Question

home / study / business / accounting / accounting questions and answers / during heaton companys first two years of operations, the company reported absorption

home / study / business / accounting / accounting questions and answers / during heaton companys first two years of operations, the company reported absorption costing ...

Your question has been answered

Let us know if you got a helpful answer. Rate this answer

Question: During Heaton Companys first two years of operations, the company reported absorption costing ...

| During Heaton Companys first two years of operations, the company reported absorption costing net operating income as follows: |

| Year 1 | Year 2 | |||

| Sales (@ $61 per unit) | $ | 1,037,000 | $ | 1,647,000 |

| Cost of goods sold (@ $40 per unit) | 680,000 | 1,080,000 | ||

| Gross margin | 357,000 | 567,000 | ||

| Selling and administrative expenses* | 309,400 | 339,400 | ||

| Net operating income | $ | 47,600 | $ | 227,600 |

| * $3 per unit variable; $258,400 fixed each year. |

| The companys $40 unit product cost is computed as follows: |

| Direct materials | $ | 9 |

| Direct labor | 8 | |

| Variable manufacturing overhead | 3 | |

| Fixed manufacturing overhead ($440,000 22,000 units) | 20 | |

| Absorption costing unit product cost | $ | 40 |

| Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings. |

| Production and cost data for the two years are: |

| Year 1 | Year 2 | |

| Units produced | 22,000 | 22,000 |

| Units sold | 17,000 | 27,000 |

| Required: |

| 1. | Prepare a variable costing contribution format income statement for each year.

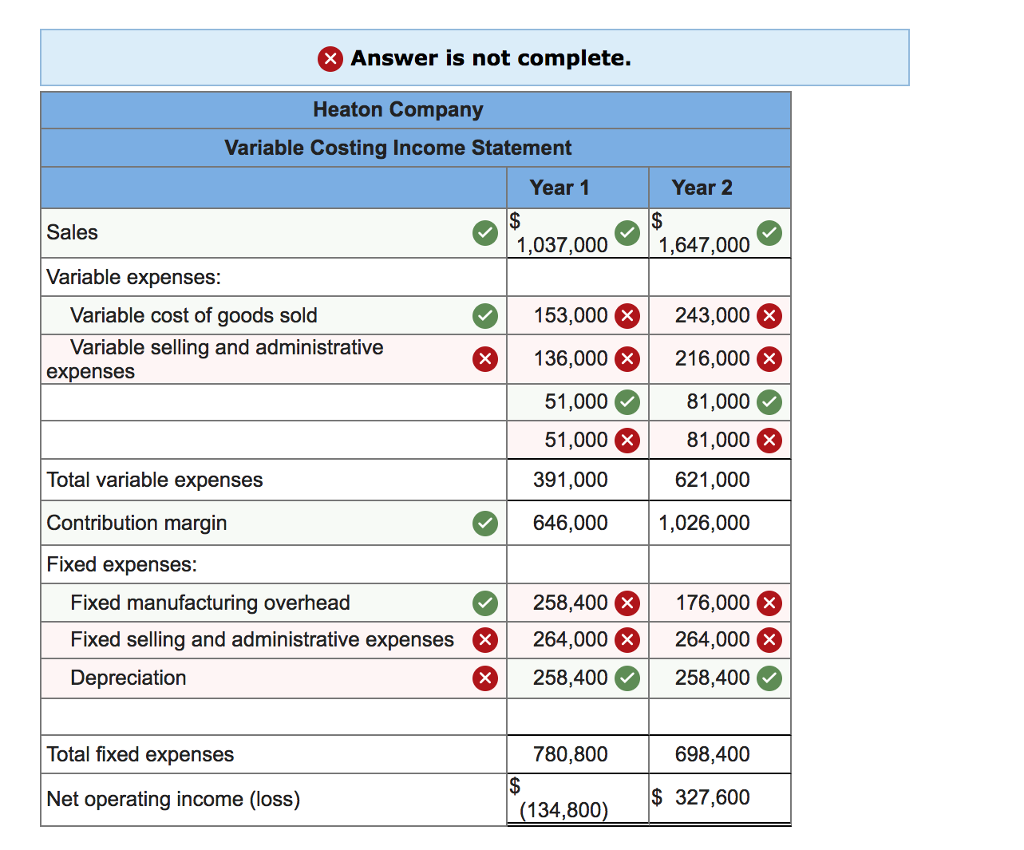

Can you please help me out with the 1A answer// this is what I currently have:

Available options for the Income Statement include: Advertising Beginning merchandise inventory Commissions Depreciation Ending merchandise inventory Fixed manufacturing overhead Fixed selling and administrative expenses Indirect labor Indirect materials Purchases Sales Variable cost of goods sold Variable selling and administrative expenses |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started