hi, i am having a hard time solving this problem 7.5B from the book Fundamental Accoutning Principles Volume 1. please help me solve it thank you:)

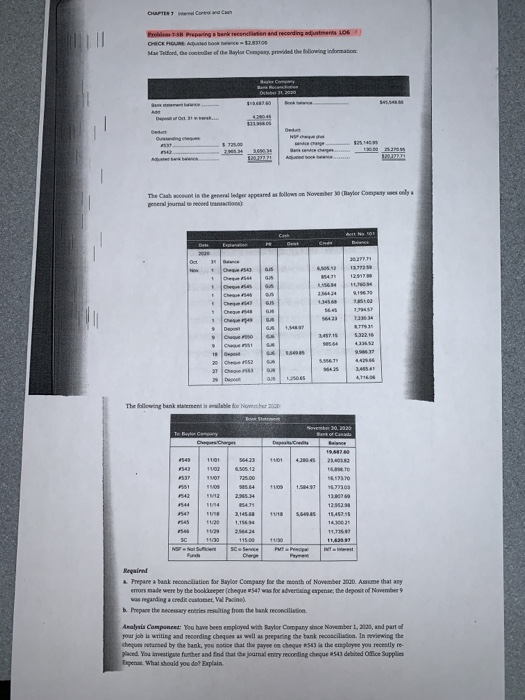

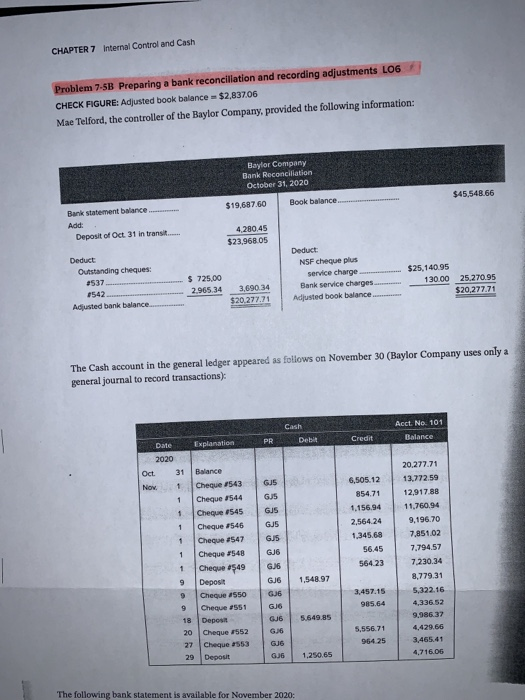

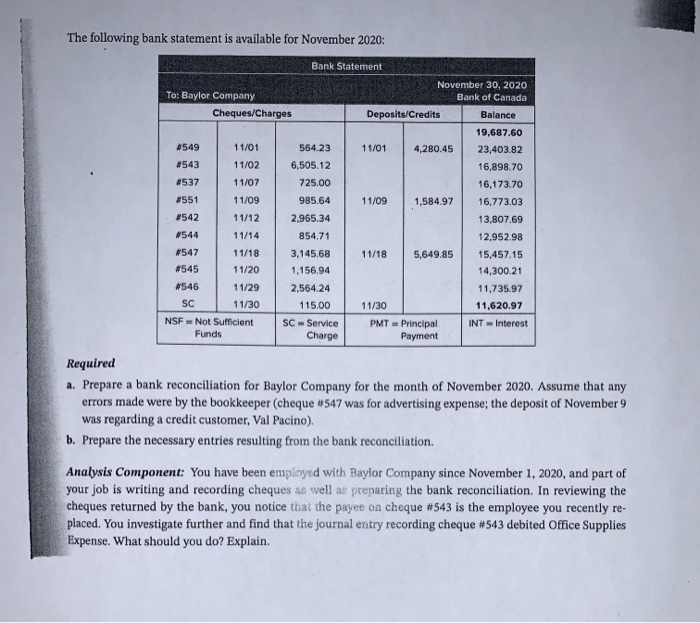

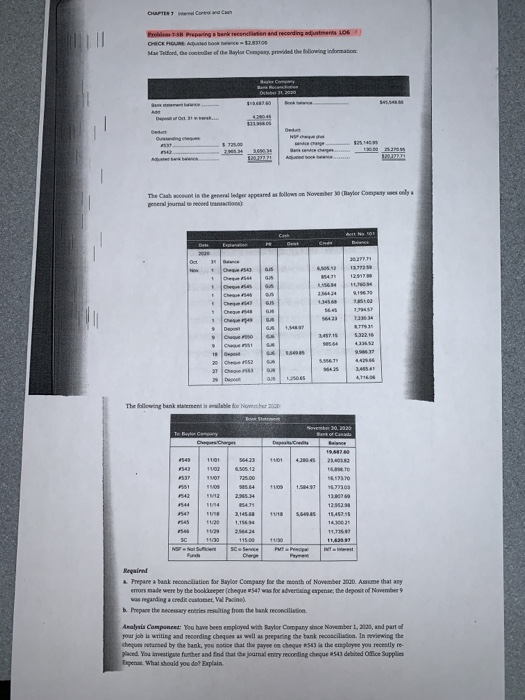

CUPTERT wear and Pr e paring bank reconciliation and recording s 106 CHECK OUR AD 2010 Madon, the code of the year Comp r wided the following information on November (aylor Company wesolya The Cash general jumalte in the general ledge appeared r national SIS The following bank statement for November Required 2. Prepare a bank reconciliation for Baylor Company for the month of November 2000. Assume that any errors de were by the bookeeper (cheque 547 was for advertising expense, the deposit od November was regarding acred womer, Painel b. Prepare the necessary entries resulting from the bank reconciliation Analysis Component You have been employed with Myter Company since November 1, 2020, and part of your job is writing and recording cheques as well as preparing the bank reconciliation. In seviewing the cheque tanned by the bank, you notice that the payee on cheque 1543 is the employee you recently re placed. You c a n further and find that the journal entry recording cheque 543 debited Oice Supplies E n What should you do? Explain. CHAPTER 7 Internal Control and Cash Problem 7-5B Preparing a bank reconciliation and recording adjustments LO6 CHECK FIGURE: Adjusted book balance $2,837.06 Mae Telford, the controller of the Baylor Company, provided the following information: Baylor Company Bank Reconciliation October 31, 2020 $45,548.66 $19,687.60 Book balance... Bank statement balance............ Add: Deposit of Oct 31 in transit... 4.280.45 $23,968.05 Deduct Outstanding cheques: #537 542 Adjusted bank balance.... $ 725,00 2.965 34 Deduct: NSF cheque plus service charge Bank service charges........... Adjusted book balance $25,140,95 130.00 25.270.95 $20,277.71 3.690.34 $20.27771 The Cash account in the general ledger appeared as follows on November 30 (Baylor Company uses only a general journal to record transactions): Acct. No. 101 PR Debit Credit Date 2020 Oct Nov 1 Balance Cheque #543 Cheque #544 Cheque #545 Cheque #546 Cheque #547 Cheque #548 Cheque 1549 Deposit Cheque 1550 Cheque 1551 Depos Cheque #552 Cheque #553 Deposit 6,505.12 854.71 1,156,94 2,564.24 1,345.68 56.45 564.23 20.277.71 13.772.59 12,917.88 11,760.94 9,196.70 7,851.02 7.794.57 7.230.34 8,779.31 5,322.16 4,336.52 9.986.37 4,429.66 3,465.41 4,716.05 1.548.97 3.457.15 985.64 GJE 5,649.85 6.36 18 20 27 29 5,556.71 964 25 GJ6 GJ61.250.65 The following bank statement is available for November 2020: The following bank statement is available for November 2020: Bank Statement November 30, 2020 To: Baylor Company Bank of Canada Cheques/Charges Deposits/Credits Balance 19,687.60 #549 11/01 564.23 11/01 4,280.45 23,403.82 #543 11/02 6,505.12 16,898.70 1537 11/07 725.00 16,173.70 1551 11/09 985.64 11/09 1,584.97 16,773.03 #542 11/12 2.965.34 13,807,69 #544 11/14 854.71 12,952.98 #547 11/18 3,145.68 11/18 5,649.85 15,457.15 #545 11/20 1,156.94 14,300.21 #546 11/29 2,564.24 11.735.97 SC 11/30 115.00 11/30 11,620.97 NSF Not Sufficient SC -Service PMT - Principal INT-Interest Funds Charge Payment Required a. Prepare a bank reconciliation for Baylor Company for the month of November 2020. Assume that any errors made were by the bookkeeper (cheque #547 was for advertising expense; the deposit of November 9 was regarding a credit customer, Val Pacino). b. Prepare the necessary entries resulting from the bank reconciliation. Analysis Component: You have been employed with Baylor Company since November 1, 2020, and part of your job is writing and recording cheques as well as preparing the bank reconciliation. In reviewing the cheques returned by the bank, you notice that the payee on cheque #543 is the employee you recently re- placed. You investigate further and find that the journal entry recording cheque #543 debited Office Supplies Expense. What should you do? Explain