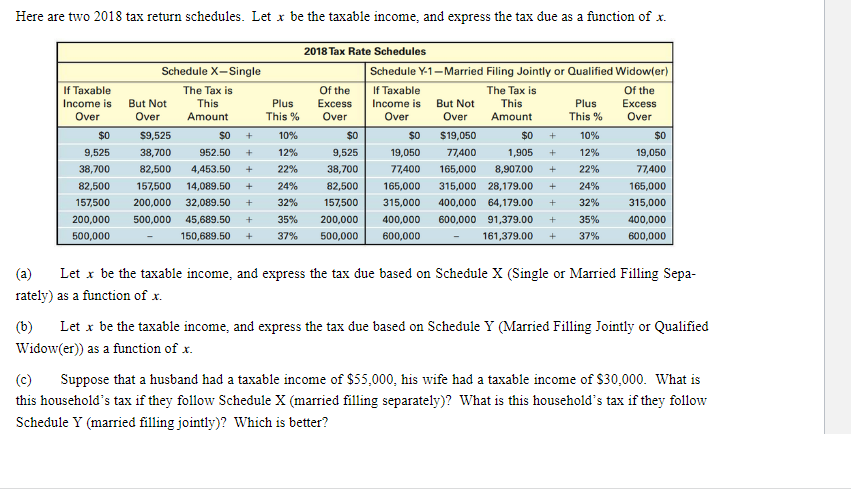

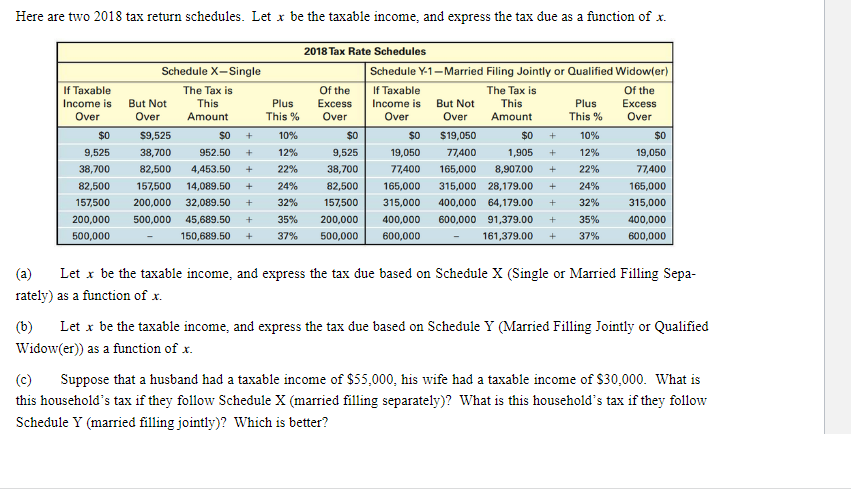

Here are two 2018 tax return schedules. Let x be the taxable income, and express the tax due as a function of x. If Taxable Income is Over 2018 Tax Rate Schedules Schedule X-Single Schedule Y-1 - Married Filing Jointly or Qualified Widowler) The Tax is Of the If Taxable The Tax is Of the But Not This Plus Excess Income is But Not This Plus Excess Over Amount This % Over Over Over Amount This% Over $9,525 SO + 10% $0 $0 $19,050 $0 + 10% $0 38,700 952.50 + 12% 9,525 19,050 77,400 1,905 + 12% 19,050 82,500 4,453.50 + 38,700 77,400 165,000 8,907.00 + 22% 77,400 157,500 14,089.50 + 24% 82,500 165,000 315,000 28,179.00 + 24% 165,000 200,000 32,089.50 + 32% 157,500 315,000 400,000 64,179.00 + 32% 315,000 500,000 45,689.50 + 35% 200,000 400,000 600,000 91,379.00 + 35% 400,000 150,689.50 37% 500,000 600,000 161,379.00 + 37% 600,000 $0 9,525 38,700 82,500 157,500 200,000 500,000 22% + (a) Let x be the taxable income, and express the tax due based on Schedule X (Single or Married Filling Sepa- rately) as a function of x. (b) Let x be the taxable income, and express the tax due based on Schedule Y (Married Filling Jointly or Qualified Widow(er)) as a function of x. c) Suppose that a husband had a taxable income of $55.000, his wife had a taxable income of $30.000. What is this household's tax if they follow Schedule X (married filling separately)? What is this household's tax if they follow Schedule Y (married filling jointly)? Which is better? Here are two 2018 tax return schedules. Let x be the taxable income, and express the tax due as a function of x. If Taxable Income is Over 2018 Tax Rate Schedules Schedule X-Single Schedule Y-1 - Married Filing Jointly or Qualified Widowler) The Tax is Of the If Taxable The Tax is Of the But Not This Plus Excess Income is But Not This Plus Excess Over Amount This % Over Over Over Amount This% Over $9,525 SO + 10% $0 $0 $19,050 $0 + 10% $0 38,700 952.50 + 12% 9,525 19,050 77,400 1,905 + 12% 19,050 82,500 4,453.50 + 38,700 77,400 165,000 8,907.00 + 22% 77,400 157,500 14,089.50 + 24% 82,500 165,000 315,000 28,179.00 + 24% 165,000 200,000 32,089.50 + 32% 157,500 315,000 400,000 64,179.00 + 32% 315,000 500,000 45,689.50 + 35% 200,000 400,000 600,000 91,379.00 + 35% 400,000 150,689.50 37% 500,000 600,000 161,379.00 + 37% 600,000 $0 9,525 38,700 82,500 157,500 200,000 500,000 22% + (a) Let x be the taxable income, and express the tax due based on Schedule X (Single or Married Filling Sepa- rately) as a function of x. (b) Let x be the taxable income, and express the tax due based on Schedule Y (Married Filling Jointly or Qualified Widow(er)) as a function of x. c) Suppose that a husband had a taxable income of $55.000, his wife had a taxable income of $30.000. What is this household's tax if they follow Schedule X (married filling separately)? What is this household's tax if they follow Schedule Y (married filling jointly)? Which is better