Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7 Evaluate the purchase of an existing 950 unit apartment complex for $12500000, the building is assumed to have a 20 year functional life.

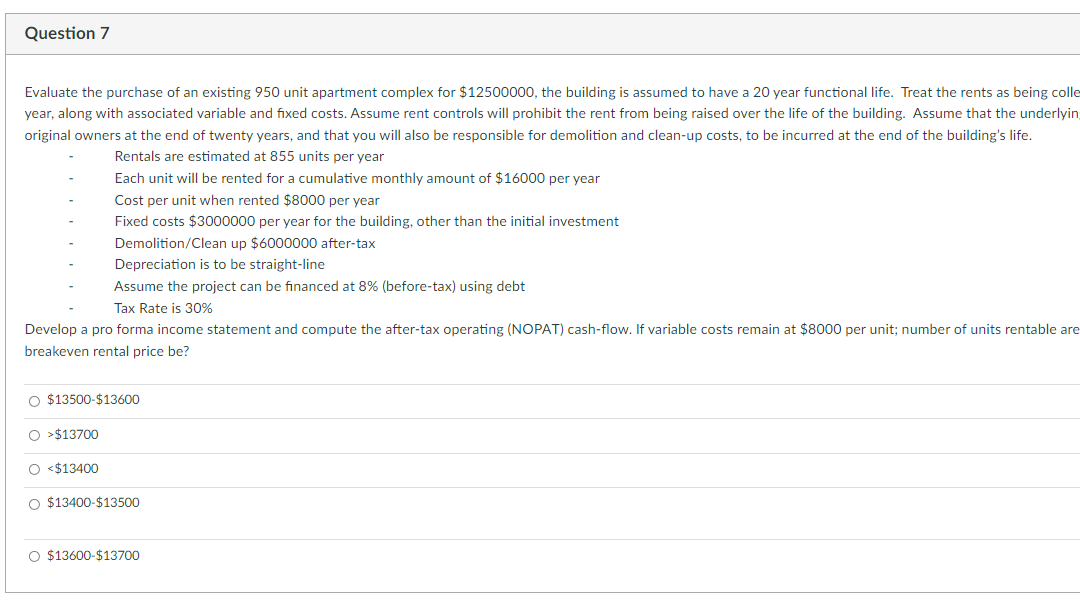

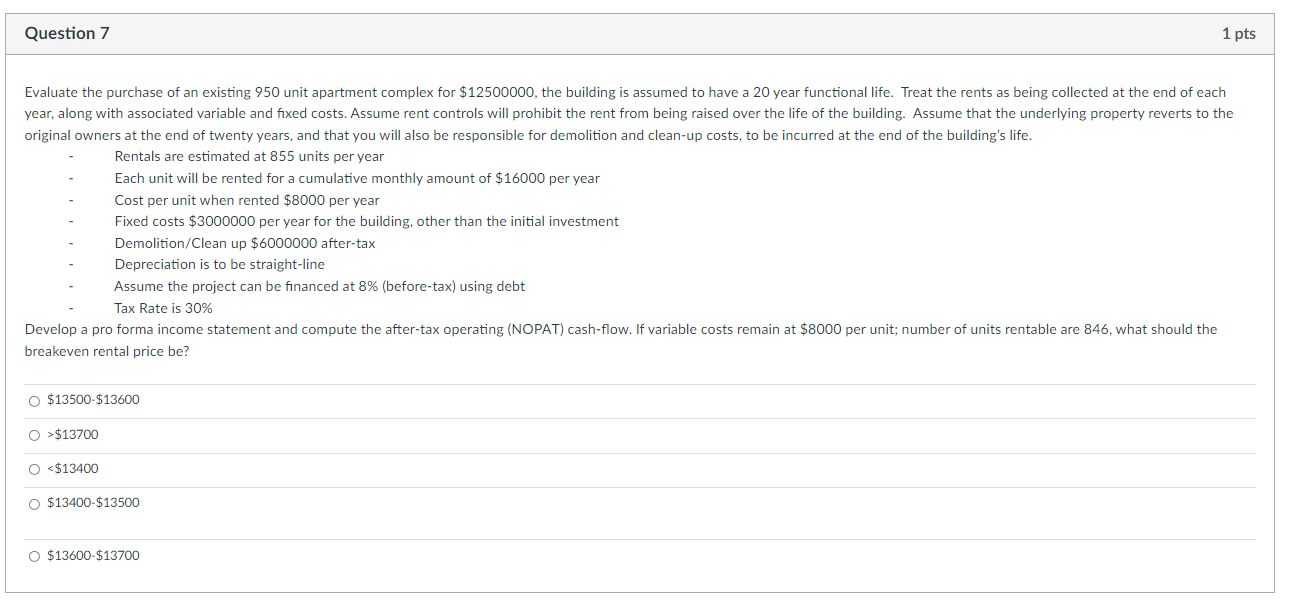

Question 7 Evaluate the purchase of an existing 950 unit apartment complex for $12500000, the building is assumed to have a 20 year functional life. Treat the rents as being colle year, along with associated variable and fixed costs. Assume rent controls will prohibit the rent from being raised over the life of the building. Assume that the underlyin original owners at the end of twenty years, and that you will also be responsible for demolition and clean-up costs, to be incurred at the end of the building's life. Rentals are estimated at 855 units per year Each unit will be rented for a cumulative monthly amount of $16000 per year Cost per unit when rented $8000 per year Fixed costs $3000000 per year for the building, other than the initial investment Demolition/Clean up $6000000 after-tax Depreciation is to be straight-line Assume the project can be financed at 8% (before-tax) using debt Tax Rate is 30% Develop a pro forma income statement and compute the after-tax operating (NOPAT) cash-flow. If variable costs remain at $8000 per unit; number of units rentable are breakeven rental price be? O $13500-$13600 O > $13700 O $13700 O $13700 O $13700 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started