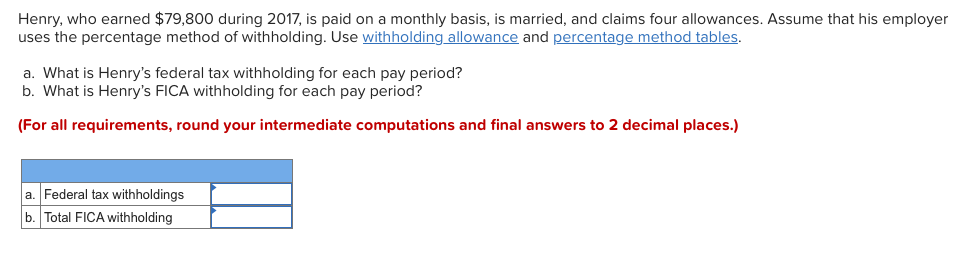

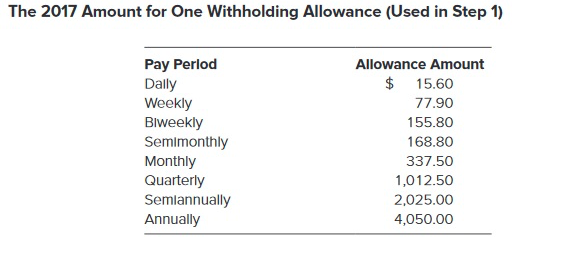

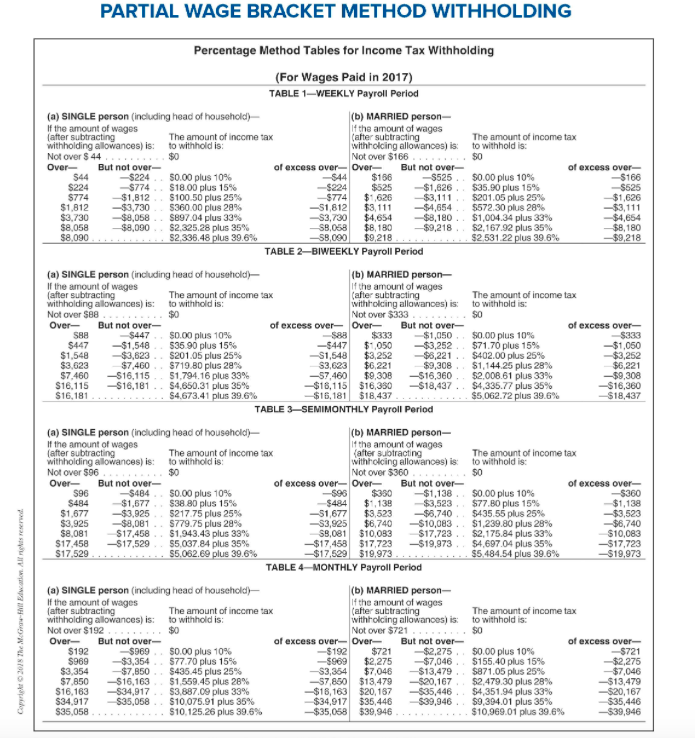

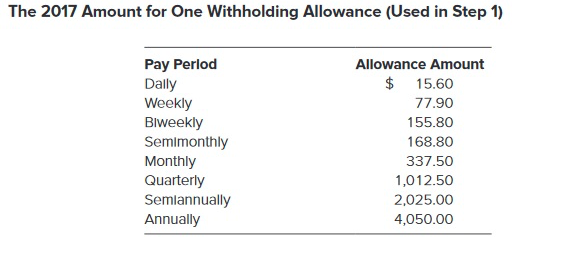

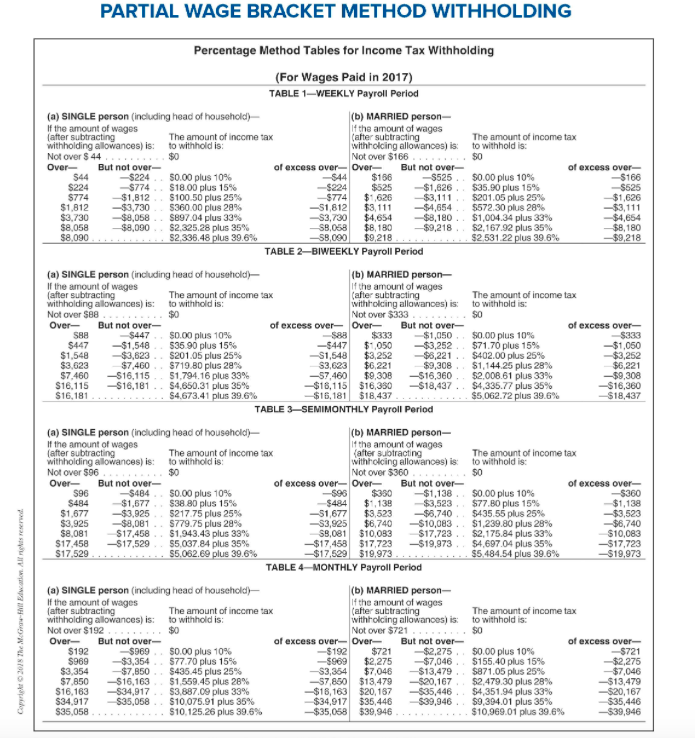

Henry, who earned $79,800 during 2017, is paid on a monthly basis, is married, and claims four allowances. Assume that his employer uses the percentage method of withholding. Use withholding allowance and percentage method tables. a. What is Henry's federal tax withholding for each pay period? b. What is Henry's FICA withholding for each pay period? For all requirements, round your intermediate computations and final answers to 2 decimal places.) a. Federal tax withholdings b. Total FICA withholding The 2017 Amount for One Withholding Allowance (Used in Step 1) Pay Perlod Dally Weekly BIweekly Semimonthly Monthly Quarterly Semlannually Annually Allowance Amount $15.60 77.90 155.80 168.80 337.50 1,012.50 2,025.00 4,050.00 PARTIAL WAGE BRACKET METHOD WITHHOLDING Percentage Method Tables for Income Tax Withholding For Wages Paid in 2017) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of househeld) If the amount of wages withholding allowances) is: to withhold is (b) MARRIED t the amount of wages after subtracting The amount of income tax The amount of income tax to withhold is: $0 withholcing allowanoes) is $0 Not over $166 Over But not over -$224 -$774 $774 --$1,812 $1.812-$3,730 of excess over-OverBut not over_ -$525 . $525 --$1,626 . $1,626-$3,1 1 1. $3.111-$4,654, $4,654-$8,180 . $8, 180-$9,218. of excess over $0.00 plus 10% $1800 plus 15% $100.50 plus 25% S360 00 plus 28% $897.04 plus 33% $2.325.28 plus 35% -$224| -$774| -s1.812| -83.730| -$8.068| S0.00 plus 10% $35.90 plus 15% S201.05 plus 25% $572 30 plus 28% $1,004.34 plus 33% S2, 167.92 plus 35% $3.730-58,058 . $8.058 $4,654 --$8,000 090 53122 plus 39 6% TABLE 2 BIWEEKLY Payroll Period (a) SINGLE person (including head of househeld If the amount of wages b) MARRIED person- If the amount ol wages (after subtracting The amount of income tax to withhold is: $0 The amount of income tax withholding allowances) is: over $88 OverBut not over- Not over $333 S0 of excess over-OverBut not over- $333-$1,050, s",050-$3,252. $3..252-$6,221. $9,308 , $9,308-516,360. of excess over-_ -S881 -5447 | -S1 ,548| soco) plus 10% S71.7 plus 15% S402.00 plus 25% $1, 1 44.25 plus 28% S2,008 61 plus 33% $4,335.77 plus 35% $5 062.72 plus 39.6% -$447 $0.00 plus 10% S35 90 plus 15% S201.05 plus 25% $719.80 plus 28% S1.79416plus 33% S4.65031 plus 35% $4673.41 $447-51 ,548 $1,548 -$,623 . $3,252 $6,221 $9,308 $16,360 3,623 $7,460 $7,460-616,115 $16.115-516,181 . . -57.460| -$16,115| 516,380-$18,437 . . $16,181 $18,437 S18 TABLE 3 SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages (b) MARRIED person- 1 the amount of (after subtracting withholcing allowances)is Not over $360 The amount of income tax The amount of income tax to withhold is: withholding alowances) is: to withhold is Not over $96 Over But not over_ $0 of excess over OverBut not over_ --$1,138, of excess over- $350 $0.00 plus 10% $77.80 plus 15% $435.55 plus 25% $1,239.80 plus 28% $2,175.84 plus 33% $4,697.04 plus 35% -$484 $484 --$1,677 $1.677-5.925 596 $0.00 plus 10% $38 80 plus 15% S217 75 plus 25% $779.75 plus 28% $1,943.43 plus 33% S5.037.84 plus 35% $. .138-$3,523, $3.523-$6,740 . $0.740-$10,083 . $17,723 . -$17,458517,723-$19,973, -$484| -51 .677 | -53,925| s9.081 | -$3,523 $3.925-$8,081 . $17,458 s 17,458-517,529 $10,083 69 TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages (b) MARRIED person- f the amount of wages after subtracting with olcing allowanoes) is: to withhold is Not over $721 The amount of inccme tax The amount of income tax withholding allowances) is: to withhold is Not over S192 $0 so OverBut not over -$969 $969 -$,354 $3.354-$7,850 $7.850-$16,163 of excess over-OverBut not over- .$2.275, $2.275 .$7,046. $3.046-$13,479. $13,479 -S20.167. 520.157-535,446. 535.446-539,946 . of xcess over- $721 $0.00 plus 10% $77 70 plus 15% S435.45 plus 25% $1.559.45 plus 28% S3.887.09 plus 33% $10.075.91 plus 35% S10. 125.26 plus 39.6% -5192 -s969| _S3,364| -57,850| -518,163| $34.917| $721 $0.00 plus 10% $155.40 plus 15% S871.05 plus 25% S2.479 30 plus 28% S4.35194 plus 33% S9.39401 plus 35% $10,969.01 plus 39.6% $13.4 S16, 163-534.917. $34.917 $35,058 167 -S35.058 $35,058 $39,946 -$39,946