Question: Hey, Sorry this is so long winded, I'm trying to figure out the question in bold. As this is a part of a larger set

Hey, Sorry this is so long winded, I'm trying to figure out the question in bold. As this is a part of a larger set of questions I included all information given, despite probably a lot of it not being relevant, because when I have previously posted this question with what I thought was all relevant information the person answering asked for more info.

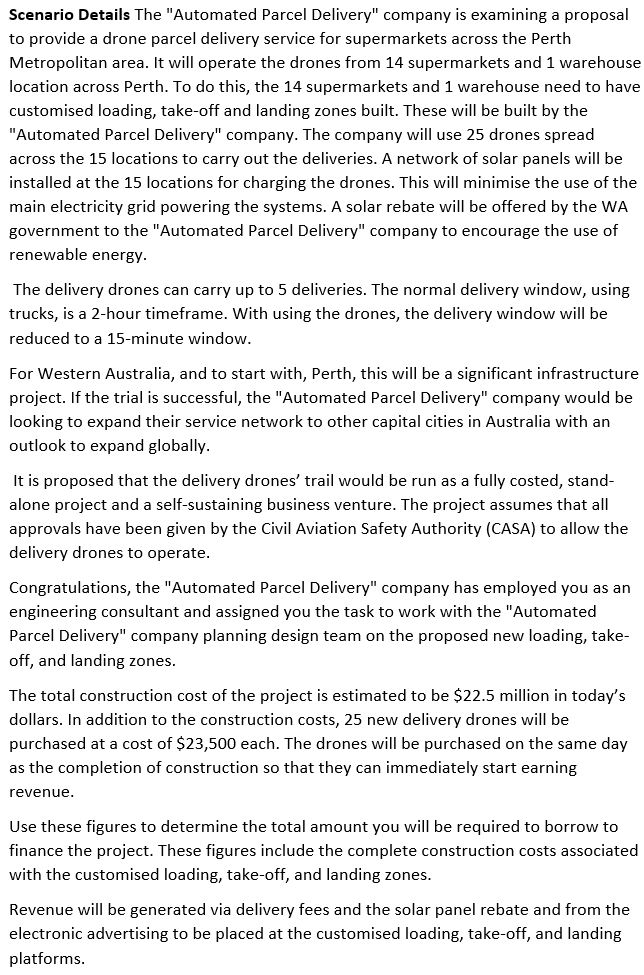

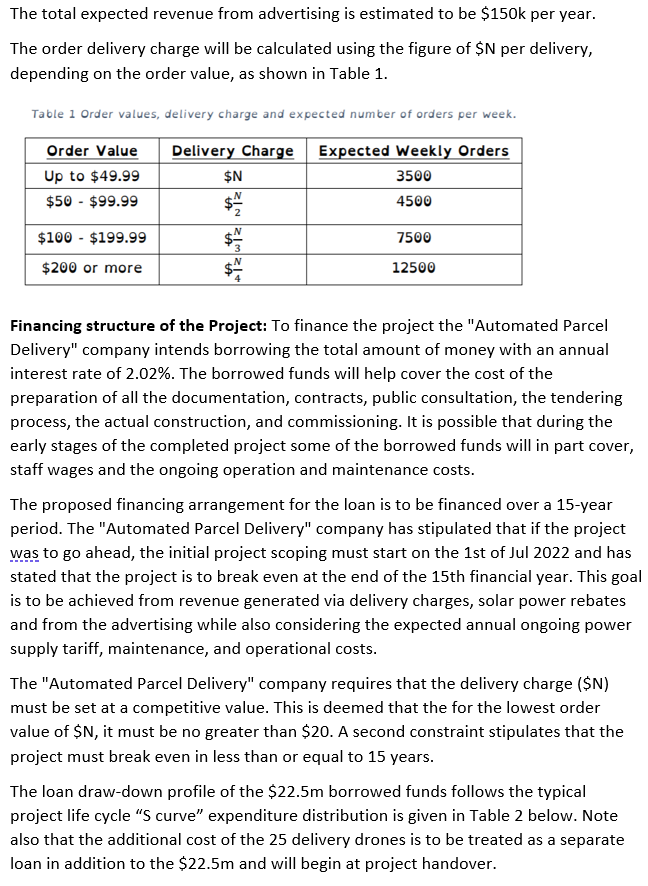

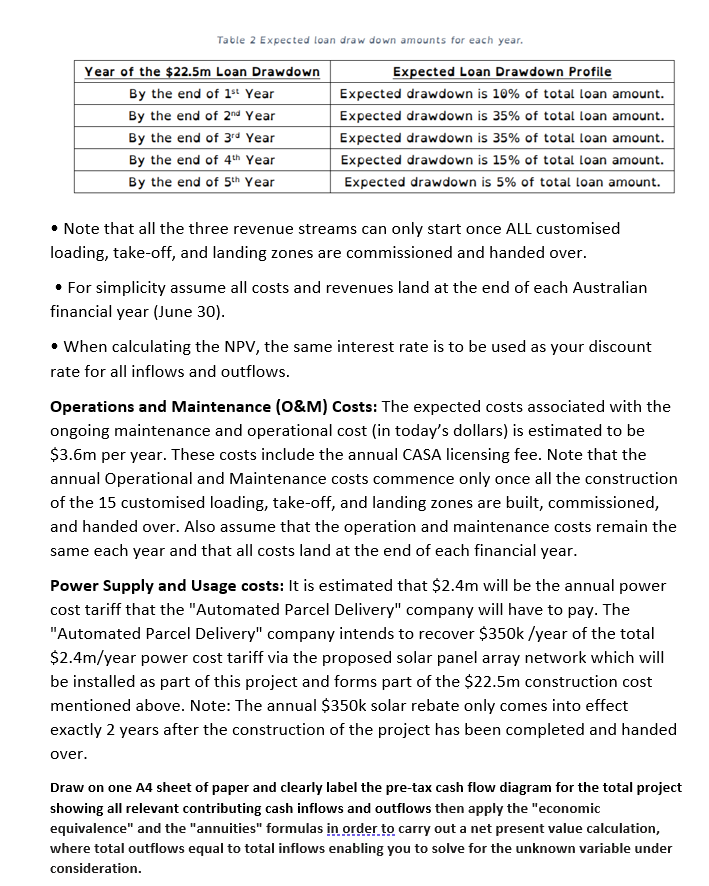

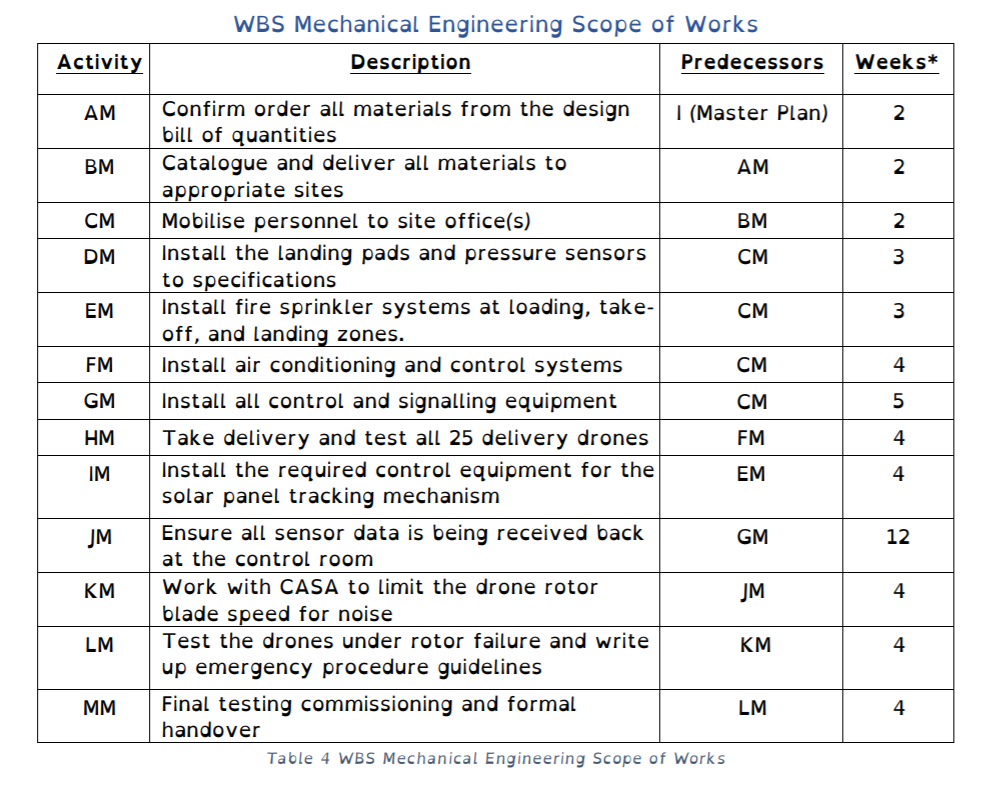

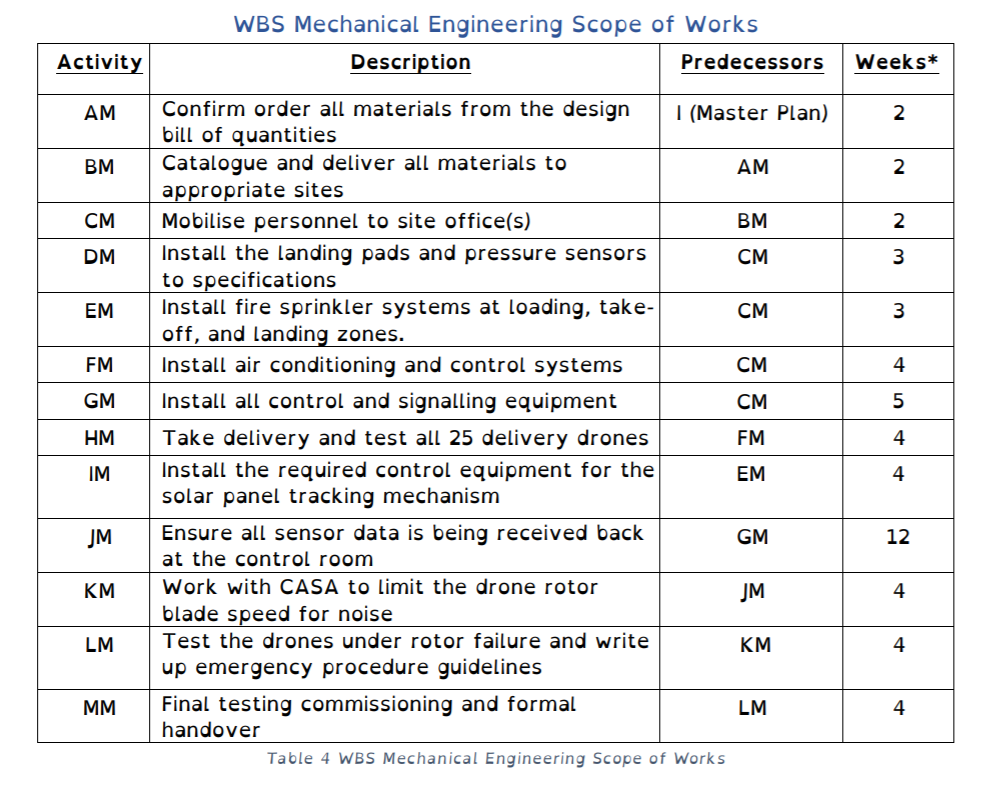

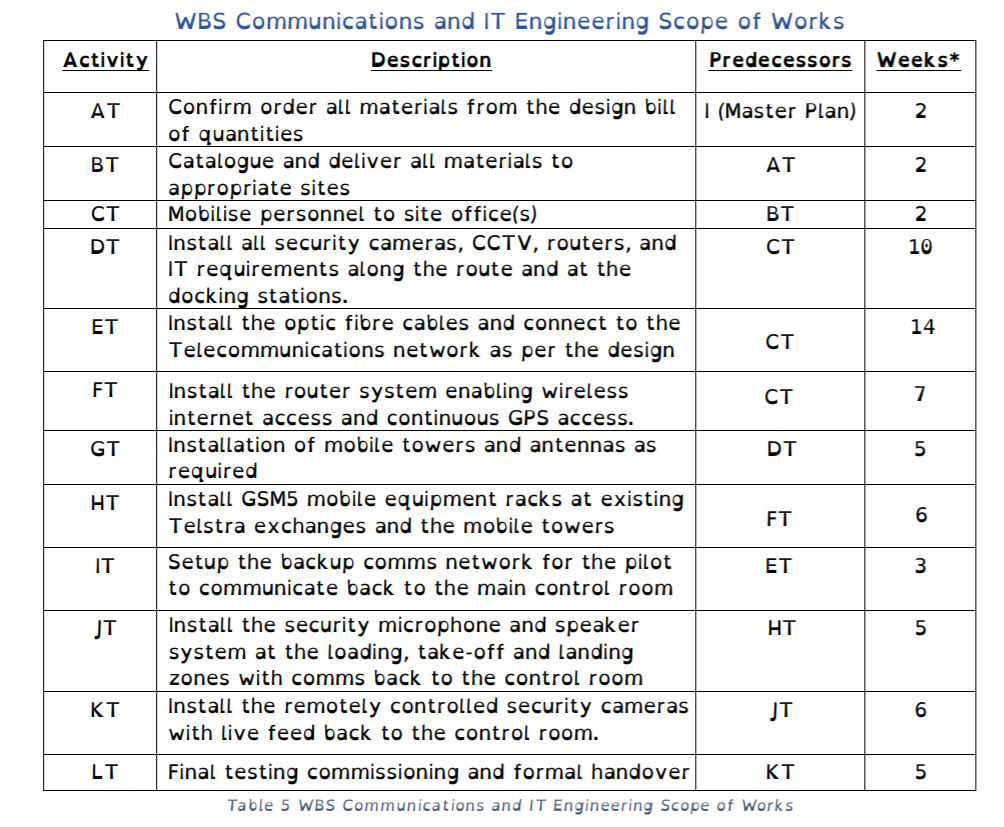

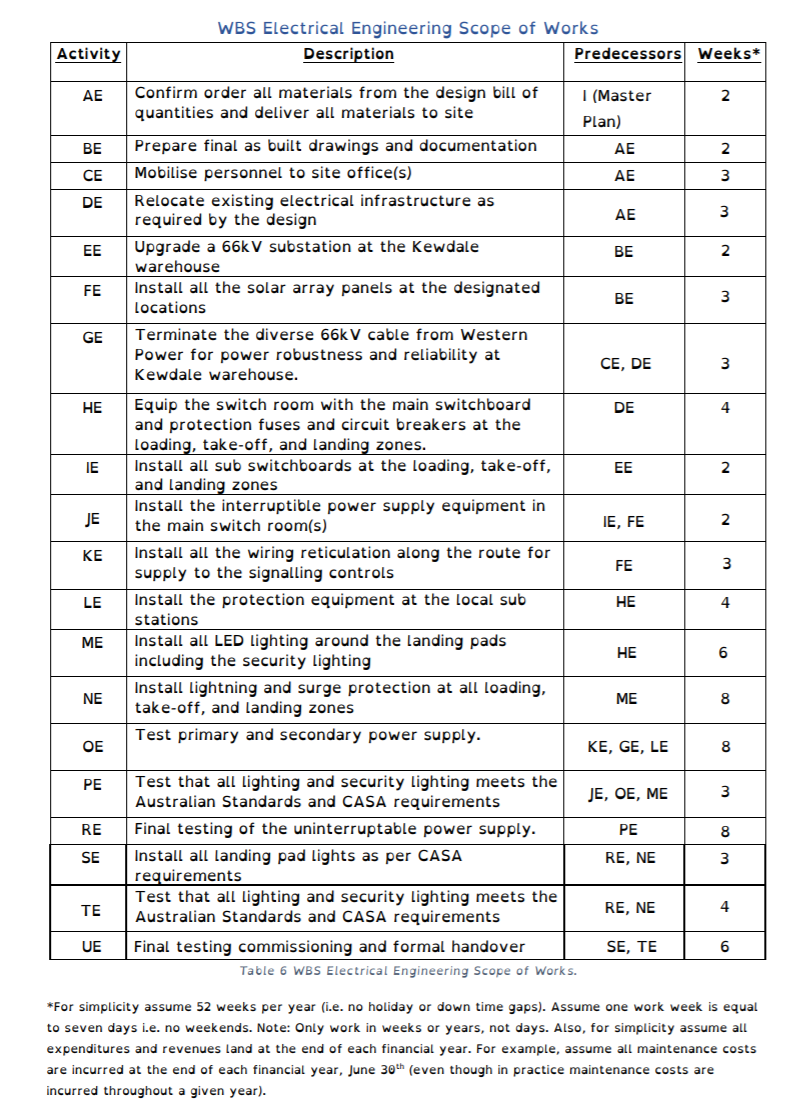

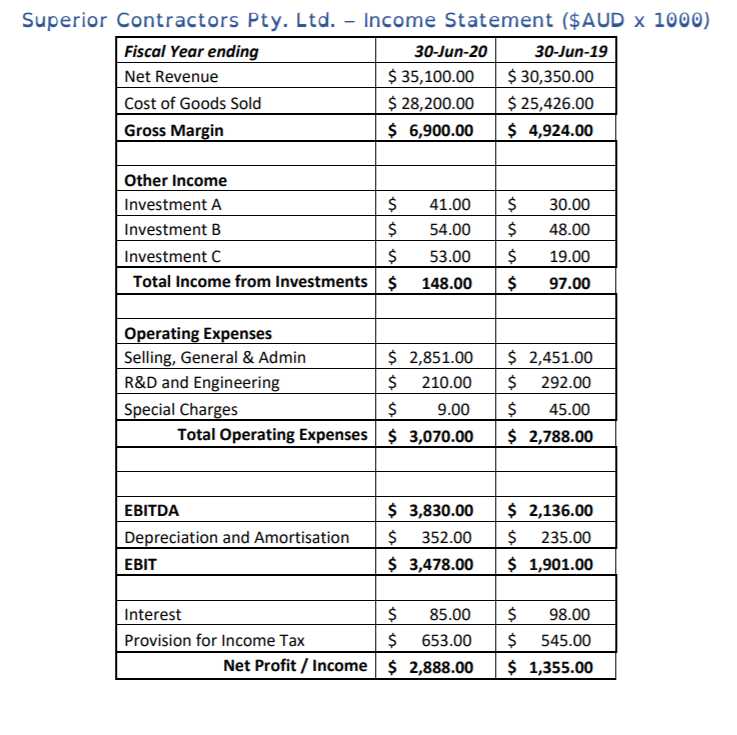

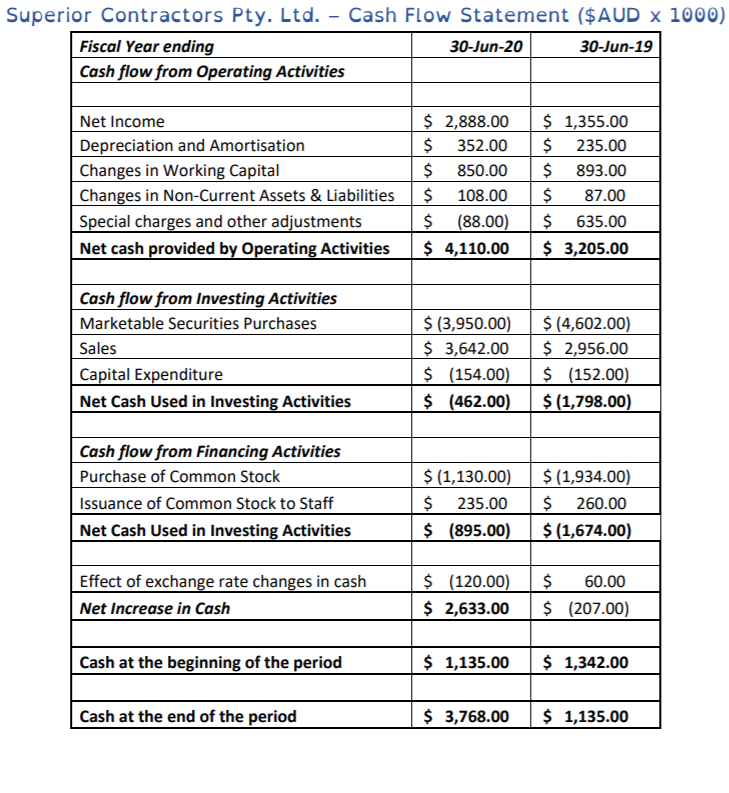

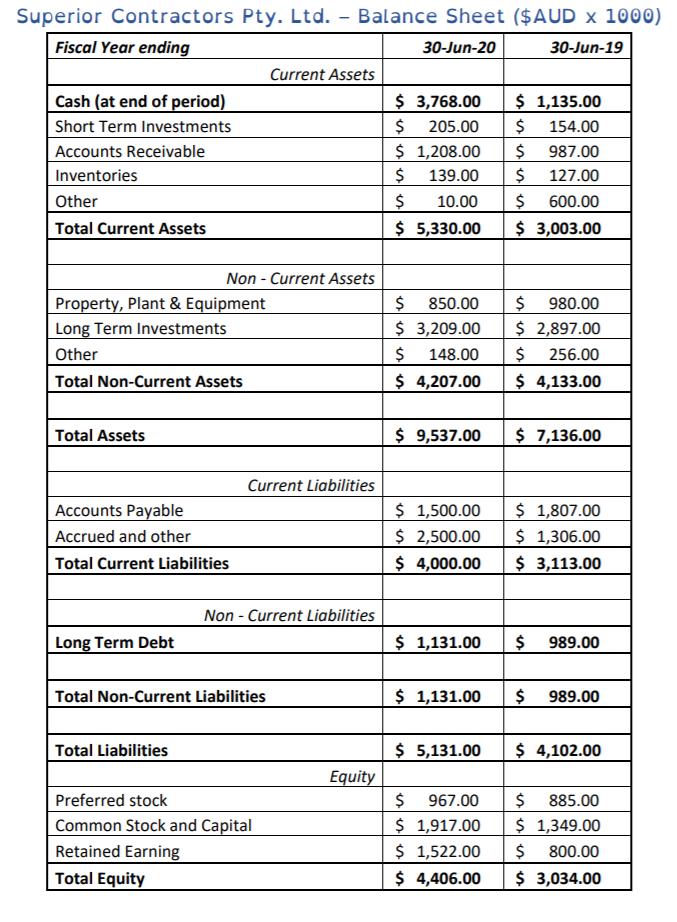

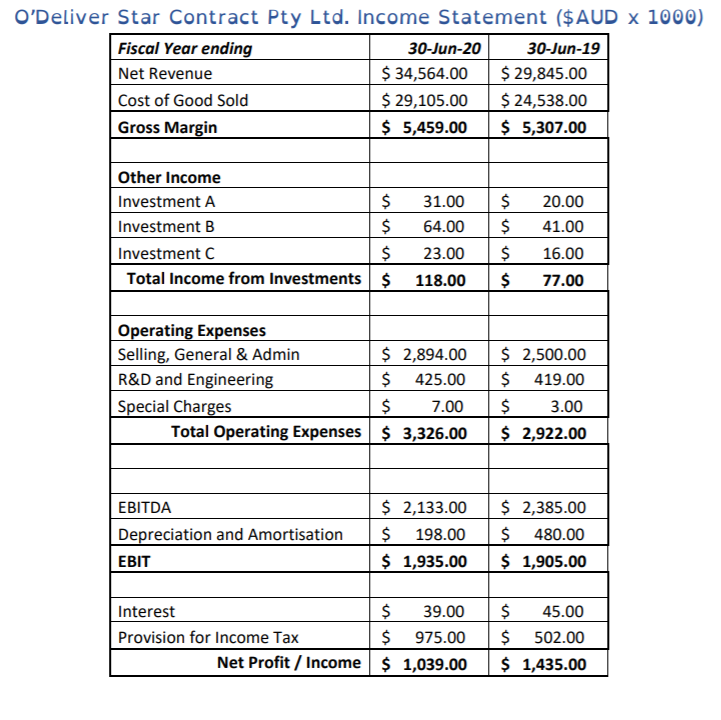

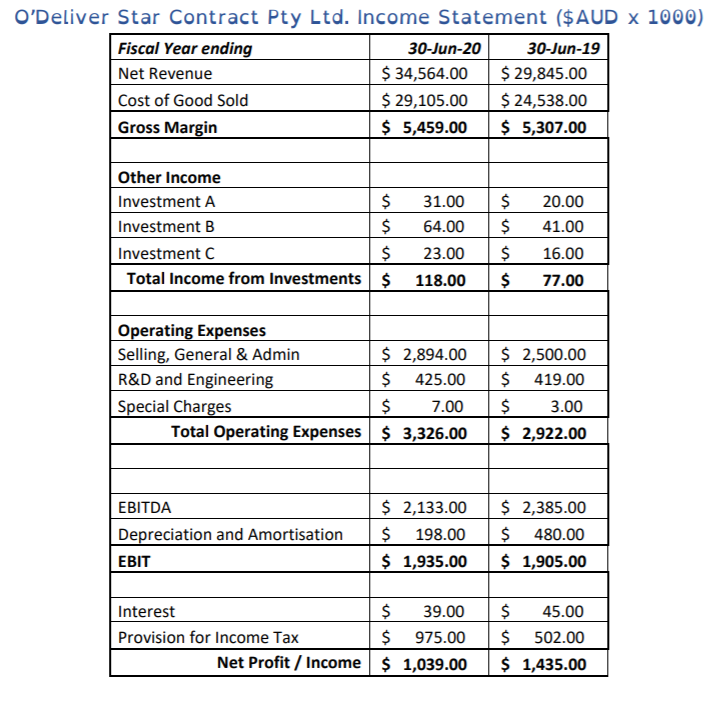

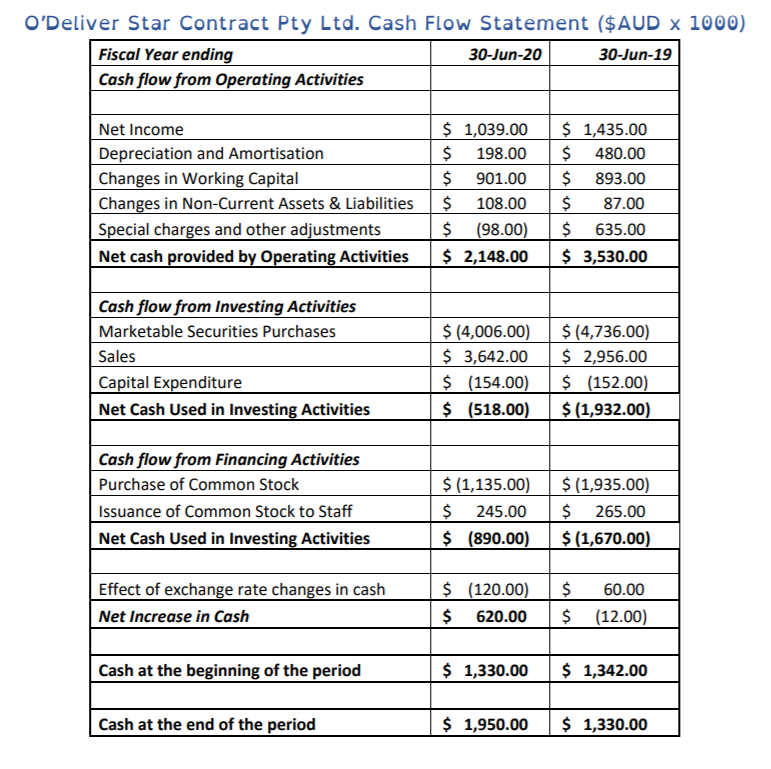

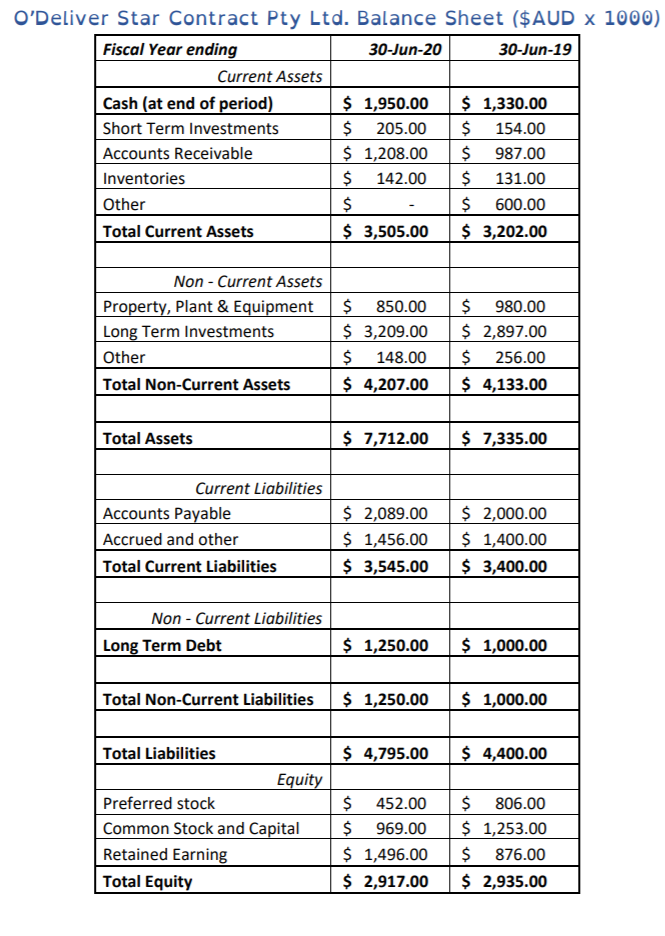

Scenario Details The "Automated Parcel Delivery" company is examining a proposal to provide a drone parcel delivery service for supermarkets across the Perth Metropolitan area. It will operate the drones from 14 supermarkets and 1 warehouse location across Perth. To do this, the 14 supermarkets and 1 warehouse need to have customised loading, take-off and landing zones built. These will be built by the "Automated Parcel Delivery" company. The company will use 25 drones spread across the 15 locations to carry out the deliveries. A network of solar panels will be installed at the 15 locations for charging the drones. This will minimise the use of the main electricity grid powering the systems. A solar rebate will be offered by the WA government to the "Automated Parcel Delivery" company to encourage the use of renewable energy. The delivery drones can carry up to 5 deliveries. The normal delivery window, using trucks, is a 2-hour timeframe. With using the drones, the delivery window will be reduced to a 15-minute window. For Western Australia, and to start with, Perth, this will be a significant infrastructure project. If the trial is successful, the "Automated Parcel Delivery" company would be looking to expand their service network to other capital cities in Australia with an outlook to expand globally. It is proposed that the delivery drones' trail would be run as a fully costed, stand- alone project and a self-sustaining business venture. The project assumes that all approvals have been given by the Civil Aviation Safety Authority (CASA) to allow the delivery drones to operate. Congratulations, the "Automated Parcel Delivery" company has employed you as an engineering consultant and assigned you the task to work with the "Automated Parcel Delivery" company planning design team on the proposed new loading, take- off, and landing zones. The total construction cost of the project is estimated to be $22.5 million in today's dollars. In addition to the construction costs, 25 new delivery drones will be purchased at a cost of $23,500 each. The drones will be purchased on the same day as the completion of construction so that they can immediately start earning revenue. Use these figures to determine the total amount you will be required to borrow to finance the project. These figures include the complete construction costs associated with the customised loading, take-off, and landing zones. Revenue will be generated via delivery fees and the solar panel rebate and from the electronic advertising to be placed at the customised loading, take-off, and landing platforms. The total expected revenue from advertising is estimated to be $150k per year. The order delivery charge will be calculated using the figure of $N per delivery, depending on the order value, as shown in Table 1. Table 1 Order values, delivery charge and expected number of orders per week. Order Value Up to $49.99 $50 - $99.99 Delivery Charge Expected Weekly Orders 3500 $ 4500 $N 7500 $100 - $199.99 $200 or more $ 12500 Financing structure of the Project: To finance the project the "Automated Parcel Delivery" company intends borrowing the total amount of money with an annual interest rate of 2.02%. The borrowed funds will help cover the cost of the preparation of all the documentation, contracts, public consultation, the tendering process, the actual construction, and commissioning. It is possible that during the early stages of the completed project some of the borrowed funds will in part cover, staff wages and the ongoing operation and maintenance costs. The proposed financing arrangement for the loan is to be financed over a 15-year period. The "Automated Parcel Delivery" company has stipulated that if the project was to go ahead, the initial project scoping must start on the 1st of Jul 2022 and has stated that the project is to break even at the end of the 15th financial year. This goal is to be achieved from revenue generated via delivery charges, solar power rebates and from the advertising while also considering the expected annual ongoing power supply tariff, maintenance, and operational costs. The "Automated Parcel Delivery" company requires that the delivery charge ($N) must be set at a competitive value. This is deemed that the for the lowest order value of $N, it must be no greater than $20. A second constraint stipulates that the project must break even in less than or equal to 15 years. The loan draw-down profile of the $22.5m borrowed funds follows the typical project life cycle S curve expenditure distribution is given in Table 2 below. Note also that the additional cost of the 25 delivery drones is to be treated as a separate loan in addition to the $22.5m and will begin at project handover. Table 2 Expected loan draw down amounts for each year. Year of the $22.5m Loan Drawdown Expected Loan Drawdown Profile By the end of 1st Year Expected drawdown is 10% of total loan amount. By the end of 2nd Year Expected drawdown is 35% of total loan amount. By the end of 3rd Year Expected drawdown is 35% of total loan amount. By the end of 4th Year Expected drawdown is 15% of total loan amount. By the end of 5th Year Expected drawdown is 5% of total loan amount. . Note that all the three revenue streams can only start once ALL customised loading, take-off, and landing zones are commissioned and handed over. For simplicity assume all costs and revenues land at the end of each Australian financial year (June 30). When calculating the NPV, the same interest rate is to be used as your discount rate for all inflows and outflows. Operations and Maintenance (O&M) Costs: The expected costs associated with the ongoing maintenance and operational cost (in today's dollars) is estimated to be $3.6m per year. These costs include the annual CASA licensing fee. Note that the annual Operational and Maintenance costs commence only once all the construction of the 15 customised loading, take-off, and landing zones are built, commissioned, and handed over. Also assume that the operation and maintenance costs remain the same each year and that all costs land at the end of each financial year. Power Supply and Usage costs: It is estimated that $2.4m will be the annual power cost tariff that the "Automated Parcel Delivery" company will have to pay. The "Automated Parcel Delivery" company intends to recover $350k/year of the total $2.4m/year power cost tariff via the proposed solar panel array network which will be installed as part of this project and forms part of the $22.5m construction cost mentioned above. Note: The annual $350k solar rebate only comes into effect exactly 2 years after the construction of the project has been completed and handed over. Draw on one A4 sheet of paper and clearly label the pre-tax cash flow diagram for the total project showing all relevant contributing cash inflows and outflows then apply the "economic equivalence" and the "annuities" formulas in order to carry out a net present value calculation, where total outflows equal to total inflows enabling you to solve for the unknown variable under consideration. Weeks* 35 25 16 8 6 17 Appendix 1 The Master Plan - Drone Parcel Delivery Activity Description Predecessors A Prepare concept plan broad scope of the project Start 1/7/22 B Seek Public Consultation and stakeholder A engagement Prepare Business Case and Obtain Environmental B Approvals D Commence and Close the Tender Period E Analyse and award contract to the winning D tenderer F Finalise and submit the detailed design of the E Civil, Electrical, Mechanical and the Comms IT engineering works and wait for final approvals fro CA (Civil Aviation Safety Authority) G Ordering of all materials required for the Civil, F Electrical, Mechanical and the Comms IT engineering works H Ordering of the 25 delivery drones G 1 Completion of the Construction Phase - for all the H Civil scope of works J Completion of the Construction Phase - for all 1 Electrical, Mechanical and the Comms IT engineering scope of works Final Commissioning and Project Handover of the J total project and commemorate with the Premier at a ribbon cutting ceremony Table 3 The master plan of the project. 12 7 22 TBD^ 18 TBD^. To be determined from the WBS tables 4, 5 & 6. WBS Mechanical Engineering Scope of Works Description Predecessors Activity Weeks* AM 2 BM 2 CM 2. DM 3 EM 3 FM 4 GM 5 HM Confirm order all materials from the design I (Master Plan) bill of quantities Catalogue and deliver all materials to AM appropriate sites Mobilise personnel to site office(s) BM Install the landing pads and pressure sensors CM to specifications Install fire sprinkler systems at loading, take- CM off, and landing zones. Install air conditioning and control systems CM Install all control and signalling equipment CM Take delivery and test all 25 delivery drones FM Install the required control equipment for the EM solar panel tracking mechanism Ensure all sensor data is being received back GM at the control room Work with CASA to limit the drone rotor JM blade speed for noise Test the drones under rotor failure and write KM up emergency procedure guidelines Final testing commissioning and formal LM handover Table 4 WBS Mechanical Engineering Scope of Works 4 IM 4 JM 12 KM 4 LM 4 MM 4 WBS Mechanical Engineering Scope of Works Description Predecessors Activity Weeks* AM 2 BM 2 CM 2. DM 3 EM 3 FM 4 GM 5 HM Confirm order all materials from the design I (Master Plan) bill of quantities Catalogue and deliver all materials to AM appropriate sites Mobilise personnel to site office(s) BM Install the landing pads and pressure sensors CM to specifications Install fire sprinkler systems at loading, take- CM off, and landing zones. Install air conditioning and control systems CM Install all control and signalling equipment CM Take delivery and test all 25 delivery drones FM Install the required control equipment for the EM solar panel tracking mechanism Ensure all sensor data is being received back GM at the control room Work with CASA to limit the drone rotor JM blade speed for noise Test the drones under rotor failure and write KM up emergency procedure guidelines Final testing commissioning and formal LM handover Table 4 WBS Mechanical Engineering Scope of Works 4 IM 4 JM 12 KM 4 LM 4 MM 4 WBS Communications and IT Engineering Scope of Works Description Predecessors Weeks* Activity AT 2 BT 2 CT 2 DT 10 ET 14 FT 7 GT 5 Confirm order all materials from the design bill | (Master Plan) of quantities Catalogue and deliver all materials to AT appropriate sites Mobilise personnel to site office(s) BT Install all security cameras, CCTV, routers, and CT IT requirements along the route and at the docking stations. Install the optic fibre cables and connect to the Telecommunications network as per the design CT Install the router system enabling wireless internet access and continuous GPS access. Installation of mobile towers and antennas as DT required Install GSM5 mobile equipment racks at existing Telstra exchanges and the mobile towers FT Setup the backup comms network for the pilot ET to communicate back to the main control room Install the security microphone and speaker HT system at the loading, take-off and landing zones with comms back to the control room Install the remotely controlled security cameras JT with live feed back to the control room. Final testing commissioning and formal handover KT Table 5 WBS Communications and IT Engineering Scope of Works HT 6 IT 3 5 KT 6 LT 5 WBS Electrical Engineering Scope of Works Description Predecessors Weeks* Activity AE 2 I (Master Plan) BE AE 2 CE AE 3 DE AE 3 EE BE 2 FE BE 3 GE CE, DE 3 HE DE 4 Confirm order all materials from the design bill of quantities and deliver all materials to site Prepare final as built drawings and documentation Mobilise personnel to site office(s) Relocate existing electrical infrastructure as required by the design Upgrade a 66kV substation at the Kewdale warehouse Install all the solar array panels at the designated locations Terminate the diverse 66kV cable from Western Power for power robustness and reliability at Kewdale warehouse. Equip the switch room with the main switchboard and protection fuses and circuit breakers at the loading, take-off, and landing zones. Install all sub switchboards at the loading, take-off, and landing zones Install the interruptible power supply equipment in the main switch room(s) Install all the wiring reticulation along the route for supply to the signalling controls Install the protection equipment at the local sub stations Install all LED lighting around the landing pads including the security Lighting Install lightning and surge protection at all loading, take-off, and landing zones Test primary and secondary power supply. IE EE 2 JE IE, FE 2 KE FE 3 LE HE 4 ME HE 6 NE ME 8 OE KE, GE, LE 8 PE JE, OE, ME 3 RE PE 8 SE RE, NE 3 Test that all lighting and security lighting meets the Australian Standards and CASA requirements Final testing of the uninterruptable power supply. Install all landing pad lights as per CASA requirements Test that all lighting and security lighting meets the Australian Standards and CASA requirements Final testing commissioning and formal handover Table 6 WBS Electrical Engineering Scope of Works. TE RE, NE 4 UE SE, TE 6 *For simplicity assume 52 weeks per year (i.e. no holiday or down time gaps). Assume one work week is equal to seven days i.e. no weekends. Note: Only work in weeks or years, not days. Also, for simplicity assume all expenditures and revenues land at the end of each financial year. For example, assume all maintenance costs are incurred at the end of each financial year, June 30th (even though in practice maintenance costs are incurred throughout a given year). Superior Contractors Pty. Ltd. - Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 35,100.00 $ 30,350.00 Cost of Goods Sold $ 28,200.00 $ 25,426.00 Gross Margin $ 6,900.00 $ 4,924.00 $ Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ 30.00 48.00 41.00 54.00 53.00 148.00 $ $ $ $ 19.00 97.00 Operating Expenses Selling, General & Admin $ 2,851.00 R&D and Engineering $ 210.00 Special Charges $ 9.00 Total Operating Expenses $ 3,070.00 $ 2,451.00 $ 292.00 $ 45.00 $ 2,788.00 EBITDA Depreciation and Amortisation EBIT $ $ 3,830.00 352.00 $ 3,478.00 $ 2,136.00 $ 235.00 $ 1,901.00 Interest $ 85.00 Provision for Income Tax $ 653.00 Net Profit / Income $ 2,888.00 $ 98.00 $ 545.00 $ 1,355.00 Superior Contractors Pty. Ltd. - Cash Flow Statement ($AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Cash flow from Operating Activities Net Income Depreciation and Amortisation Changes in Working Capital Changes in Non-Current Assets & Liabilities Special charges and other adjustments Net cash provided by Operating Activities $ 2,888.00 $ 352.00 $ 850.00 $ 108.00 $ (88.00) $ 4,110.00 $ 1,355.00 $ 235.00 $ 893.00 $ 87.00 $ 635.00 $ 3,205.00 Cash flow from Investing Activities Marketable Securities Purchases Sales Capital Expenditure Net Cash Used in Investing Activities $ (3,950.00) $ 3,642.00 $ (154.00) $ (462.00) $ (4,602.00) $ 2,956.00 $ (152.00) $ (1,798.00) Cash flow from Financing Activities Purchase of Common Stock Issuance of Common Stock to Staff Net Cash Used in Investing Activities $ (1,130.00) $ 235.00 $ (895.00) $(1,934.00) $ 260.00 $ (1,674.00) Effect of exchange rate changes in cash Net Increase in Cash $ (120.00) $ 2,633.00 $ 60.00 $ (207.00) Cash at the beginning of the period $ 1,135.00 $ 1,342.00 Cash at the end of the period $ 3,768.00 $ 1,135.00 Superior Contractors Pty. Ltd. - Balance Sheet ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Current Assets Cash (at end of period) $ 3,768.00 $ 1,135.00 Short Term Investments $ 205.00 $ 154.00 Accounts Receivable $ 1,208.00 $ 987.00 Inventories $ 139.00 $ 127.00 Other $ 10.00 $ 600.00 Total Current Assets $ 5,330.00 $ 3,003.00 Non - Current Assets Property, Plant & Equipment Long Term Investments Other Total Non-Current Assets $ 850.00 $ 3,209.00 $ 148.00 $ 4,207.00 $ 980.00 $ 2,897.00 $ 256.00 $ 4,133.00 Total Assets $ 9,537.00 $ 7,136.00 Current Liabilities Accounts Payable Accrued and other Total Current Liabilities $ 1,500.00 $ 2,500.00 $ 4,000.00 $ 1,807.00 $ 1,306.00 $ 3,113.00 Non - Current Liabilities Long Term Debt $ 1,131.00 $ 989.00 Total Non-Current Liabilities $ 1,131.00 $ 989.00 Total Liabilities $ 5,131.00 $ 4,102.00 Equity Preferred stock Common Stock and Capital Retained Earning Total Equity $ 967.00 $ 1,917.00 $ 1,522.00 $ 4,406.00 $ 885.00 $ 1,349.00 $ 800.00 $ 3,034.00 O'Deliver Star Contract Pty Ltd. Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 34,564.00 $ 29,845.00 Cost of Good Sold $ 29,105.00 $ 24,538.00 Gross Margin $ 5,459.00 $ 5,307.00 31.00 Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ $ $ 20.00 41.00 64.00 23.00 118.00 16.00 $ $ 77.00 Operating Expenses Selling, General & Admin $ 2,894.00 R&D and Engineering $ 425.00 Special Charges $ 7.00 Total Operating Expenses $ 3,326.00 $ 2,500.00 $ 419.00 $ 3.00 $ 2,922.00 EBITDA Depreciation and Amortisation EBIT $ 2,133.00 $ 198.00 $ 1,935.00 $ 2,385.00 $ 480.00 $ 1,905.00 Interest $ 39.00 Provision for Income Tax $ 975.00 Net Profit / Income $ 1,039.00 $ 45.00 $ 502.00 $ 1,435.00 O'Deliver Star Contract Pty Ltd. Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 34,564.00 $ 29,845.00 Cost of Good Sold $ 29,105.00 $ 24,538.00 Gross Margin $ 5,459.00 $ 5,307.00 31.00 Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ $ $ 20.00 41.00 64.00 23.00 118.00 16.00 $ $ 77.00 Operating Expenses Selling, General & Admin $ 2,894.00 R&D and Engineering $ 425.00 Special Charges $ 7.00 Total Operating Expenses $ 3,326.00 $ 2,500.00 $ 419.00 $ 3.00 $ 2,922.00 EBITDA Depreciation and Amortisation EBIT $ 2,133.00 $ 198.00 $ 1,935.00 $ 2,385.00 $ 480.00 $ 1,905.00 Interest $ 39.00 Provision for Income Tax $ 975.00 Net Profit / Income $ 1,039.00 $ 45.00 $ 502.00 $ 1,435.00 O'Deliver Star Contract Pty Ltd. Cash Flow Statement ($ AUD X 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Cash flow from Operating Activities Net Income Depreciation and Amortisation Changes in Working Capital Changes in Non-Current Assets & Liabilities Special charges and other adjustments Net cash provided by Operating Activities $ 1,039.00 $ 198.00 $ 901.00 $ 108.00 $ (98.00) $ 2,148.00 $ 1,435.00 $ 480.00 $ 893.00 $ 87.00 $ 635.00 $ 3,530.00 Cash flow from Investing Activities Marketable Securities Purchases Sales Capital Expenditure Net Cash Used in Investing Activities $ (4,006.00) $ 3,642.00 $ (154.00) $ (518.00) $ (4,736.00) $ 2,956.00 $ (152.00) $ (1,932.00) Cash flow from Financing Activities Purchase of Common Stock Issuance of Common Stock to Staff Net Cash Used in Investing Activities $ (1,135.00) $ 245.00 $ (890.00) $(1,935.00) $ 265.00 $ (1,670.00) 60.00 Effect of exchange rate changes in cash Net Increase in Cash $ (120.00) $ 620.00 $ $ (12.00) Cash at the beginning of the period $ 1,330.00 $ 1,342.00 Cash at the end of the period $ 1,950.00 $ 1,330.00 O'Deliver Star Contract Pty Ltd. Balance Sheet ($AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Current Assets Cash (at end of period) $ 1,950.00 $ 1,330.00 Short Term Investments $ 205.00 $ 154.00 Accounts Receivable $ 1,208.00 $ 987.00 Inventories $ 142.00 $ 131.00 Other $ $ 600.00 Total Current Assets $ 3,505.00 $ 3,202.00 ulululu $ Non - Current Assets Property, Plant & Equipment Long Term Investments Other Total Non-Current Assets ulu $ 850.00 $ 3,209.00 $ 148.00 $ 4,207.00 $ 980.00 $ 2,897.00 $ 256.00 $ 4,133.00 Total Assets $ 7,712.00 $ 7,335.00 Current Liabilities Accounts Payable Accrued and other Total Current Liabilities $ 2,089.00 $ 1,456.00 $ 3,545.00 $ 2,000.00 $ 1,400.00 $ 3,400.00 Non - Current Liabilities Long Term Debt $ 1,250.00 $ 1,000.00 Total Non-Current Liabilities $ 1,250.00 $ 1,000.00 $ 4,795.00 $ 4,400.00 $ Total Liabilities Equity Preferred stock Common Stock and Capital Retained Earning Total Equity $ 452.00 $ 969.00 $ 1,496.00 $ 2,917.00 806.00 $ 1,253.00 $ 876.00 $ 2,935.00 Scenario Details The "Automated Parcel Delivery" company is examining a proposal to provide a drone parcel delivery service for supermarkets across the Perth Metropolitan area. It will operate the drones from 14 supermarkets and 1 warehouse location across Perth. To do this, the 14 supermarkets and 1 warehouse need to have customised loading, take-off and landing zones built. These will be built by the "Automated Parcel Delivery" company. The company will use 25 drones spread across the 15 locations to carry out the deliveries. A network of solar panels will be installed at the 15 locations for charging the drones. This will minimise the use of the main electricity grid powering the systems. A solar rebate will be offered by the WA government to the "Automated Parcel Delivery" company to encourage the use of renewable energy. The delivery drones can carry up to 5 deliveries. The normal delivery window, using trucks, is a 2-hour timeframe. With using the drones, the delivery window will be reduced to a 15-minute window. For Western Australia, and to start with, Perth, this will be a significant infrastructure project. If the trial is successful, the "Automated Parcel Delivery" company would be looking to expand their service network to other capital cities in Australia with an outlook to expand globally. It is proposed that the delivery drones' trail would be run as a fully costed, stand- alone project and a self-sustaining business venture. The project assumes that all approvals have been given by the Civil Aviation Safety Authority (CASA) to allow the delivery drones to operate. Congratulations, the "Automated Parcel Delivery" company has employed you as an engineering consultant and assigned you the task to work with the "Automated Parcel Delivery" company planning design team on the proposed new loading, take- off, and landing zones. The total construction cost of the project is estimated to be $22.5 million in today's dollars. In addition to the construction costs, 25 new delivery drones will be purchased at a cost of $23,500 each. The drones will be purchased on the same day as the completion of construction so that they can immediately start earning revenue. Use these figures to determine the total amount you will be required to borrow to finance the project. These figures include the complete construction costs associated with the customised loading, take-off, and landing zones. Revenue will be generated via delivery fees and the solar panel rebate and from the electronic advertising to be placed at the customised loading, take-off, and landing platforms. The total expected revenue from advertising is estimated to be $150k per year. The order delivery charge will be calculated using the figure of $N per delivery, depending on the order value, as shown in Table 1. Table 1 Order values, delivery charge and expected number of orders per week. Order Value Up to $49.99 $50 - $99.99 Delivery Charge Expected Weekly Orders 3500 $ 4500 $N 7500 $100 - $199.99 $200 or more $ 12500 Financing structure of the Project: To finance the project the "Automated Parcel Delivery" company intends borrowing the total amount of money with an annual interest rate of 2.02%. The borrowed funds will help cover the cost of the preparation of all the documentation, contracts, public consultation, the tendering process, the actual construction, and commissioning. It is possible that during the early stages of the completed project some of the borrowed funds will in part cover, staff wages and the ongoing operation and maintenance costs. The proposed financing arrangement for the loan is to be financed over a 15-year period. The "Automated Parcel Delivery" company has stipulated that if the project was to go ahead, the initial project scoping must start on the 1st of Jul 2022 and has stated that the project is to break even at the end of the 15th financial year. This goal is to be achieved from revenue generated via delivery charges, solar power rebates and from the advertising while also considering the expected annual ongoing power supply tariff, maintenance, and operational costs. The "Automated Parcel Delivery" company requires that the delivery charge ($N) must be set at a competitive value. This is deemed that the for the lowest order value of $N, it must be no greater than $20. A second constraint stipulates that the project must break even in less than or equal to 15 years. The loan draw-down profile of the $22.5m borrowed funds follows the typical project life cycle S curve expenditure distribution is given in Table 2 below. Note also that the additional cost of the 25 delivery drones is to be treated as a separate loan in addition to the $22.5m and will begin at project handover. Table 2 Expected loan draw down amounts for each year. Year of the $22.5m Loan Drawdown Expected Loan Drawdown Profile By the end of 1st Year Expected drawdown is 10% of total loan amount. By the end of 2nd Year Expected drawdown is 35% of total loan amount. By the end of 3rd Year Expected drawdown is 35% of total loan amount. By the end of 4th Year Expected drawdown is 15% of total loan amount. By the end of 5th Year Expected drawdown is 5% of total loan amount. . Note that all the three revenue streams can only start once ALL customised loading, take-off, and landing zones are commissioned and handed over. For simplicity assume all costs and revenues land at the end of each Australian financial year (June 30). When calculating the NPV, the same interest rate is to be used as your discount rate for all inflows and outflows. Operations and Maintenance (O&M) Costs: The expected costs associated with the ongoing maintenance and operational cost (in today's dollars) is estimated to be $3.6m per year. These costs include the annual CASA licensing fee. Note that the annual Operational and Maintenance costs commence only once all the construction of the 15 customised loading, take-off, and landing zones are built, commissioned, and handed over. Also assume that the operation and maintenance costs remain the same each year and that all costs land at the end of each financial year. Power Supply and Usage costs: It is estimated that $2.4m will be the annual power cost tariff that the "Automated Parcel Delivery" company will have to pay. The "Automated Parcel Delivery" company intends to recover $350k/year of the total $2.4m/year power cost tariff via the proposed solar panel array network which will be installed as part of this project and forms part of the $22.5m construction cost mentioned above. Note: The annual $350k solar rebate only comes into effect exactly 2 years after the construction of the project has been completed and handed over. Draw on one A4 sheet of paper and clearly label the pre-tax cash flow diagram for the total project showing all relevant contributing cash inflows and outflows then apply the "economic equivalence" and the "annuities" formulas in order to carry out a net present value calculation, where total outflows equal to total inflows enabling you to solve for the unknown variable under consideration. Weeks* 35 25 16 8 6 17 Appendix 1 The Master Plan - Drone Parcel Delivery Activity Description Predecessors A Prepare concept plan broad scope of the project Start 1/7/22 B Seek Public Consultation and stakeholder A engagement Prepare Business Case and Obtain Environmental B Approvals D Commence and Close the Tender Period E Analyse and award contract to the winning D tenderer F Finalise and submit the detailed design of the E Civil, Electrical, Mechanical and the Comms IT engineering works and wait for final approvals fro CA (Civil Aviation Safety Authority) G Ordering of all materials required for the Civil, F Electrical, Mechanical and the Comms IT engineering works H Ordering of the 25 delivery drones G 1 Completion of the Construction Phase - for all the H Civil scope of works J Completion of the Construction Phase - for all 1 Electrical, Mechanical and the Comms IT engineering scope of works Final Commissioning and Project Handover of the J total project and commemorate with the Premier at a ribbon cutting ceremony Table 3 The master plan of the project. 12 7 22 TBD^ 18 TBD^. To be determined from the WBS tables 4, 5 & 6. WBS Mechanical Engineering Scope of Works Description Predecessors Activity Weeks* AM 2 BM 2 CM 2. DM 3 EM 3 FM 4 GM 5 HM Confirm order all materials from the design I (Master Plan) bill of quantities Catalogue and deliver all materials to AM appropriate sites Mobilise personnel to site office(s) BM Install the landing pads and pressure sensors CM to specifications Install fire sprinkler systems at loading, take- CM off, and landing zones. Install air conditioning and control systems CM Install all control and signalling equipment CM Take delivery and test all 25 delivery drones FM Install the required control equipment for the EM solar panel tracking mechanism Ensure all sensor data is being received back GM at the control room Work with CASA to limit the drone rotor JM blade speed for noise Test the drones under rotor failure and write KM up emergency procedure guidelines Final testing commissioning and formal LM handover Table 4 WBS Mechanical Engineering Scope of Works 4 IM 4 JM 12 KM 4 LM 4 MM 4 WBS Mechanical Engineering Scope of Works Description Predecessors Activity Weeks* AM 2 BM 2 CM 2. DM 3 EM 3 FM 4 GM 5 HM Confirm order all materials from the design I (Master Plan) bill of quantities Catalogue and deliver all materials to AM appropriate sites Mobilise personnel to site office(s) BM Install the landing pads and pressure sensors CM to specifications Install fire sprinkler systems at loading, take- CM off, and landing zones. Install air conditioning and control systems CM Install all control and signalling equipment CM Take delivery and test all 25 delivery drones FM Install the required control equipment for the EM solar panel tracking mechanism Ensure all sensor data is being received back GM at the control room Work with CASA to limit the drone rotor JM blade speed for noise Test the drones under rotor failure and write KM up emergency procedure guidelines Final testing commissioning and formal LM handover Table 4 WBS Mechanical Engineering Scope of Works 4 IM 4 JM 12 KM 4 LM 4 MM 4 WBS Communications and IT Engineering Scope of Works Description Predecessors Weeks* Activity AT 2 BT 2 CT 2 DT 10 ET 14 FT 7 GT 5 Confirm order all materials from the design bill | (Master Plan) of quantities Catalogue and deliver all materials to AT appropriate sites Mobilise personnel to site office(s) BT Install all security cameras, CCTV, routers, and CT IT requirements along the route and at the docking stations. Install the optic fibre cables and connect to the Telecommunications network as per the design CT Install the router system enabling wireless internet access and continuous GPS access. Installation of mobile towers and antennas as DT required Install GSM5 mobile equipment racks at existing Telstra exchanges and the mobile towers FT Setup the backup comms network for the pilot ET to communicate back to the main control room Install the security microphone and speaker HT system at the loading, take-off and landing zones with comms back to the control room Install the remotely controlled security cameras JT with live feed back to the control room. Final testing commissioning and formal handover KT Table 5 WBS Communications and IT Engineering Scope of Works HT 6 IT 3 5 KT 6 LT 5 WBS Electrical Engineering Scope of Works Description Predecessors Weeks* Activity AE 2 I (Master Plan) BE AE 2 CE AE 3 DE AE 3 EE BE 2 FE BE 3 GE CE, DE 3 HE DE 4 Confirm order all materials from the design bill of quantities and deliver all materials to site Prepare final as built drawings and documentation Mobilise personnel to site office(s) Relocate existing electrical infrastructure as required by the design Upgrade a 66kV substation at the Kewdale warehouse Install all the solar array panels at the designated locations Terminate the diverse 66kV cable from Western Power for power robustness and reliability at Kewdale warehouse. Equip the switch room with the main switchboard and protection fuses and circuit breakers at the loading, take-off, and landing zones. Install all sub switchboards at the loading, take-off, and landing zones Install the interruptible power supply equipment in the main switch room(s) Install all the wiring reticulation along the route for supply to the signalling controls Install the protection equipment at the local sub stations Install all LED lighting around the landing pads including the security Lighting Install lightning and surge protection at all loading, take-off, and landing zones Test primary and secondary power supply. IE EE 2 JE IE, FE 2 KE FE 3 LE HE 4 ME HE 6 NE ME 8 OE KE, GE, LE 8 PE JE, OE, ME 3 RE PE 8 SE RE, NE 3 Test that all lighting and security lighting meets the Australian Standards and CASA requirements Final testing of the uninterruptable power supply. Install all landing pad lights as per CASA requirements Test that all lighting and security lighting meets the Australian Standards and CASA requirements Final testing commissioning and formal handover Table 6 WBS Electrical Engineering Scope of Works. TE RE, NE 4 UE SE, TE 6 *For simplicity assume 52 weeks per year (i.e. no holiday or down time gaps). Assume one work week is equal to seven days i.e. no weekends. Note: Only work in weeks or years, not days. Also, for simplicity assume all expenditures and revenues land at the end of each financial year. For example, assume all maintenance costs are incurred at the end of each financial year, June 30th (even though in practice maintenance costs are incurred throughout a given year). Superior Contractors Pty. Ltd. - Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 35,100.00 $ 30,350.00 Cost of Goods Sold $ 28,200.00 $ 25,426.00 Gross Margin $ 6,900.00 $ 4,924.00 $ Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ 30.00 48.00 41.00 54.00 53.00 148.00 $ $ $ $ 19.00 97.00 Operating Expenses Selling, General & Admin $ 2,851.00 R&D and Engineering $ 210.00 Special Charges $ 9.00 Total Operating Expenses $ 3,070.00 $ 2,451.00 $ 292.00 $ 45.00 $ 2,788.00 EBITDA Depreciation and Amortisation EBIT $ $ 3,830.00 352.00 $ 3,478.00 $ 2,136.00 $ 235.00 $ 1,901.00 Interest $ 85.00 Provision for Income Tax $ 653.00 Net Profit / Income $ 2,888.00 $ 98.00 $ 545.00 $ 1,355.00 Superior Contractors Pty. Ltd. - Cash Flow Statement ($AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Cash flow from Operating Activities Net Income Depreciation and Amortisation Changes in Working Capital Changes in Non-Current Assets & Liabilities Special charges and other adjustments Net cash provided by Operating Activities $ 2,888.00 $ 352.00 $ 850.00 $ 108.00 $ (88.00) $ 4,110.00 $ 1,355.00 $ 235.00 $ 893.00 $ 87.00 $ 635.00 $ 3,205.00 Cash flow from Investing Activities Marketable Securities Purchases Sales Capital Expenditure Net Cash Used in Investing Activities $ (3,950.00) $ 3,642.00 $ (154.00) $ (462.00) $ (4,602.00) $ 2,956.00 $ (152.00) $ (1,798.00) Cash flow from Financing Activities Purchase of Common Stock Issuance of Common Stock to Staff Net Cash Used in Investing Activities $ (1,130.00) $ 235.00 $ (895.00) $(1,934.00) $ 260.00 $ (1,674.00) Effect of exchange rate changes in cash Net Increase in Cash $ (120.00) $ 2,633.00 $ 60.00 $ (207.00) Cash at the beginning of the period $ 1,135.00 $ 1,342.00 Cash at the end of the period $ 3,768.00 $ 1,135.00 Superior Contractors Pty. Ltd. - Balance Sheet ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Current Assets Cash (at end of period) $ 3,768.00 $ 1,135.00 Short Term Investments $ 205.00 $ 154.00 Accounts Receivable $ 1,208.00 $ 987.00 Inventories $ 139.00 $ 127.00 Other $ 10.00 $ 600.00 Total Current Assets $ 5,330.00 $ 3,003.00 Non - Current Assets Property, Plant & Equipment Long Term Investments Other Total Non-Current Assets $ 850.00 $ 3,209.00 $ 148.00 $ 4,207.00 $ 980.00 $ 2,897.00 $ 256.00 $ 4,133.00 Total Assets $ 9,537.00 $ 7,136.00 Current Liabilities Accounts Payable Accrued and other Total Current Liabilities $ 1,500.00 $ 2,500.00 $ 4,000.00 $ 1,807.00 $ 1,306.00 $ 3,113.00 Non - Current Liabilities Long Term Debt $ 1,131.00 $ 989.00 Total Non-Current Liabilities $ 1,131.00 $ 989.00 Total Liabilities $ 5,131.00 $ 4,102.00 Equity Preferred stock Common Stock and Capital Retained Earning Total Equity $ 967.00 $ 1,917.00 $ 1,522.00 $ 4,406.00 $ 885.00 $ 1,349.00 $ 800.00 $ 3,034.00 O'Deliver Star Contract Pty Ltd. Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 34,564.00 $ 29,845.00 Cost of Good Sold $ 29,105.00 $ 24,538.00 Gross Margin $ 5,459.00 $ 5,307.00 31.00 Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ $ $ 20.00 41.00 64.00 23.00 118.00 16.00 $ $ 77.00 Operating Expenses Selling, General & Admin $ 2,894.00 R&D and Engineering $ 425.00 Special Charges $ 7.00 Total Operating Expenses $ 3,326.00 $ 2,500.00 $ 419.00 $ 3.00 $ 2,922.00 EBITDA Depreciation and Amortisation EBIT $ 2,133.00 $ 198.00 $ 1,935.00 $ 2,385.00 $ 480.00 $ 1,905.00 Interest $ 39.00 Provision for Income Tax $ 975.00 Net Profit / Income $ 1,039.00 $ 45.00 $ 502.00 $ 1,435.00 O'Deliver Star Contract Pty Ltd. Income Statement ($ AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Net Revenue $ 34,564.00 $ 29,845.00 Cost of Good Sold $ 29,105.00 $ 24,538.00 Gross Margin $ 5,459.00 $ 5,307.00 31.00 Other Income Investment A $ Investment B $ Investment C $ Total Income from Investments $ $ $ 20.00 41.00 64.00 23.00 118.00 16.00 $ $ 77.00 Operating Expenses Selling, General & Admin $ 2,894.00 R&D and Engineering $ 425.00 Special Charges $ 7.00 Total Operating Expenses $ 3,326.00 $ 2,500.00 $ 419.00 $ 3.00 $ 2,922.00 EBITDA Depreciation and Amortisation EBIT $ 2,133.00 $ 198.00 $ 1,935.00 $ 2,385.00 $ 480.00 $ 1,905.00 Interest $ 39.00 Provision for Income Tax $ 975.00 Net Profit / Income $ 1,039.00 $ 45.00 $ 502.00 $ 1,435.00 O'Deliver Star Contract Pty Ltd. Cash Flow Statement ($ AUD X 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Cash flow from Operating Activities Net Income Depreciation and Amortisation Changes in Working Capital Changes in Non-Current Assets & Liabilities Special charges and other adjustments Net cash provided by Operating Activities $ 1,039.00 $ 198.00 $ 901.00 $ 108.00 $ (98.00) $ 2,148.00 $ 1,435.00 $ 480.00 $ 893.00 $ 87.00 $ 635.00 $ 3,530.00 Cash flow from Investing Activities Marketable Securities Purchases Sales Capital Expenditure Net Cash Used in Investing Activities $ (4,006.00) $ 3,642.00 $ (154.00) $ (518.00) $ (4,736.00) $ 2,956.00 $ (152.00) $ (1,932.00) Cash flow from Financing Activities Purchase of Common Stock Issuance of Common Stock to Staff Net Cash Used in Investing Activities $ (1,135.00) $ 245.00 $ (890.00) $(1,935.00) $ 265.00 $ (1,670.00) 60.00 Effect of exchange rate changes in cash Net Increase in Cash $ (120.00) $ 620.00 $ $ (12.00) Cash at the beginning of the period $ 1,330.00 $ 1,342.00 Cash at the end of the period $ 1,950.00 $ 1,330.00 O'Deliver Star Contract Pty Ltd. Balance Sheet ($AUD x 1000) Fiscal Year ending 30-Jun-20 30-Jun-19 Current Assets Cash (at end of period) $ 1,950.00 $ 1,330.00 Short Term Investments $ 205.00 $ 154.00 Accounts Receivable $ 1,208.00 $ 987.00 Inventories $ 142.00 $ 131.00 Other $ $ 600.00 Total Current Assets $ 3,505.00 $ 3,202.00 ulululu $ Non - Current Assets Property, Plant & Equipment Long Term Investments Other Total Non-Current Assets ulu $ 850.00 $ 3,209.00 $ 148.00 $ 4,207.00 $ 980.00 $ 2,897.00 $ 256.00 $ 4,133.00 Total Assets $ 7,712.00 $ 7,335.00 Current Liabilities Accounts Payable Accrued and other Total Current Liabilities $ 2,089.00 $ 1,456.00 $ 3,545.00 $ 2,000.00 $ 1,400.00 $ 3,400.00 Non - Current Liabilities Long Term Debt $ 1,250.00 $ 1,000.00 Total Non-Current Liabilities $ 1,250.00 $ 1,000.00 $ 4,795.00 $ 4,400.00 $ Total Liabilities Equity Preferred stock Common Stock and Capital Retained Earning Total Equity $ 452.00 $ 969.00 $ 1,496.00 $ 2,917.00 806.00 $ 1,253.00 $ 876.00 $ 2,935.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts