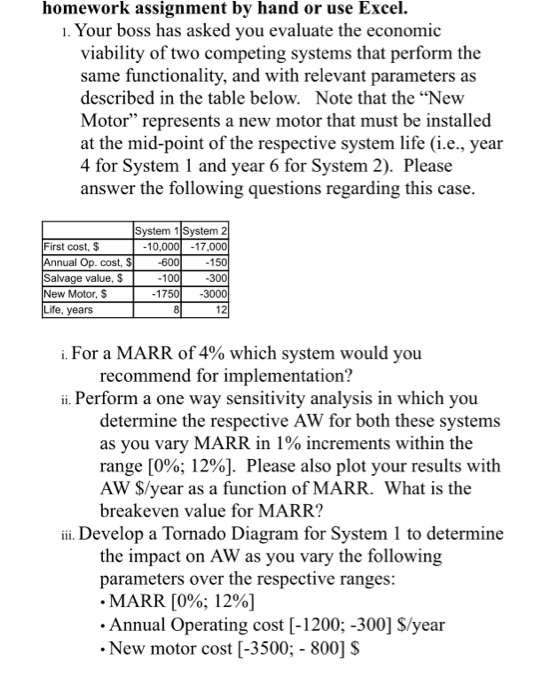

homework assignment by hand or use Excel. 1. Your boss has asked you evaluate the economic viability of two competing systems that perform the same functionality, and with relevant parameters as described in the table below. Note that the New Motor represents a new motor that must be installed at the mid-point of the respective system life (i.e., year 4 for System 1 and year 6 for System 2). Please answer the following questions regarding this case. System 1 System 2 First cost, $ -10,000 -17,000 Annual Op. cost, $ 600 - 150 Salvage value, $ -100 -300 New Motor, $ - 1750 -3000 Life, years 8 12 i. For a MARR of 4% which system would you recommend for implementation? ii. Perform a one way sensitivity analysis in which you determine the respective AW for both these systems as you vary MARR in 1% increments within the range [0%; 12%]. Please also plot your results with AW $/year as a function of MARR. What is the breakeven value for MARR? iii. Develop a Tornado Diagram for System 1 to determine the impact on AW as you vary the following parameters over the respective ranges: MARR [0%; 12%] Annual Operating cost [-1200; -300] S/year New motor cost (-3500; - 800] $ homework assignment by hand or use Excel. 1. Your boss has asked you evaluate the economic viability of two competing systems that perform the same functionality, and with relevant parameters as described in the table below. Note that the New Motor represents a new motor that must be installed at the mid-point of the respective system life (i.e., year 4 for System 1 and year 6 for System 2). Please answer the following questions regarding this case. System 1 System 2 First cost, $ -10,000 -17,000 Annual Op. cost, $ 600 - 150 Salvage value, $ -100 -300 New Motor, $ - 1750 -3000 Life, years 8 12 i. For a MARR of 4% which system would you recommend for implementation? ii. Perform a one way sensitivity analysis in which you determine the respective AW for both these systems as you vary MARR in 1% increments within the range [0%; 12%]. Please also plot your results with AW $/year as a function of MARR. What is the breakeven value for MARR? iii. Develop a Tornado Diagram for System 1 to determine the impact on AW as you vary the following parameters over the respective ranges: MARR [0%; 12%] Annual Operating cost [-1200; -300] S/year New motor cost (-3500; - 800] $