help with excel formula and questions 1-3

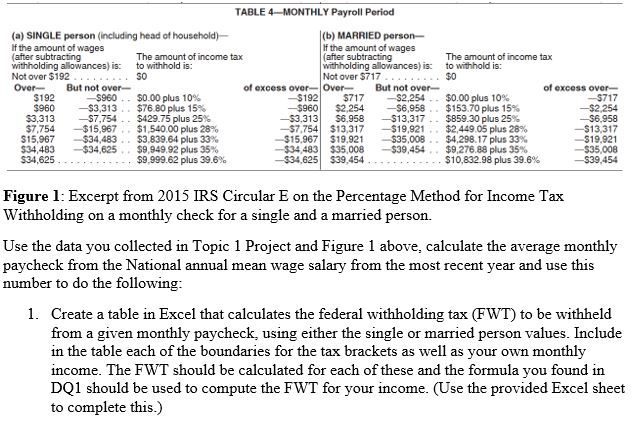

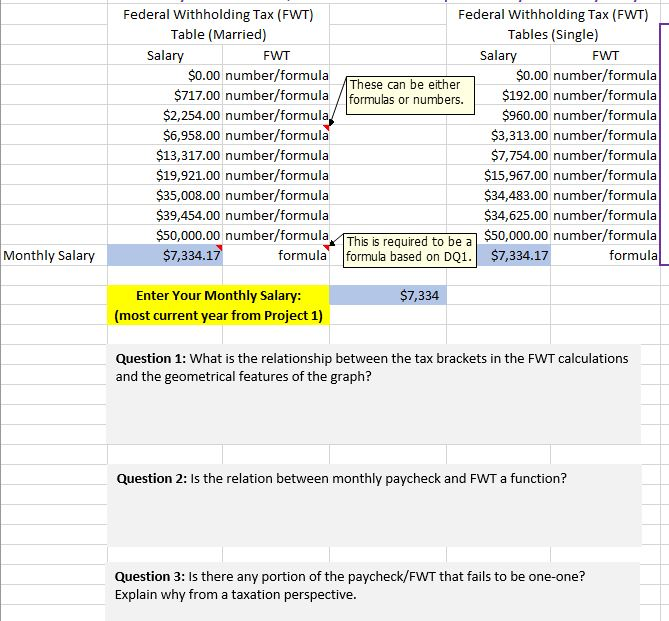

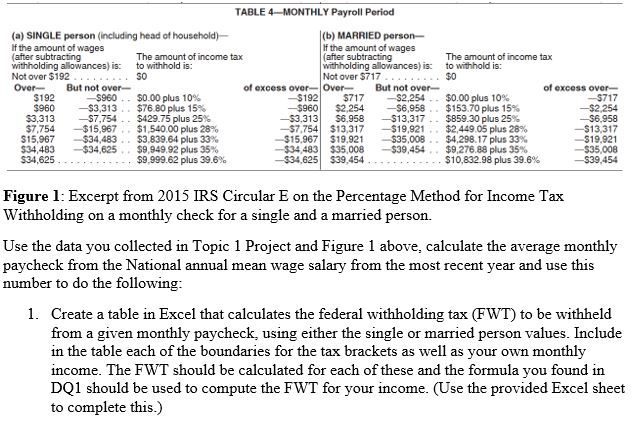

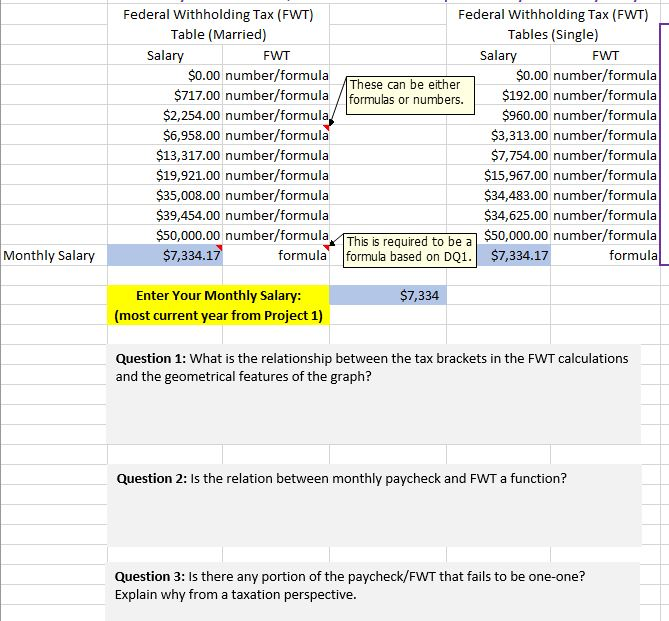

TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages after subtracting withholding allowances) is: to withhold is: Not over $192 OverBut not over- (b) MARRIED person- If the amount of wages The amount of income tax The amount of income tax withholding allowancesis: to withhold is: Not over $717 S0 $0 of excess over-Over- But not over- of excess over- $717 -$2,254 $6.958 $13,317 $19,921 -$35,008 S39,454 192 -S960 . , $0.00 plus 10% -$192| --$960| -53.313| -$7,754| --$15.967| --$34,483| S717-52,254. $2254 --$6,958, S6.958 -SI 3,317-- $0.00 plus 10% $153.70 plus 15% $859.30 plus 25% $2.449 05 plus 28% $4,298, 17 plus 33% $9,276.88 plus 35% $10,832.98 plus 39.6% $960-$3,313.. $3.31 3-$7,754 . . $7,754 --$15,967 $7680 pks 15% S429.75 plus 25% $1.54000 plu$ 28% $3.839.64 plus 33% $9.949.92 plus 35% $9.999.62 plus 39.6% $15.967-$34.483.. S34.483-$34,625 $13.317-$19.921 $19.921 --$35,008 $35,008 --$39,464 34,625 $34,625 339,454 Figure 1: Excerpt from 2015 IRS Circular E on the Percentage Method for Income Tax Withholding on a monthly check for a single and a married person. Use the data you collected in Topic 1 Project and Figure 1 above, calculate the average monthly paycheck from the National annual mean wage salary from the most recent year and use this number to do the following 1. Create a table in Excel that calculates the federal withholding tax (FWT) to be withheld from a given monthly paycheck, using either the single or married person values. Include in the table each of the boundaries for the tax brackets as well as your own monthly income. The FWT should be calculated for each of these and the formula you found in DQ1 should be used to compute the FWT for your income. (Use the provided Excel sheet to complete this.) Federal Withholding Tax (FWT) Table (Married) Federal Withholding Tax (FWT) Tables (Single) Sala FWT Salary FWT $0.00 number/formula $0.00 number/formula $192.00 number/formula $960.00 number/formula $3,313.00 number/formula $7,754.00 number/formula $15,967.00 number/formula $34,483.00 number/formula $34,625.00 number/formula $50,000.00 number/formula formula These can be either $717.00 number/formula /formulas or numbers. $2,254.00 number/formula $6,958.00 number/formula $13,317.00 number/formula $19,921.00 number/formula $35,008.00 number/formula $39,454.00 number/formula $50,000.00 number/formula $7,334.17 This is required to be a formulaformula based on DQ1.$7,334.17 Monthly Salary Enter Your Monthly Salary: $7,334 (most current year from Project 1) Question 1: What is the relationship between the tax brackets in the FWT calculations and the geometrical features of the graph? Question 2: Is the relation between monthly paycheck and FWT a function? Question 3: Is there any portion of the paycheck/FWT that fails to be one-one? Explain why from a taxation perspective TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages after subtracting withholding allowances) is: to withhold is: Not over $192 OverBut not over- (b) MARRIED person- If the amount of wages The amount of income tax The amount of income tax withholding allowancesis: to withhold is: Not over $717 S0 $0 of excess over-Over- But not over- of excess over- $717 -$2,254 $6.958 $13,317 $19,921 -$35,008 S39,454 192 -S960 . , $0.00 plus 10% -$192| --$960| -53.313| -$7,754| --$15.967| --$34,483| S717-52,254. $2254 --$6,958, S6.958 -SI 3,317-- $0.00 plus 10% $153.70 plus 15% $859.30 plus 25% $2.449 05 plus 28% $4,298, 17 plus 33% $9,276.88 plus 35% $10,832.98 plus 39.6% $960-$3,313.. $3.31 3-$7,754 . . $7,754 --$15,967 $7680 pks 15% S429.75 plus 25% $1.54000 plu$ 28% $3.839.64 plus 33% $9.949.92 plus 35% $9.999.62 plus 39.6% $15.967-$34.483.. S34.483-$34,625 $13.317-$19.921 $19.921 --$35,008 $35,008 --$39,464 34,625 $34,625 339,454 Figure 1: Excerpt from 2015 IRS Circular E on the Percentage Method for Income Tax Withholding on a monthly check for a single and a married person. Use the data you collected in Topic 1 Project and Figure 1 above, calculate the average monthly paycheck from the National annual mean wage salary from the most recent year and use this number to do the following 1. Create a table in Excel that calculates the federal withholding tax (FWT) to be withheld from a given monthly paycheck, using either the single or married person values. Include in the table each of the boundaries for the tax brackets as well as your own monthly income. The FWT should be calculated for each of these and the formula you found in DQ1 should be used to compute the FWT for your income. (Use the provided Excel sheet to complete this.) Federal Withholding Tax (FWT) Table (Married) Federal Withholding Tax (FWT) Tables (Single) Sala FWT Salary FWT $0.00 number/formula $0.00 number/formula $192.00 number/formula $960.00 number/formula $3,313.00 number/formula $7,754.00 number/formula $15,967.00 number/formula $34,483.00 number/formula $34,625.00 number/formula $50,000.00 number/formula formula These can be either $717.00 number/formula /formulas or numbers. $2,254.00 number/formula $6,958.00 number/formula $13,317.00 number/formula $19,921.00 number/formula $35,008.00 number/formula $39,454.00 number/formula $50,000.00 number/formula $7,334.17 This is required to be a formulaformula based on DQ1.$7,334.17 Monthly Salary Enter Your Monthly Salary: $7,334 (most current year from Project 1) Question 1: What is the relationship between the tax brackets in the FWT calculations and the geometrical features of the graph? Question 2: Is the relation between monthly paycheck and FWT a function? Question 3: Is there any portion of the paycheck/FWT that fails to be one-one? Explain why from a taxation perspective