,000 15,000 The estimated percentage by past due is Current 396, 1-30 days past due 896, 31-60 days past due, 35%,-60 Days 80%. Calculate the year-end allowance for doubtful accounts using both methods and the adjusting entries for the correct year-end balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started