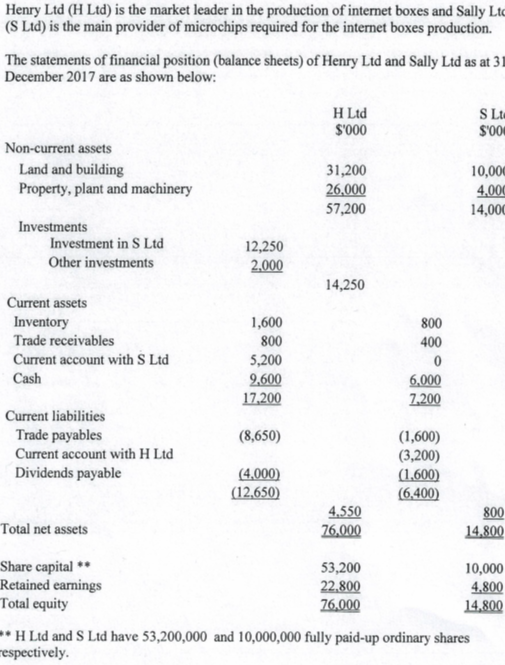

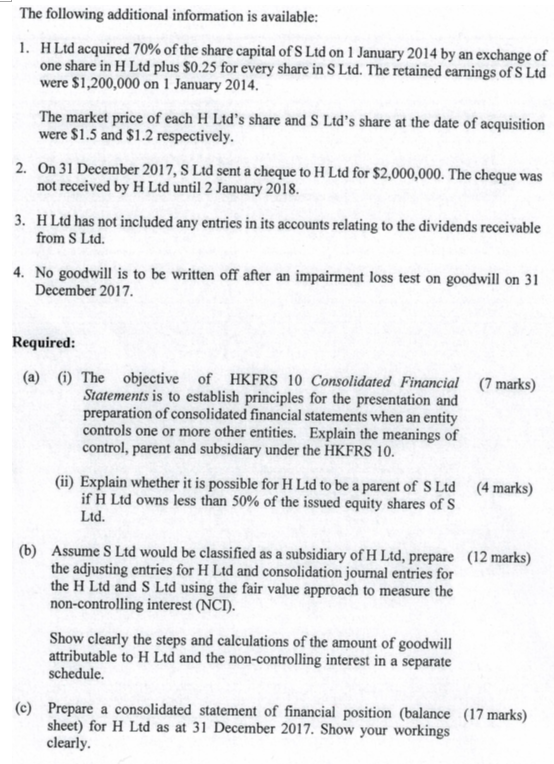

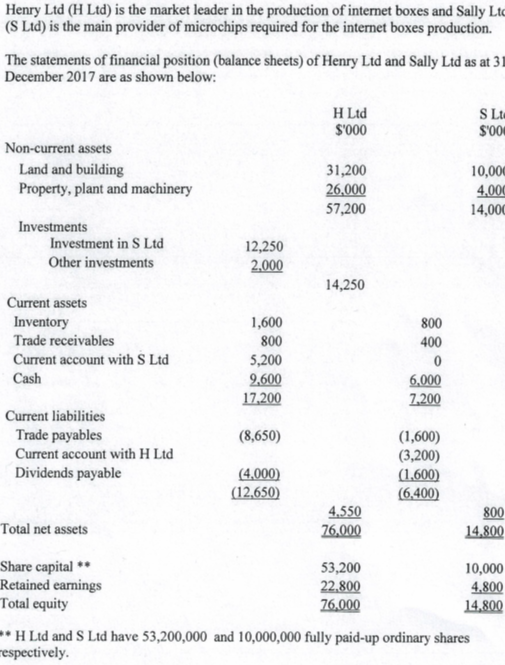

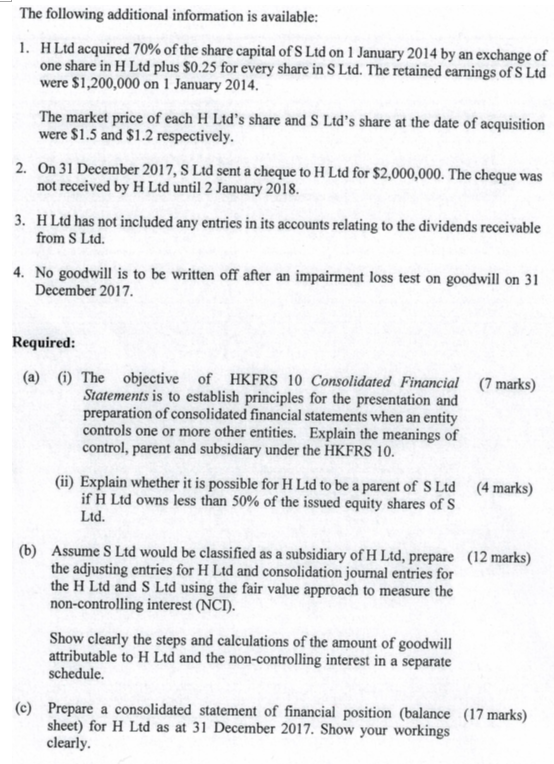

Henry Ltd (H Ltd) is the market leader in the production of internet boxes and Sally Lt (S Ltd) is the main provider of microchips required for the internet boxes production. The statements of financial position (balance sheets) of Henry Ltd and Sally Ltd as at 31 December 2017 are as shown below H Ltd S Lt Non-current assets Land and building Property, plant and machinery 31,200 10,000 57,200 14,00 Investment in S Ltd Other investments 12,250 14,250 Current assets 1,600 800 5,200 9,600 17.200 Inventory Trade receivables Current account with S Ltd Cash 800 Current liabilities Trade payables Current account with H Ltd Dividends payable (8,650) (1,600) (3,200) (1,600) 550 Total net assets Share capital Retained earnings Total equity 10,000 4,800 53,200 H Ltd and S Ltd have 53,200,000 and 10,000,000 fully paid-up ordinary shares espectively The following additional information is available: H Ltd acquired 70% of the share capital of S Ltd on 1 January 2014 by an exchange of one share in H Ltd plus $0.25 for every share in S Ltd. The retained earnings of S Ltd were $1,200,000 on 1 January 2014. 1 The market price of each H Ltd's share and S Ltd's share at the date of acquisition were $1.5 and $1.2 respectively. 2. On 31 December 2017, S Ltd sent a cheque to H Ltd for $2,000,000. The cheque was 3. HLtd has not included any entries in its accounts relating to the dividends receivable 4. No goodwill is to be written off after an impairment loss test on goodwill on 31 not received by H Ltd until 2 January 2018. from S Ltd. December 2017. Required: (a) ) The objective of HKFRS 10 Consolidated Financial 7 marks) Statements is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. Explain the meanings of control, parent and subsidiary under the HKFRS 10. (Gi) Explain whether it is possible for H Ltd to be a parent of S Ltd if H Ltd owns less than 50% of the issued equity shares of S (4 marks) Ltd. Assume S Ltd would be classified as a subsidiary of H Ltd, prepare the adjusting entries for H Ltd and consolidation journal entries for ir value approach to measure the (b) (12 marks) the H Ltd and S Ltd using the fa non-controlling interest (NCI). Show clearly the steps and calculations of the amount of goodwill attributable to H Ltd and the non-controlling interest in a separate schedule. (e) Prepare a consolidated statement of financial position (balance (17 marks) sheet) for H Ltd as at 31 December 2017. Show your workings clearly Henry Ltd (H Ltd) is the market leader in the production of internet boxes and Sally Lt (S Ltd) is the main provider of microchips required for the internet boxes production. The statements of financial position (balance sheets) of Henry Ltd and Sally Ltd as at 31 December 2017 are as shown below H Ltd S Lt Non-current assets Land and building Property, plant and machinery 31,200 10,000 57,200 14,00 Investment in S Ltd Other investments 12,250 14,250 Current assets 1,600 800 5,200 9,600 17.200 Inventory Trade receivables Current account with S Ltd Cash 800 Current liabilities Trade payables Current account with H Ltd Dividends payable (8,650) (1,600) (3,200) (1,600) 550 Total net assets Share capital Retained earnings Total equity 10,000 4,800 53,200 H Ltd and S Ltd have 53,200,000 and 10,000,000 fully paid-up ordinary shares espectively The following additional information is available: H Ltd acquired 70% of the share capital of S Ltd on 1 January 2014 by an exchange of one share in H Ltd plus $0.25 for every share in S Ltd. The retained earnings of S Ltd were $1,200,000 on 1 January 2014. 1 The market price of each H Ltd's share and S Ltd's share at the date of acquisition were $1.5 and $1.2 respectively. 2. On 31 December 2017, S Ltd sent a cheque to H Ltd for $2,000,000. The cheque was 3. HLtd has not included any entries in its accounts relating to the dividends receivable 4. No goodwill is to be written off after an impairment loss test on goodwill on 31 not received by H Ltd until 2 January 2018. from S Ltd. December 2017. Required: (a) ) The objective of HKFRS 10 Consolidated Financial 7 marks) Statements is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. Explain the meanings of control, parent and subsidiary under the HKFRS 10. (Gi) Explain whether it is possible for H Ltd to be a parent of S Ltd if H Ltd owns less than 50% of the issued equity shares of S (4 marks) Ltd. Assume S Ltd would be classified as a subsidiary of H Ltd, prepare the adjusting entries for H Ltd and consolidation journal entries for ir value approach to measure the (b) (12 marks) the H Ltd and S Ltd using the fa non-controlling interest (NCI). Show clearly the steps and calculations of the amount of goodwill attributable to H Ltd and the non-controlling interest in a separate schedule. (e) Prepare a consolidated statement of financial position (balance (17 marks) sheet) for H Ltd as at 31 December 2017. Show your workings clearly