Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HipHop Inc. makes and sells trampolines. The company is considering replacing one of its manufacturing machines with a new one. Both the new and

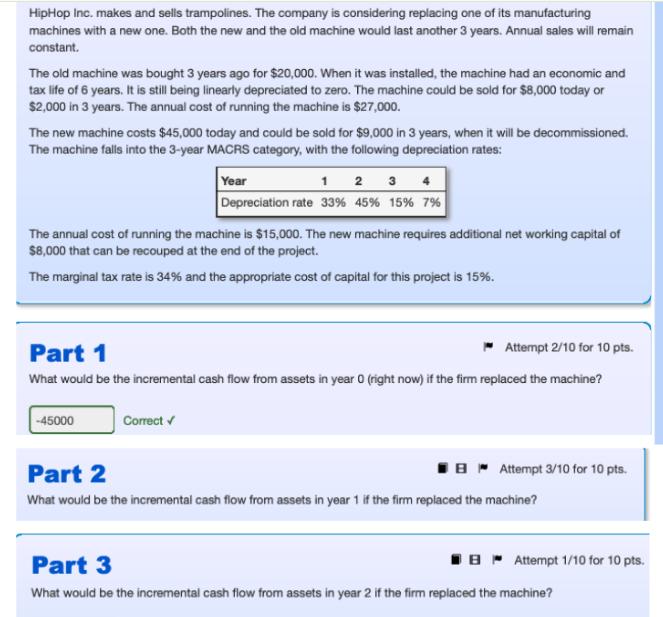

HipHop Inc. makes and sells trampolines. The company is considering replacing one of its manufacturing machines with a new one. Both the new and the old machine would last another 3 years. Annual sales will remain constant. The old machine was bought 3 years ago for $20,000. When it was installed, the machine had an economic and tax life of 6 years. It is still being linearly depreciated to zero. The machine could be sold for $8,000 today or $2,000 in 3 years. The annual cost of running the machine is $27,000. The new machine costs $45,000 today and could be sold for $9,000 in 3 years, when it will be decommissioned. The machine falls into the 3-year MACRS category, with the following depreciation rates: Year 1 2 3 Depreciation rate 33% 45% 15% 7% The annual cost of running the machine is $15,000. The new machine requires additional net working capital of $8,000 that can be recouped at the end of the project. The marginal tax rate is 34% and the appropriate cost of capital for this project is 15%. Part 1 Attempt 2/10 for 10 pts. What would be the incremental cash flow from assets in year 0 (right now) if the firm replaced the machine? -45000 Correct Part 2 BAttempt 3/10 for 10 pts. What would be the incremental cash flow from assets in year 1 if the firm replaced the machine? Part 3 BAttempt 1/10 for 10 pts. What would be the incremental cash flow from assets in year 2 if the firm replaced the machine? Part 4 Attempt 1/10 for 10 pts. What would be the incremental cash flow from assets in year 3 if the firm replaced the machine? Part 5 What is the NPV of the replacement project? Attempt 1/10 for 10 pts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started