Answered step by step

Verified Expert Solution

Question

1 Approved Answer

High-Low Analysis Land O'Lakes is looking to estimate total labor costs for next year as the need for additional labor arises. Total labor costs are

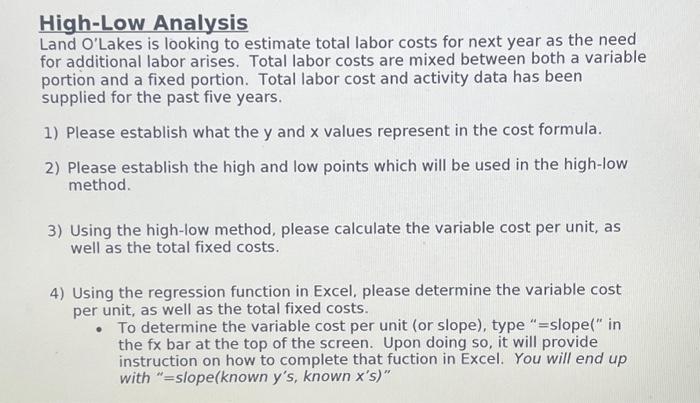

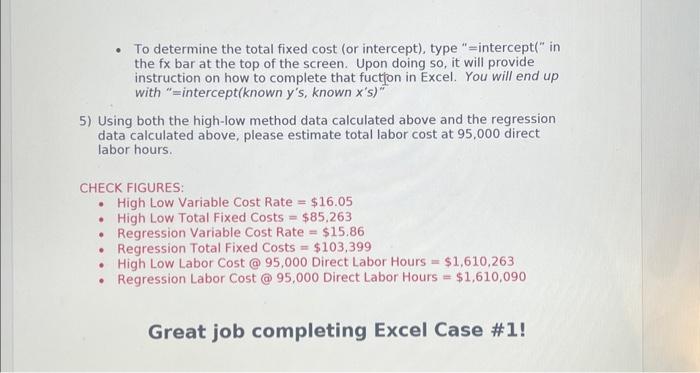

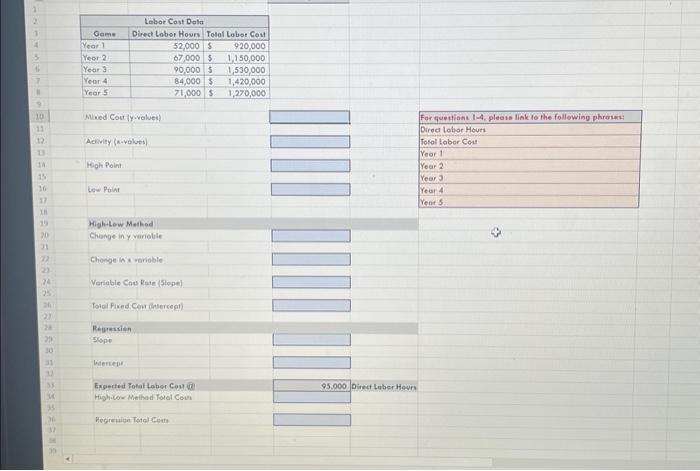

High-Low Analysis Land O'Lakes is looking to estimate total labor costs for next year as the need for additional labor arises. Total labor costs are mixed between both a variable portion and a fixed portion. Total labor cost and activity data has been supplied for the past five years. 1) Please establish what the y and x values represent in the cost formula. 2) Please establish the high and low points which will be used in the high-low method. 3) Using the high-low method, please calculate the variable cost per unit, as well as the total fixed costs. 4) Using the regression function in Excel, please determine the variable cost per unit, as well as the total fixed costs. To determine the variable cost per unit (or slope), type "=slope(" in the fx bar at the top of the screen. Upon doing so, it will provide instruction on how to complete that fuction in Excel. You will end up with "=slope(known y's, known x's)"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started