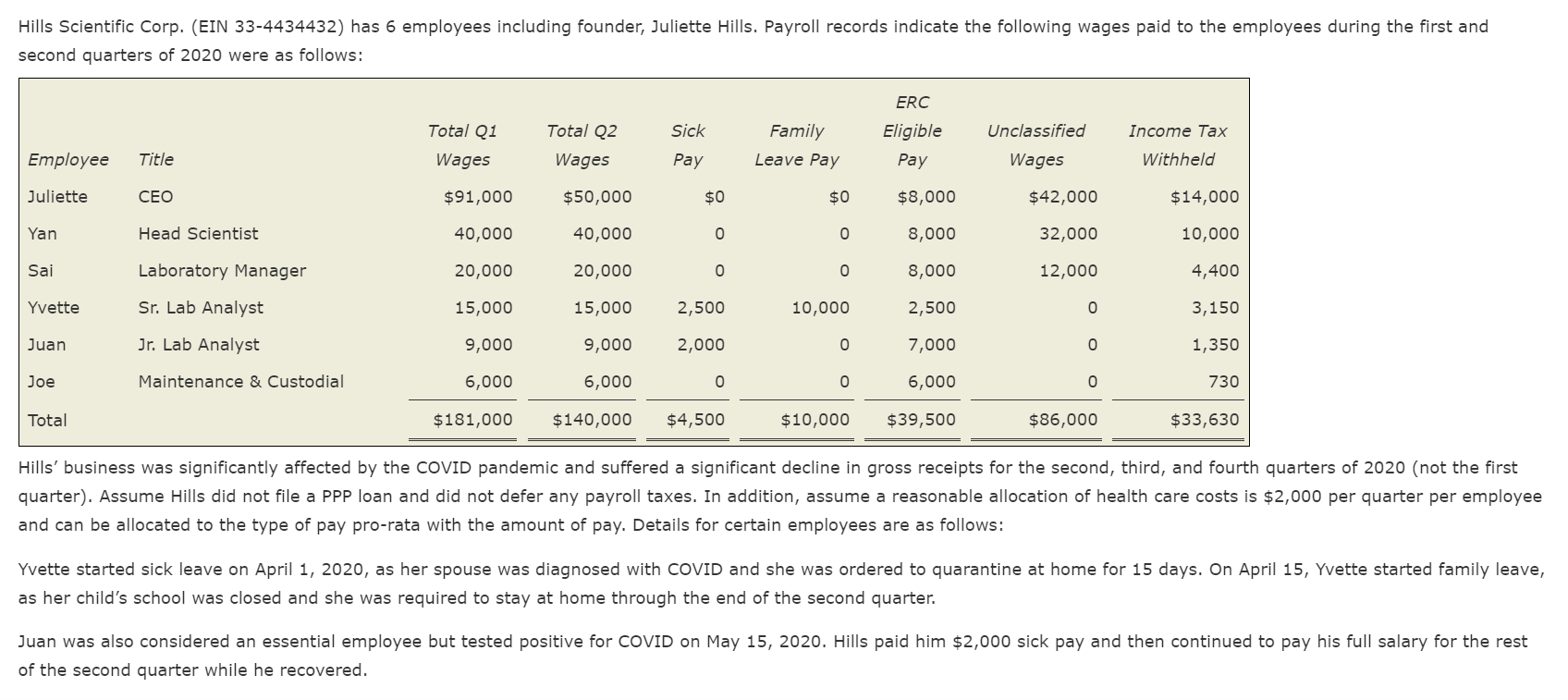

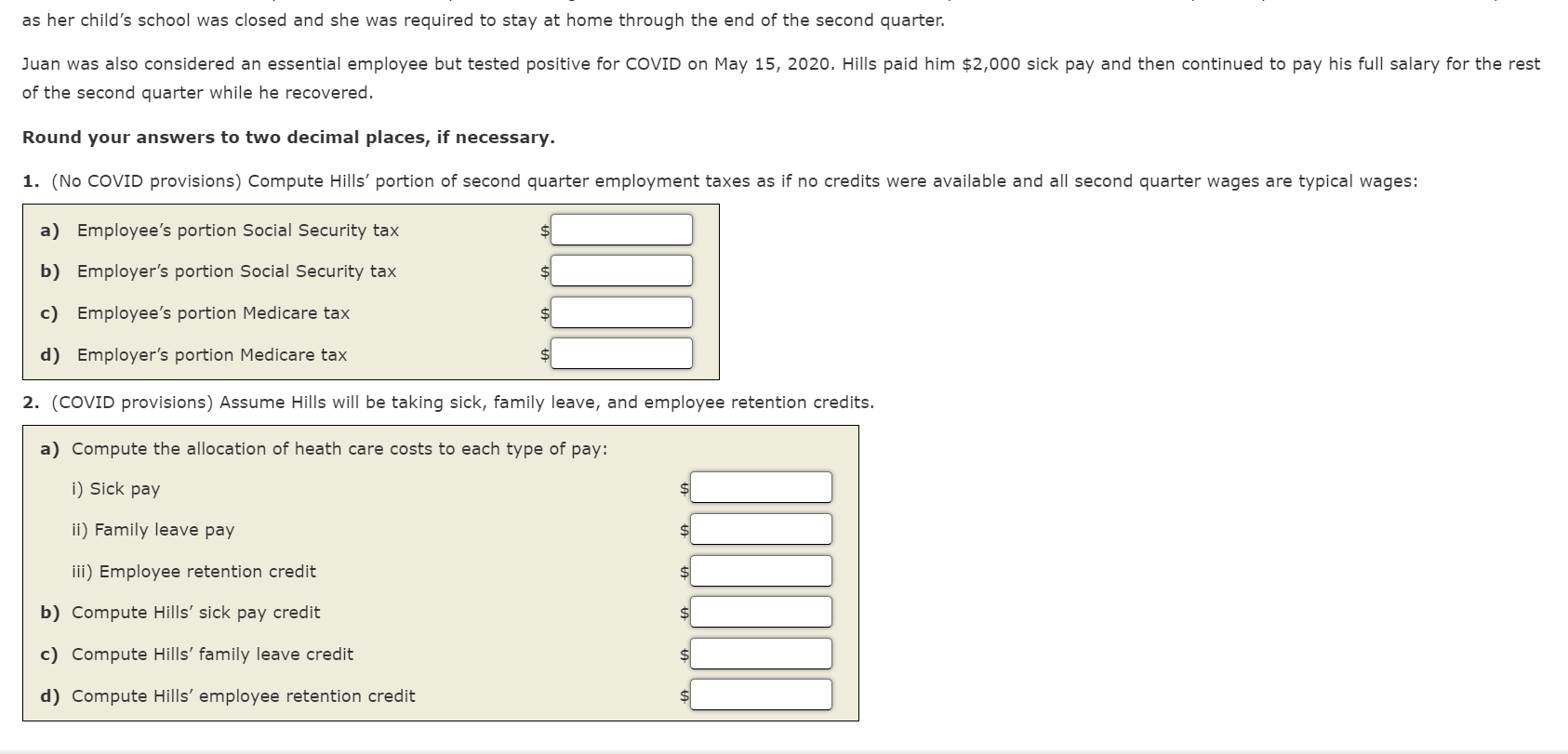

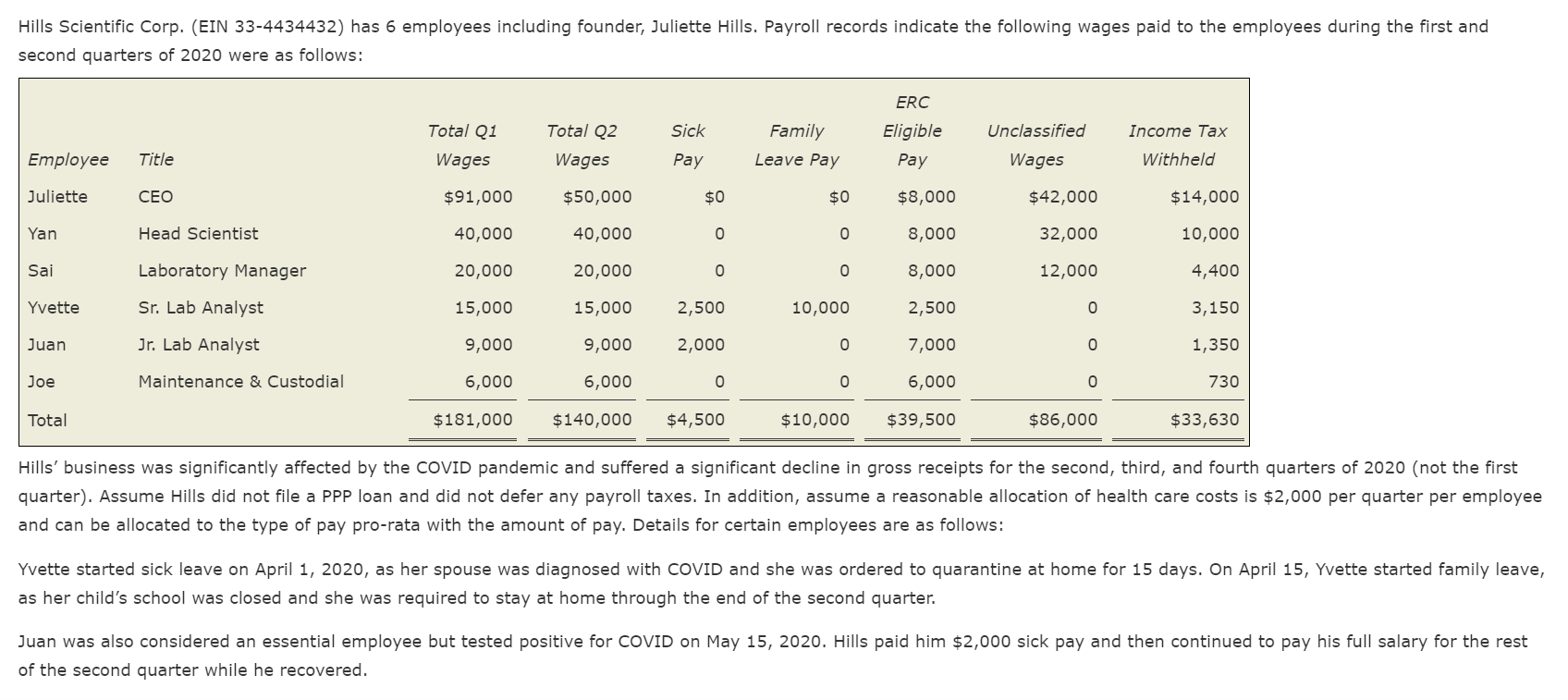

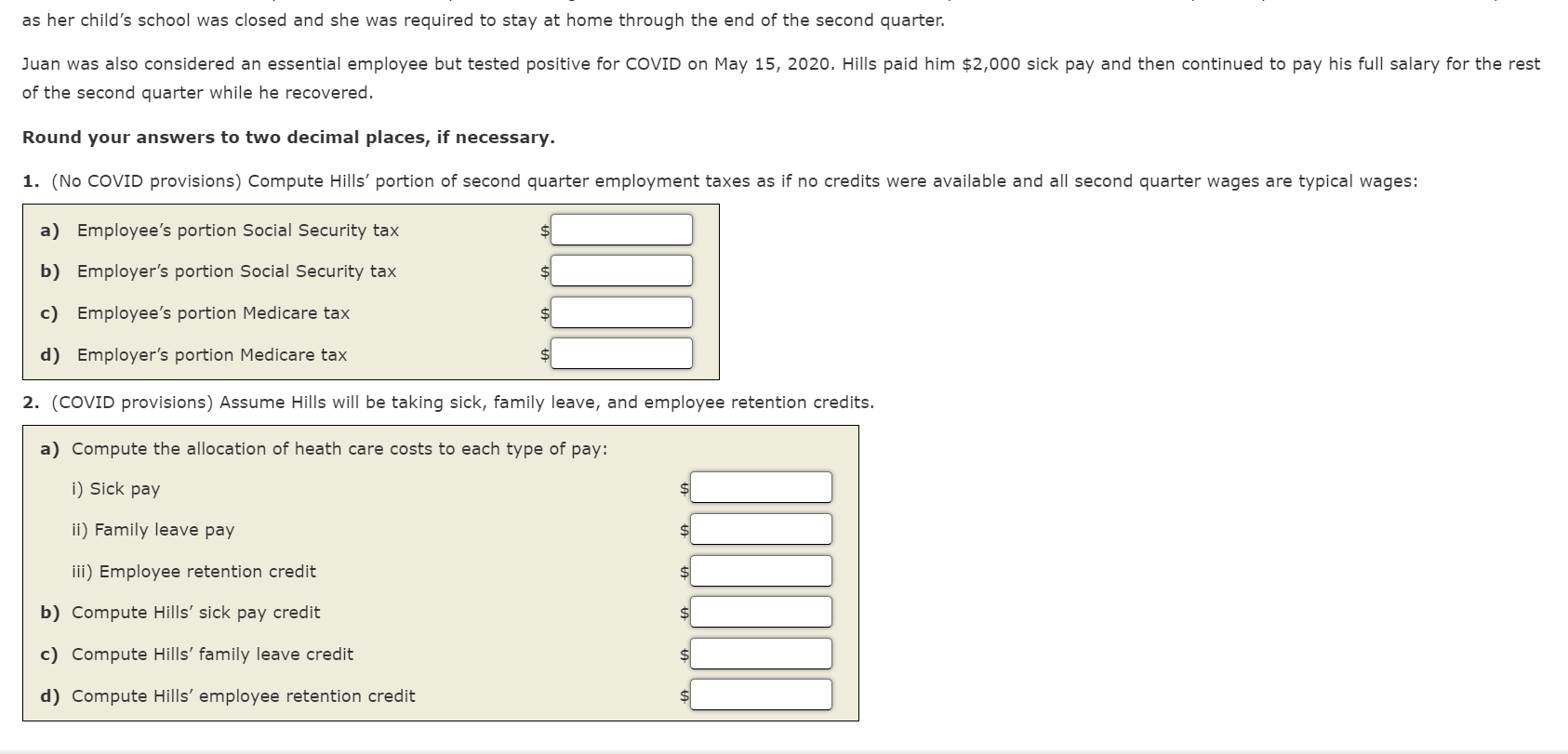

Hills Scientific Corp. (EIN 33-4434432) has 6 employees including founder, Juliette Hills. Payroll records indicate the following wages paid to the employees during the first and second quarters of 2020 were as follows: ERC Sick Unclassified Total Q1 Wages Total Q2 Wages Family Leave Pay Eligible Pay Income Tax Withheld Employee Title Pay Wages Juliette CEO $91,000 $50,000 $0 $0 $8,000 $42,000 $14,000 Yan Head Scientist 40,000 40,000 0 0 8,000 32,000 10,000 Sai Laboratory Manager 20,000 20,000 0 o 0 8,000 12,000 4,400 Yvette Sr. Lab Analyst 15,000 15,000 2,500 10,000 2,500 0 3,150 Juan Jr. Lab Analyst 9,000 9,000 2,000 o 7,000 0 1,350 Joe Maintenance & Custodial 6,000 6,000 0 o 6,000 0 730 Total $ 181,000 $140,000 $4,500 $10,000 $39,500 $86,000 $33,630 Hills' business was significantly affected by the COVID pandemic and suffered a significant decline in gross receipts for the second, third, and fourth quarters of 2020 (not the first quarter). Assume Hills did not file a PPP loan and did not defer any payroll taxes. In addition, assume a reasonable allocation of health care costs is $2,000 per quarter per employee and can be allocated to the type of pay pro-rata with the amount of pay. Details for certain employees are as follows: Yvette started sick leave on April 1, 2020, as her spouse was diagnosed with COVID and she was ordered to quarantine at home for 15 days. On April 15, Yvette started family leave, as her child's school was closed and she was required to stay at home through the end of the second quarter. Juan was also considered an essential employee but tested positive for COVID on May 15, 2020. Hills paid him $2,000 sick pay and then continued to pay his full salary for the rest of the second quarter while he recovered. as her child's school was closed and she was required to stay at home through the end of the second quarter. Juan was also considered an essential employee but tested positive for COVID on May 15, 2020. Hills paid him $2,000 sick pay and then continued to pay his full salary for the rest of the second quarter while he recovered. Round your answers to two decimal places, if necessary. 1. (No COVID provisions) Compute Hills' portion of second quarter employment taxes as if no credits were available and all second quarter wages are typical wages: a) Employee's portion Social Security tax $ b) Employer's portion Social Security tax S c) Employee's portion Medicare tax d) Employer's portion Medicare tax 2. (COVID provisions) Assume Hills will be taking sick, family leave, and employee retention credits. Compute the allocation of heath care costs to each type of pay: i) Sick pay $ ii) Family leave pay iii) Employee retention credit $ b) Compute Hills' sick pay credit c) Compute Hills' family leave credit $ d) Compute Hills' employee retention credit Hills Scientific Corp. (EIN 33-4434432) has 6 employees including founder, Juliette Hills. Payroll records indicate the following wages paid to the employees during the first and second quarters of 2020 were as follows: ERC Sick Unclassified Total Q1 Wages Total Q2 Wages Family Leave Pay Eligible Pay Income Tax Withheld Employee Title Pay Wages Juliette CEO $91,000 $50,000 $0 $0 $8,000 $42,000 $14,000 Yan Head Scientist 40,000 40,000 0 0 8,000 32,000 10,000 Sai Laboratory Manager 20,000 20,000 0 o 0 8,000 12,000 4,400 Yvette Sr. Lab Analyst 15,000 15,000 2,500 10,000 2,500 0 3,150 Juan Jr. Lab Analyst 9,000 9,000 2,000 o 7,000 0 1,350 Joe Maintenance & Custodial 6,000 6,000 0 o 6,000 0 730 Total $ 181,000 $140,000 $4,500 $10,000 $39,500 $86,000 $33,630 Hills' business was significantly affected by the COVID pandemic and suffered a significant decline in gross receipts for the second, third, and fourth quarters of 2020 (not the first quarter). Assume Hills did not file a PPP loan and did not defer any payroll taxes. In addition, assume a reasonable allocation of health care costs is $2,000 per quarter per employee and can be allocated to the type of pay pro-rata with the amount of pay. Details for certain employees are as follows: Yvette started sick leave on April 1, 2020, as her spouse was diagnosed with COVID and she was ordered to quarantine at home for 15 days. On April 15, Yvette started family leave, as her child's school was closed and she was required to stay at home through the end of the second quarter. Juan was also considered an essential employee but tested positive for COVID on May 15, 2020. Hills paid him $2,000 sick pay and then continued to pay his full salary for the rest of the second quarter while he recovered. as her child's school was closed and she was required to stay at home through the end of the second quarter. Juan was also considered an essential employee but tested positive for COVID on May 15, 2020. Hills paid him $2,000 sick pay and then continued to pay his full salary for the rest of the second quarter while he recovered. Round your answers to two decimal places, if necessary. 1. (No COVID provisions) Compute Hills' portion of second quarter employment taxes as if no credits were available and all second quarter wages are typical wages: a) Employee's portion Social Security tax $ b) Employer's portion Social Security tax S c) Employee's portion Medicare tax d) Employer's portion Medicare tax 2. (COVID provisions) Assume Hills will be taking sick, family leave, and employee retention credits. Compute the allocation of heath care costs to each type of pay: i) Sick pay $ ii) Family leave pay iii) Employee retention credit $ b) Compute Hills' sick pay credit c) Compute Hills' family leave credit $ d) Compute Hills' employee retention credit