Answered step by step

Verified Expert Solution

Question

1 Approved Answer

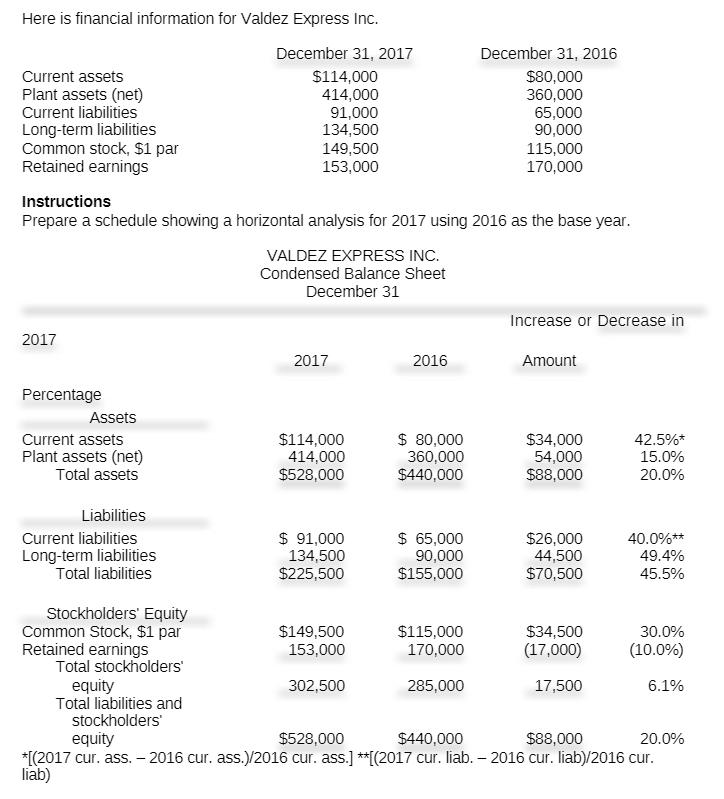

Here is financial information for Valdez Express Inc. December 31, 2017 December 31, 2016 $114,000 414,000 91,000 134,500 149,500 153,000 $80,000 360,000 65,000 90,000

Here is financial information for Valdez Express Inc. December 31, 2017 December 31, 2016 $114,000 414,000 91,000 134,500 149,500 153,000 $80,000 360,000 65,000 90,000 Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, $1 par Retained earnings 115,000 170,000 Instructions Prepare a schedule showing a horizontal analysis for 2017 using 2016 as the base year. VALDEZ EXPRESS INC. Condensed Balance Sheet December 31 Increase or Decrease in 2017 2017 2016 Amount Percentage Assets Current assets Plant assets (net) Total assets $114,000 414,000 $528,000 $ 80,000 360,000 $440,000 $34,000 54,000 $88,000 42.5%* 15.0% 20.0% Liabilities Current liabilities Long-term liabilities Total liabilities $ 91,000 134,500 $225,500 $ 65,000 90,000 $155,000 $26,000 44,500 $70,500 40.0%** 49.4% 45.5% Stockholders' Equity Common Stock, $1 par Retained earnings Total stockholders' equity Total liabilities and stockholders' $149,500 153,000 $115,000 170,000 $34,500 (17,000) 30.0% (10.0%) 302,500 285,000 17,500 6.1% equity $528,000 $440,000 $88,000 20.0% *[(2017 cur. ass. 2016 cur. ass.)/2016 cur. ass.] **[(2017 cur. liab. - 2016 cur. liab)/2016 cur. liab)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

VALDEZ EXPRESS INC Condensed balace sheet Dec312017 Dec3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e2c5b3e274_182073.pdf

180 KBs PDF File

635e2c5b3e274_182073.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started