Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HOMEWORK 1: Prepare a return for the D'Andrios. Dominic D. (SSN 074-66-2343, born 11/4/1980) and Lucille L. D'Andrio (SSN 021 90-8723, born 10/11/1984) are married

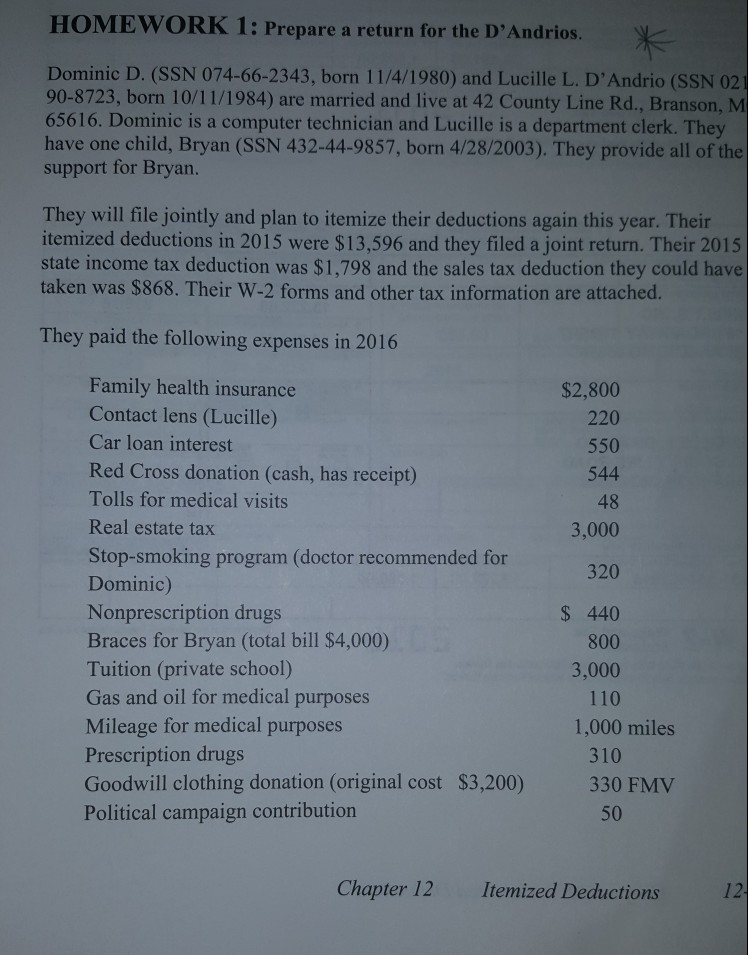

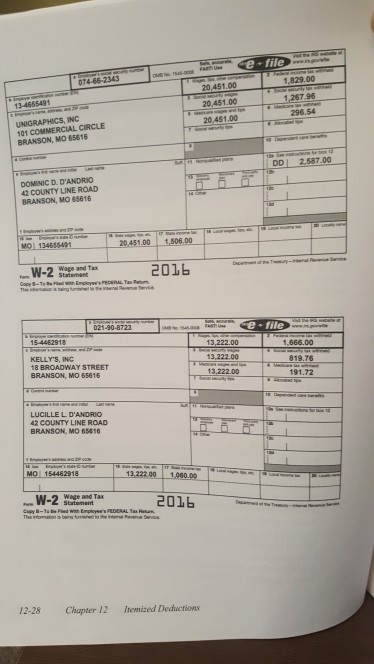

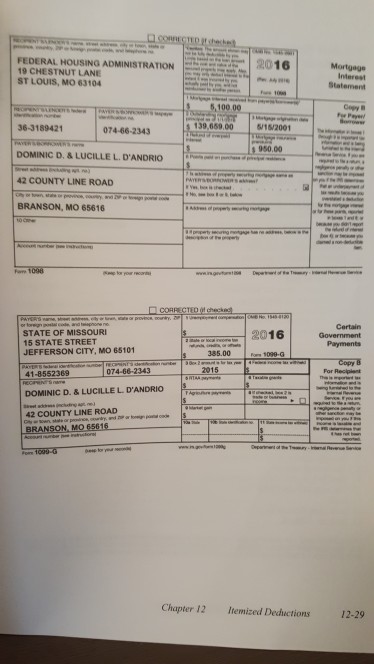

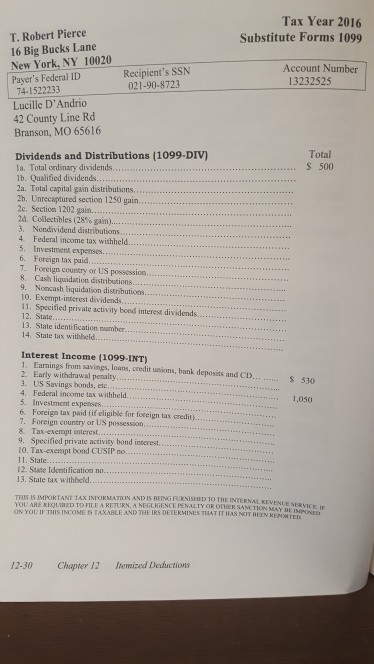

HOMEWORK 1: Prepare a return for the D'Andrios. Dominic D. (SSN 074-66-2343, born 11/4/1980) and Lucille L. D'Andrio (SSN 021 90-8723, born 10/11/1984) are married and live at 42 County Line Rd., Branson, M 65616. Dominic is a computer technician and Lucille is a department clerk. They have one child, Bryan (SSN 432-44-9857, born 4/28/2003). They provide all of the support for Bryan. They will file jointly and plan to itemize their deductions again this year. Their itemized deductions in 2015 were $13,596 and they filed a joint return. Their 2015 state income tax deduction was $1,798 and the sales tax deduction they could have taken was $868. Their W-2 forms and other tax information are attached. They paid the following expenses in 2016 Family health insurance Contact lens (Lucille) Car loan interest Red Cross donation (cash, has receipt) Tolls for medical visits Real estate tax Stop-smoking program (doctor recommended for Dominic) Nonprescription drugs Braces for Bryan (total bill $4,000) Tuition (private school) Gas and oil for medical purposes Mileage for medical purposes Prescription drugs Goodwill clothing donation (original cost $3,200) Political campaign contribution $2,800 220 550 544 48 3,000 320 440 800 3,000 110 1,000 miles 310 330 FMV 50 Chapter 12 Itemized Deductions 12 HOMEWORK 1: Prepare a return for the D'Andrios. Dominic D. (SSN 074-66-2343, born 11/4/1980) and Lucille L. D'Andrio (SSN 021 90-8723, born 10/11/1984) are married and live at 42 County Line Rd., Branson, M 65616. Dominic is a computer technician and Lucille is a department clerk. They have one child, Bryan (SSN 432-44-9857, born 4/28/2003). They provide all of the support for Bryan. They will file jointly and plan to itemize their deductions again this year. Their itemized deductions in 2015 were $13,596 and they filed a joint return. Their 2015 state income tax deduction was $1,798 and the sales tax deduction they could have taken was $868. Their W-2 forms and other tax information are attached. They paid the following expenses in 2016 Family health insurance Contact lens (Lucille) Car loan interest Red Cross donation (cash, has receipt) Tolls for medical visits Real estate tax Stop-smoking program (doctor recommended for Dominic) Nonprescription drugs Braces for Bryan (total bill $4,000) Tuition (private school) Gas and oil for medical purposes Mileage for medical purposes Prescription drugs Goodwill clothing donation (original cost $3,200) Political campaign contribution $2,800 220 550 544 48 3,000 320 440 800 3,000 110 1,000 miles 310 330 FMV 50 Chapter 12 Itemized Deductions 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started