Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here you have a list of suggested steps: 1- Put together the Income Statement for the next 5 years. 2- Calculate the Operating Cash

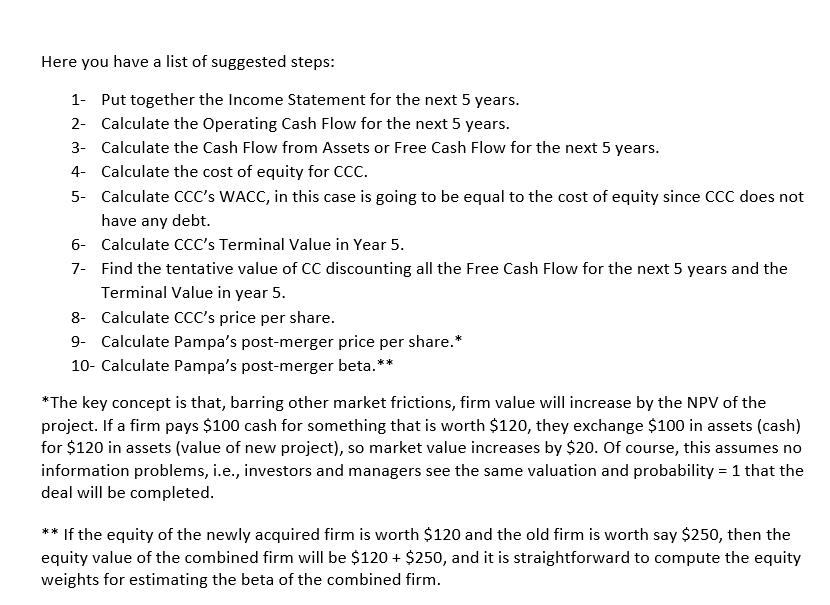

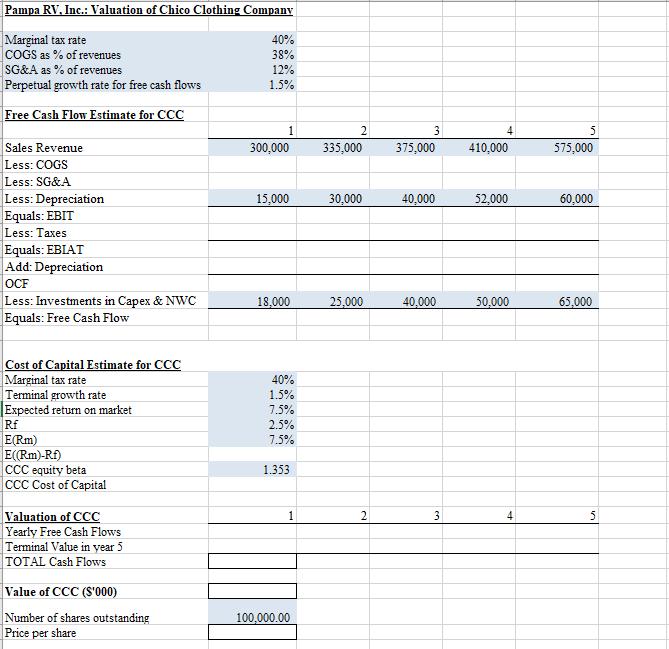

Here you have a list of suggested steps: 1- Put together the Income Statement for the next 5 years. 2- Calculate the Operating Cash Flow for the next 5 years. 3- Calculate the Cash Flow from Assets or Free Cash Flow for the next 5 years. 4- Calculate the cost of equity for CCC. 5- Calculate CCC's WACC, in this case is going to be equal to the cost of equity since CCC does not have any debt. Calculate CCC's Terminal Value in Year 5. 6- 7- Find the tentative value of CC discounting all the Free Cash Flow for the next 5 years and the Terminal Value in year 5. 8- Calculate CCC's price per share. 9- Calculate Pampa's post-merger price per share.* 10- Calculate Pampa's post-merger beta.** *The key concept is that, barring other market frictions, firm value will increase by the NPV of the project. If a firm pays $100 cash for something that is worth $120, they exchange $100 in assets (cash) for $120 in assets (value of new project), so market value increases by $20. Of course, this assumes no information problems, i.e., investors and managers see the same valuation and probability = 1 that the deal will be completed. ** If the equity of the newly acquired firm is worth $120 and the old firm is worth say $250, then the equity value of the combined firm will be $120+ $250, and it is straightforward to compute the equity weights for estimating the beta of the combined firm. Pampa RV, Inc.: Valuation of Chico Clothing Company Marginal tax rate COGS as % of revenues SG&A as % of revenues Perpetual growth rate for free cash flows Free Cash Flow Estimate for CCC Sales Revenue Less: COGS Less: SG&A Less: Depreciation Equals: EBIT Less: Taxes Equals: EBIAT Add: Depreciation OCF Less: Investments in Capex & NWC Equals: Free Cash Flow Cost of Capital Estimate for CCC Marginal tax rate Terminal growth rate Expected return on market Rf E(Rm) E((Rm)-Rf) CCC equity beta CCC Cost of Capital Valuation of CCC Yearly Free Cash Flows Terminal Value in year 5 TOTAL Cash Flows Value of CCC ($'000) Number of shares outstanding Price per share 40% 38% 12% 1.5% 1 300,000 15,000 18,000 40% 1.5% 7.5% 2.5% 7.5% 1.353 1 100,000.00 2 335,000 30,000 25,000 2 3 375,000 40,000 40,000 3 4 410,000 52,000 50,000 5 575,000 60,000 65,000 5

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

0 1 2 3 4 5 Free Cash Flow Estimate for CCC Sales revenue as given Less COGS 38 of sales revenue Les...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started