Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Herelt, Incorporated, a calendar year taxpayer, purchased equipment for $395,600 and placed it in service on April 1, 2022. The equipment was seven-year recovery property,

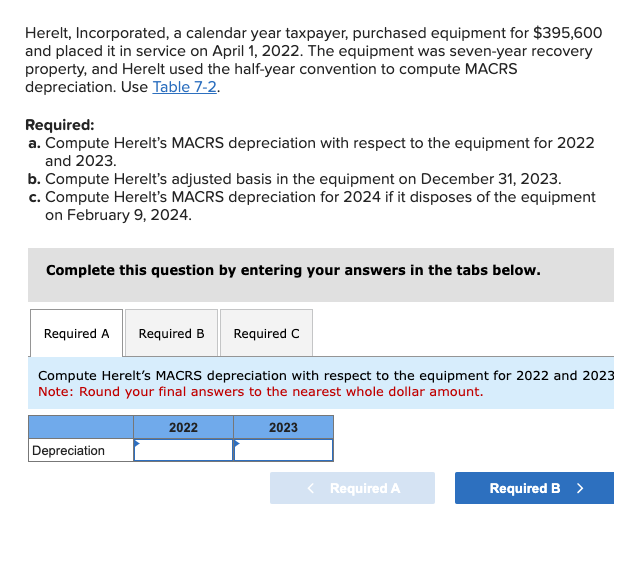

Herelt, Incorporated, a calendar year taxpayer, purchased equipment for $395,600 and placed it in service on April 1, 2022. The equipment was seven-year recovery property, and Herelt used the half-year convention to compute MACRS depreciation. Use Table 7-2. Required: a. Compute Herelt's MACRS depreciation with respect to the equipment for 2022 and 2023. b. Compute Herelt's adjusted basis in the equipment on December 31, 2023. c. Compute Herelt's MACRS depreciation for 2024 if it disposes of the equipment on February 9,2024. Complete this question by entering your answers in the tabs below. Compute Herelt's MACRS depreciation with respect to the equipment for 2022 and 202 Note: Round your final answers to the nearest whole dollar amount

Herelt, Incorporated, a calendar year taxpayer, purchased equipment for $395,600 and placed it in service on April 1, 2022. The equipment was seven-year recovery property, and Herelt used the half-year convention to compute MACRS depreciation. Use Table 7-2. Required: a. Compute Herelt's MACRS depreciation with respect to the equipment for 2022 and 2023. b. Compute Herelt's adjusted basis in the equipment on December 31, 2023. c. Compute Herelt's MACRS depreciation for 2024 if it disposes of the equipment on February 9,2024. Complete this question by entering your answers in the tabs below. Compute Herelt's MACRS depreciation with respect to the equipment for 2022 and 202 Note: Round your final answers to the nearest whole dollar amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started