Hi,

I need help trying to figure out the answers to fill in the boxes. Can someone help me please?

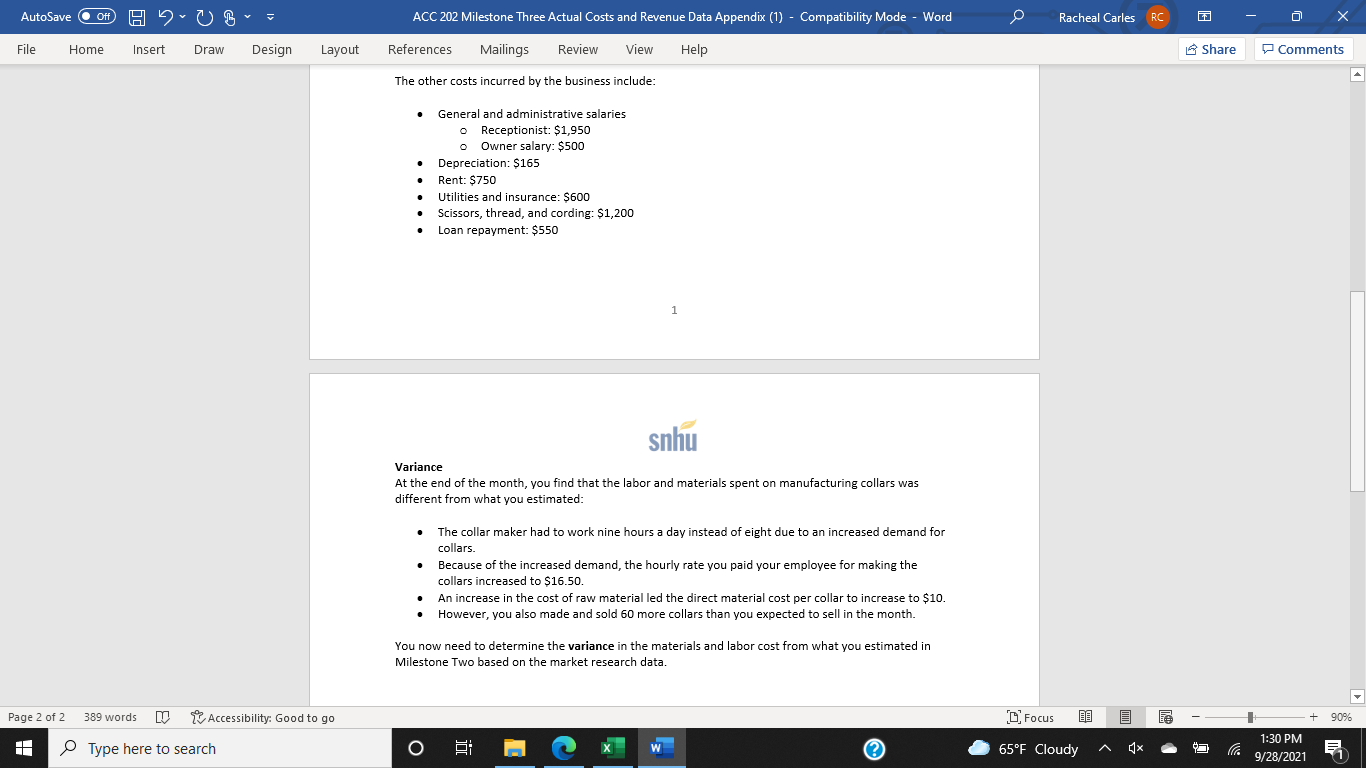

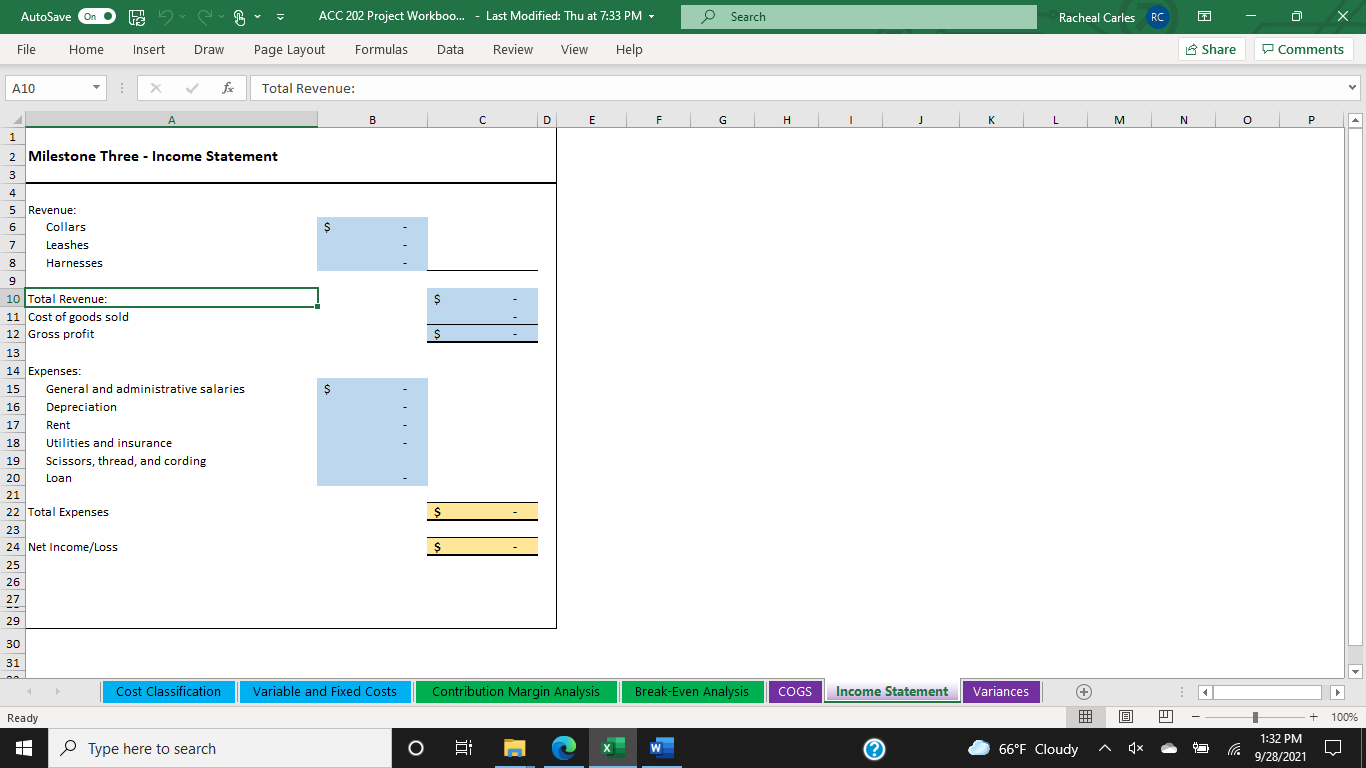

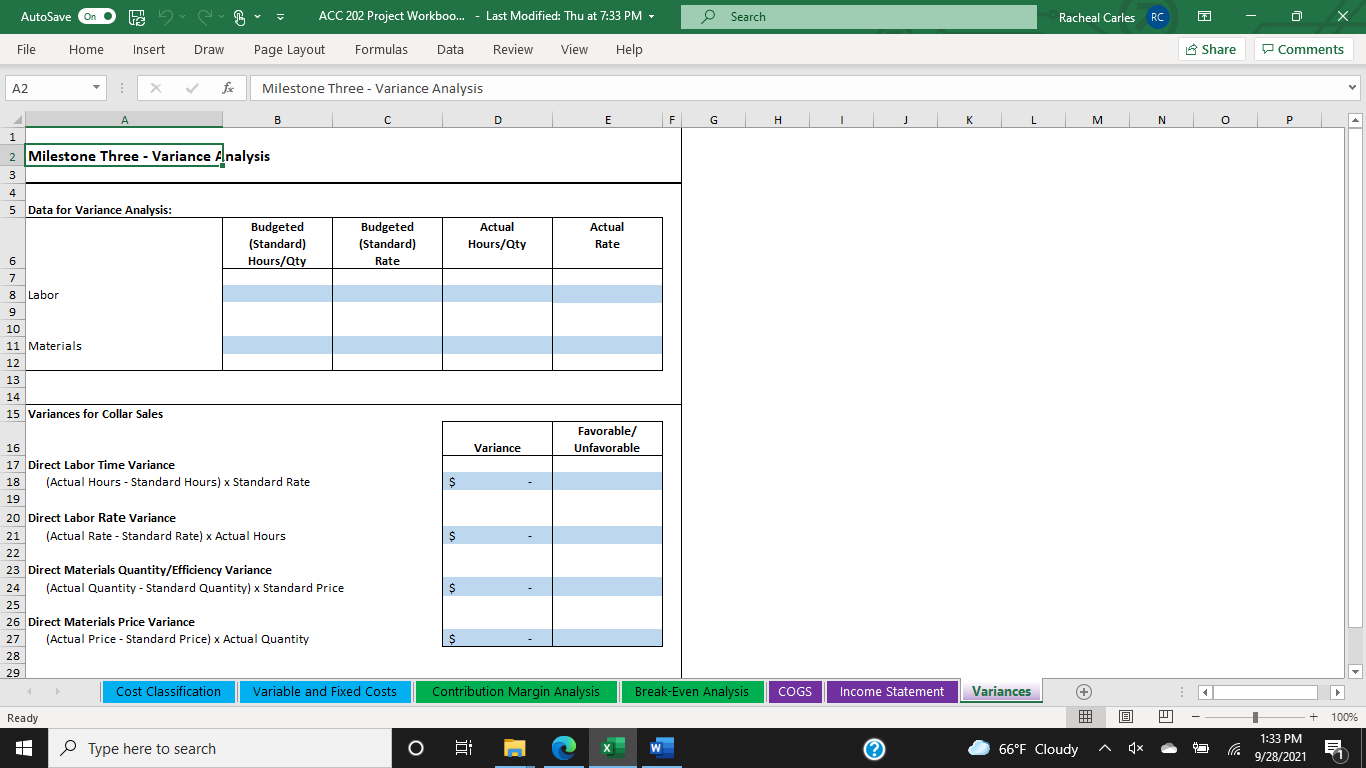

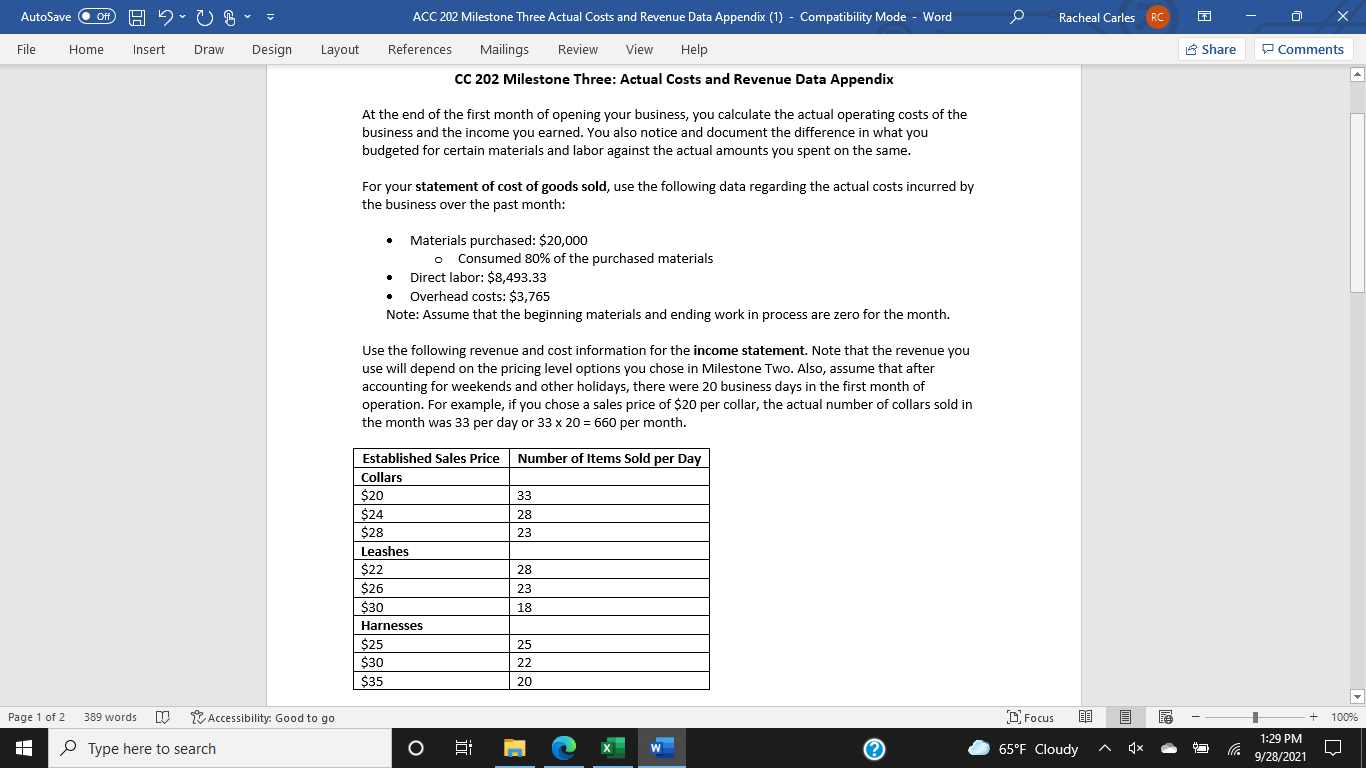

AutoSave O Off) ACC 202 Milestone Three Actual Costs and Revenue Data Appendix (1) - Compatibility Mode - Word O Racheal Carles RC X File Home Insert Draw Design Layout References Mailings Review View Help Share Comments The other costs incurred by the business include: General and administrative salaries Receptionist: $1,950 o Owner salary: $500 Depreciation: $165 Rent: $750 . . Utilities and insurance: $600 Scissors, thread, and cording: $1,200 . Loan repayment: $550 snhu Variance At the end of the month, you find that the labor and materials spent on manufacturing collars was different from what you estimated: . The collar maker had to work nine hours a day instead of eight due to an increased demand for collars. . Because of the increased demand, the hourly rate you paid your employee for making the collars increased to $16.50. An increase in the cost of raw material led the direct material cost per collar to increase to $10. . . However, you also made and sold 60 more collars than you expected to sell in the month. You now need to determine the variance in the materials and labor cost from what you estimated in Milestone Two based on the market research data. Page 2 of 2 389 words DO Accessibility: Good to go [ Focus + 90% 1:30 PM Type here to search O Ei X W ? 65 F Cloudy 9/28/2021AutoSave On ACC 202 Project Workboo... - Last Modified: Thu at 7:33 PM - Search Racheal Carles RC X Share Comments File Home Insert Draw Page Layout Formulas Data Review View Help A10 X V Total Revenue: A B C D E F G H J K L M N O P Milestone Three - Income Statement OUT AWINE Revenue: Collars S Leashes Harnesses 10 Total Revenue: $ 11 Cost of goods sold 12 Gross profit $ 13 14 Expenses: 15 General and administrative salaries 5 16 Depreciation 17 Rent 18 Utilities and insurance 19 Scissors, thread, and cording 20 Loan 21 22 Total Expenses 23 24 Net Income/Loss S 25 26 27 29 30 31 Cost Classification Variable and Fixed Costs Contribution Margin Analysis Break-Even Analysis COGS Income Statement Variances + + 100% Ready 1:32 PM Type here to search O W ? 66"F Cloudy A 9/28/2021AutoSave On ACC 202 Project Workboo... - Last Modified: Thu at 7:33 PM - Search Racheal Carles RC X File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments A2 X V Milestone Three - Variance Analysis B C D E F G H J K L M N 0 P W N H Milestone Three - Variance Analysis 5 Data for Variance Analysis: Budgeted Budgeted Actual Actual Standard) [Standard) Hours/Qty Rate Hours/Qty Rate 8 Labor 9 10 11 Materials 12 13 14 15 Variances for Collar Sales Favorable/ 16 Variance Unfavorable 17 Direct Labor Time Variance 18 (Actual Hours - Standard Hours) x Standard Rate S 19 20 Direct Labor Rate Variance 21 (Actual Rate - Standard Rate) x Actual Hours S 22 23 Direct Materials Quantity/Efficiency Variance 24 (Actual Quantity - Standard Quantity) x Standard Price S 25 26 Direct Materials Price Variance 27 (Actual Price - Standard Price) x Actual Quantity 28 29 Cost Classification Variable and Fixed Costs Contribution Margin Analysis Break-Even Analysis COGS Income Statement Variances + Ready + 100% 1:33 PM Type here to search O W ? 66"F Cloudy 9/28/2021File Page 1 of2 Home 389 words Insert DJ Draw Design TIE/Accessibility: Good to go a ,0 Type here to search Layout References Mailings Review View Help CC 102 Milestone Three: Actual Cost: and Revenue Data Appendix At the end of the rst month at opening your business, you calculate the actual operating costs at the business and the income you earned. You also notice and document the differenoe in what you budgeted for certain materials and labor against the actual amounts you spent on the same. For your statement o'foost of goods sold, use the following data regarding the actual oosts incurred by the business over the past month: 0 Materials purchased: 520,000 o Consumed 80% of the purchased materials - Direct labor: $3,433.33 0 Overhead costs: $3,765 Note: Assume that the beginning materials and ending work in process are zero for the month. Use the following revenue and Dost information for the income statement. Note that the revenue you use will depend on the pricing level options you chose in Milestone Two. Also, assume that after accounting for weekends and oth er holidays, there were 2|] business days in the rst month of operation. For example. if you chose a sales price of $20 per collar, the actual number of collars sold in the month was 33 per day or 35 x 20 = 560 per month. Established Sales Price Number of Items Sold per Day Collars $20 33 $24 28 $28 23 Leashes s22 28 S26 23 $30 123 Harnesses s25 25 $30 22 $35 20 CD1 Focus Ii l Sha re ++ 5' Comments 100%