Question

Here is the answer of c. What does the answer mean? Why it can determine whether it does average out this year (the definition is

Here is the answer of c. What does the answer mean? Why it can determine whether it does average out this year(the definition is mentioned in reason1)

one approach is to randomly select a sample of sales late in each year (depending upon how far in advance passengers typically book tickets) and attempt to determine whether they approximate one another. Also, an estimate might be based on number of reservations booked in the new year if it is possible to efficiently capture that information from the preceding year (which seems doubtful). Using that approach one still needs to make an estimate of revenues related to the bookings. Another approach that might or might not be possible, is to obtain assistance from the sales department (reservation department). For example, the sales department could have helpful reports that could help the accountant to make an estimate of sales for next years flight.

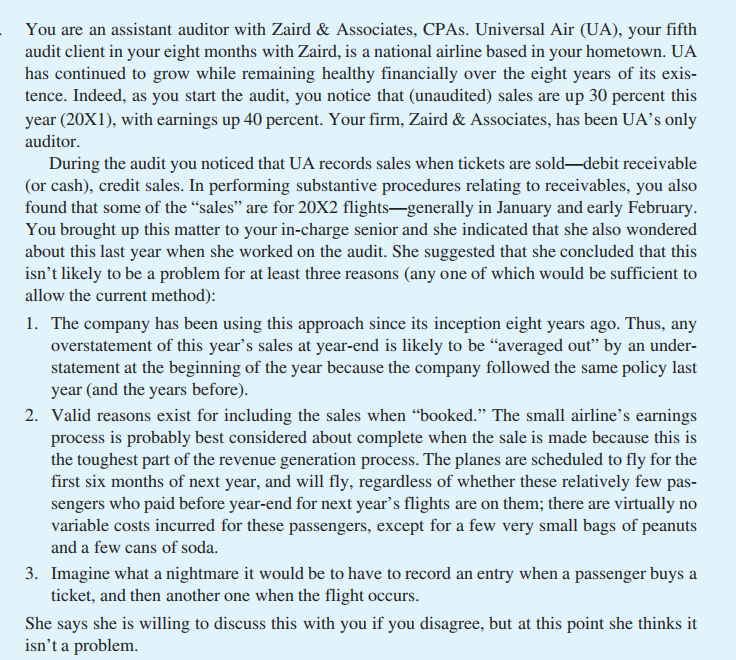

You are an assistant auditor with Zaird & Associates, CPAs. Universal Air (UA), your fifth audit client in your eight months with Zaird, is a national airline based in your hometown. UA has continued to grow while remaining healthy financially over the eight years of its exis- tence. Indeed, as you start the audit, you notice that (unaudited) sales are up 30 percent this year (20X1), with earnings up 40 percent. Your firm, Zaird & Associates, has been UA's only auditor. During the audit you noticed that UA records sales when tickets are sold-debit receivable (or cash), credit sales. In performing substantive procedures relating to receivables, you also found that some of the "sales" are for 20X2 flights-generally in January and early February. You brought up this matter to your in-charge senior and she indicated that she also wondered about this last year when she worked on the audit. She suggested that she concluded that this isn't likely to be a problem for at least three reasons (any one of which would be sufficient to allow the current method): 1. The company has been using this approach since its inception eight years ago. Thus, any overstatement of this year's sales at year-end is likely to be "averaged out" by an under- statement at the beginning of the year because the company followed the same policy last year and the years before). 2. Valid reasons exist for including the sales when "booked. The small airline's earnings process is probably best considered about complete when the sale is made because this is the toughest part of the revenue generation process. The planes are scheduled to fly for the first six months of next year, and will fly, regardless of whether these relatively few pas- sengers who paid before year-end for next year's flights are on them; there are virtually no variable costs incurred for these passengers, except for a few very small bags of peanuts and a few cans of soda. 3. Imagine what a nightmare it would be to have to record an entry when a passenger buys a ticket, and then another one when the flight occurs. She says she is willing to discuss this with you if you disagree, but at this point she thinks it isn't a problem. b. Given this situation, would you expect the procedure to "average out over the year? C. How might one determine whether it does average out over the year? You are an assistant auditor with Zaird & Associates, CPAs. Universal Air (UA), your fifth audit client in your eight months with Zaird, is a national airline based in your hometown. UA has continued to grow while remaining healthy financially over the eight years of its exis- tence. Indeed, as you start the audit, you notice that (unaudited) sales are up 30 percent this year (20X1), with earnings up 40 percent. Your firm, Zaird & Associates, has been UA's only auditor. During the audit you noticed that UA records sales when tickets are sold-debit receivable (or cash), credit sales. In performing substantive procedures relating to receivables, you also found that some of the "sales" are for 20X2 flights-generally in January and early February. You brought up this matter to your in-charge senior and she indicated that she also wondered about this last year when she worked on the audit. She suggested that she concluded that this isn't likely to be a problem for at least three reasons (any one of which would be sufficient to allow the current method): 1. The company has been using this approach since its inception eight years ago. Thus, any overstatement of this year's sales at year-end is likely to be "averaged out" by an under- statement at the beginning of the year because the company followed the same policy last year and the years before). 2. Valid reasons exist for including the sales when "booked. The small airline's earnings process is probably best considered about complete when the sale is made because this is the toughest part of the revenue generation process. The planes are scheduled to fly for the first six months of next year, and will fly, regardless of whether these relatively few pas- sengers who paid before year-end for next year's flights are on them; there are virtually no variable costs incurred for these passengers, except for a few very small bags of peanuts and a few cans of soda. 3. Imagine what a nightmare it would be to have to record an entry when a passenger buys a ticket, and then another one when the flight occurs. She says she is willing to discuss this with you if you disagree, but at this point she thinks it isn't a problem. b. Given this situation, would you expect the procedure to "average out over the year? C. How might one determine whether it does average out over the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started