Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hent 2: With illustrative examples and calculations, definelexplain, state the objective describe the implementation process, and the net effect of the following financial strategies a.

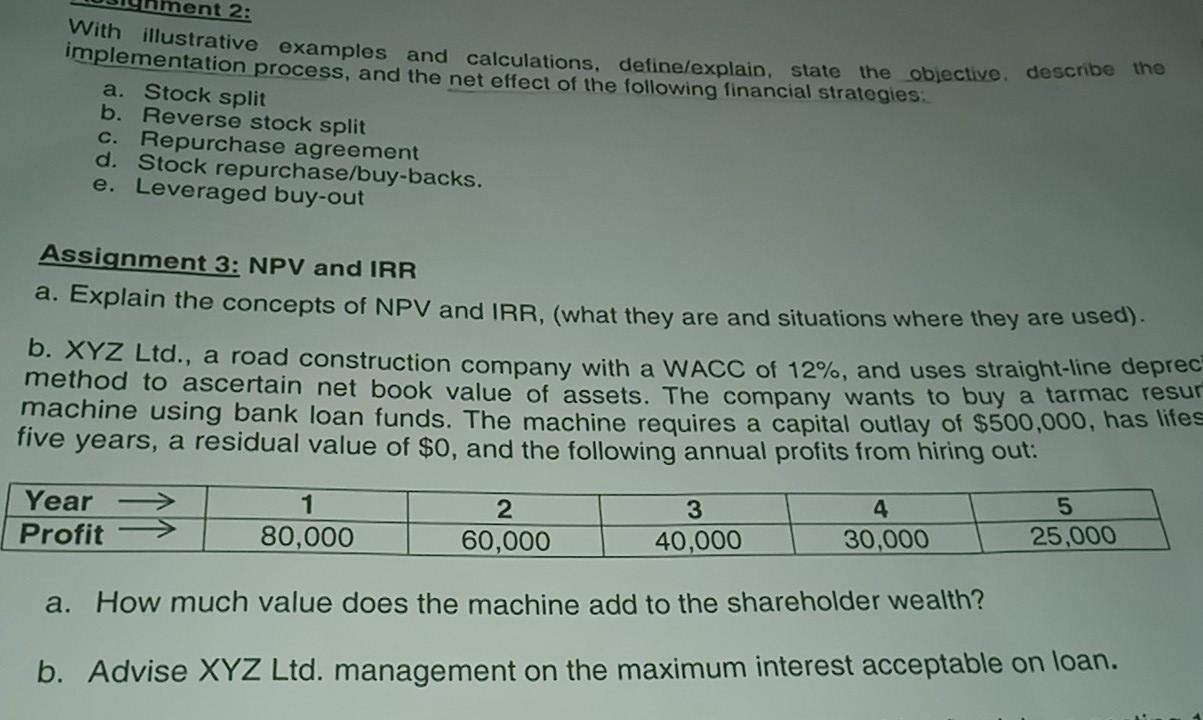

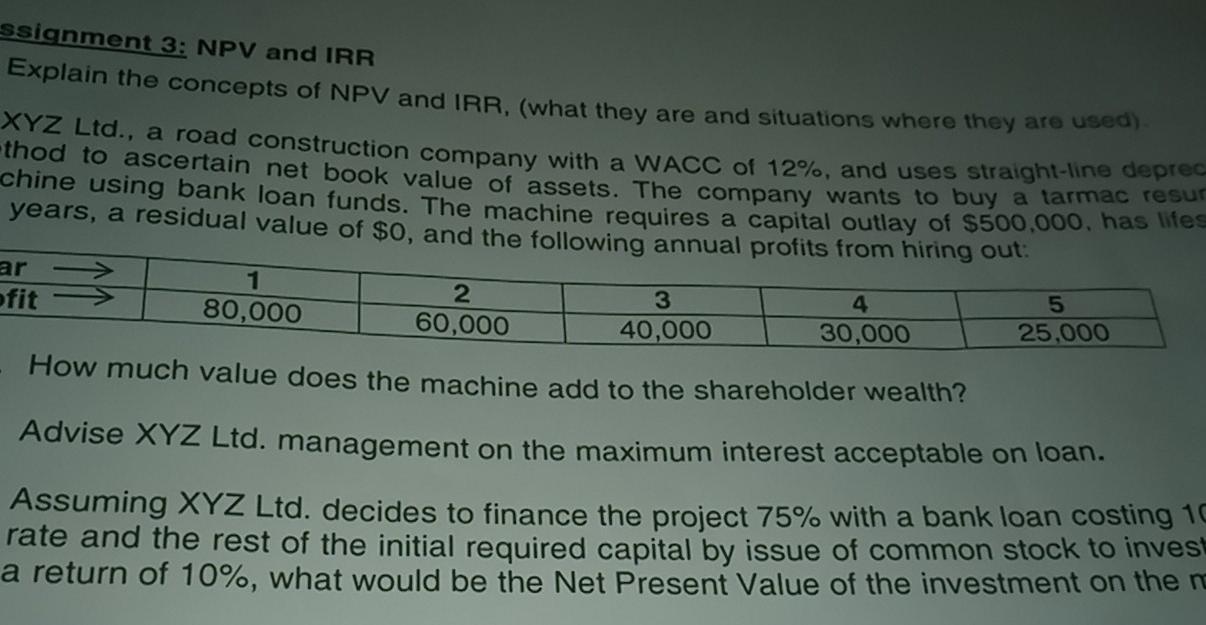

hent 2: With illustrative examples and calculations, definelexplain, state the objective describe the implementation process, and the net effect of the following financial strategies a. Stock split b. Reverse stock split Repurchase agreement d. Stock repurchase/buy-backs. e. Leveraged buy-out C. Assignment 3: NPV and IRR a. Explain the concepts of NPV and IRR, (what they are and situations where they are used). b. XYZ Ltd., a road construction company with a WACC of 12%, and uses straight-line deprec method to ascertain net book value of assets. The company wants to buy a tarmac resur machine using bank loan funds. The machine requires a capital outlay of $500,000, has lifes five years, a residual value of $0, and the following annual profits from hiring out: Year -> 1 2 3 4 5 Profit 80,000 60,000 40,000 30,000 25,000 a. How much value does the machine add to the shareholder wealth? b. Advise XYZ Ltd. management on the maximum interest acceptable on loan. ssignment 3: NPV and IRR Explain the concepts of NPV and IRR, (what they are and situations where they are used) XYZ Ltd., a road construction company with a WACC of 12%, and uses straight-line deprer chine using bank loan funds. The machine requires a capital outlay of $500,000, has lites years, a residual value of $0, and the following annual profits from hiring out: fit 1 80,000 60,000 3 40,000 4 30,000 5 25,000 How much value does the machine add to the shareholder wealth? Advise XYZ Ltd. management on the maximum interest acceptable on loan. Assuming XYZ Ltd. decides to finance the project 75% with a bank loan costing 10 rate and the rest of the initial required capital by issue of common stock to invest a return of 10%, what would be the Net Present Value of the investment on the no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started