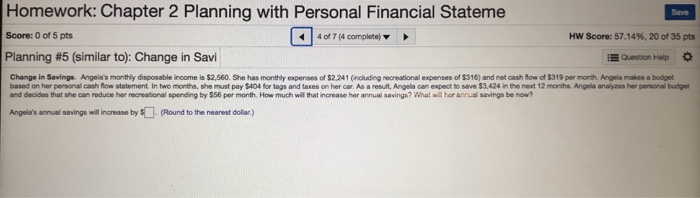

Question: Homework: Chapter 2 Planning with Personal Financial Stateme Save Score: 0 of 5 pts 4of714 completo) HW Score: 57.14%, 20 of 35 pts Planning #5

Homework: Chapter 2 Planning with Personal Financial Stateme Save Score: 0 of 5 pts 4of714 completo) HW Score: 57.14%, 20 of 35 pts Planning #5 (similar to): Change in Savi eston Help * Change in Savings. Angela's monthily disposable income is $2,560. She has monthly expenses of $2,241 (ncluding recreational expenses of $316) and net cash fow of $319 per month. Angela makes a budget based on her personal cash flow statement In two months, she must pay $404 for tags and taxes on her car. As a result, Angela can expect to save $3,424 in the next 12 months. Angela analyzes her personal budget and decides that she can reduce her recreational spending by $56 per month. How much will that increase her annual savings? Wha! will hor annual savings be now? Angela's arrual savings wil nrease by (Round to the nearest dolar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts