hi im looking for some help/soultions to these questions

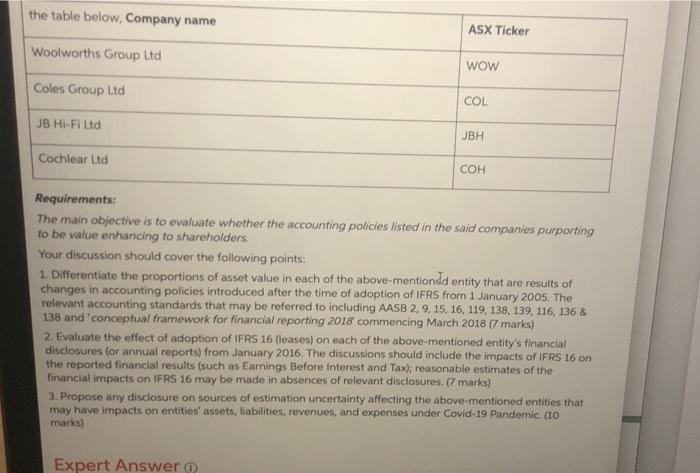

the table below, Company name ASX Ticker Woolworths Group Ltd WOW Coles Group Ltd COL JB Hi-Fi Ltd JBH Cochlear Ltd COH Requirements: The main objective is to evaluate whether the accounting policies listed in the said companies purporting to be value enhancing to shareholders. Your discussion should cover the following points: 1. Differentiate the proportions of asset value in each of the above-mentiondd entity that are results of changes in accounting policies introduced after the time of adoption of IFRS from 1 January 2005. The relevant accounting standards that may be referred to including AASB 2, 9, 15, 16, 119, 138, 139, 116, 136 & 138 and conceptual framework for financial reporting 2018 commencing March 2018 (7 marks) 2. Evaluate the effect of adoption of IFRS 16 (leases) on each of the above-mentioned entity's financial disclosures (or annual reports) from January 2016. The discussions should include the impacts of IFRS 16 on the reported financial results (such as Earnings Before interest and Tax): reasonable estimates of the financial impacts on IFRS 16 may be made in absences of relevant disclosures. (1 marks) 3. Propose any disclosure on sources of estimation uncertainty affecting the above mentioned entities that may have impacts on entities' assets, liabilities, revenues, and expenses under Covid-19 Pandemic (10 marks) Expert Answer the table below, Company name ASX Ticker Woolworths Group Ltd WOW Coles Group Ltd COL JB Hi-Fi Ltd JBH Cochlear Ltd COH Requirements: The main objective is to evaluate whether the accounting policies listed in the said companies purporting to be value enhancing to shareholders. Your discussion should cover the following points: 1. Differentiate the proportions of asset value in each of the above-mentiondd entity that are results of changes in accounting policies introduced after the time of adoption of IFRS from 1 January 2005. The relevant accounting standards that may be referred to including AASB 2, 9, 15, 16, 119, 138, 139, 116, 136 & 138 and conceptual framework for financial reporting 2018 commencing March 2018 (7 marks) 2. Evaluate the effect of adoption of IFRS 16 (leases) on each of the above-mentioned entity's financial disclosures (or annual reports) from January 2016. The discussions should include the impacts of IFRS 16 on the reported financial results (such as Earnings Before interest and Tax): reasonable estimates of the financial impacts on IFRS 16 may be made in absences of relevant disclosures. (1 marks) 3. Propose any disclosure on sources of estimation uncertainty affecting the above mentioned entities that may have impacts on entities' assets, liabilities, revenues, and expenses under Covid-19 Pandemic (10 marks) Expert