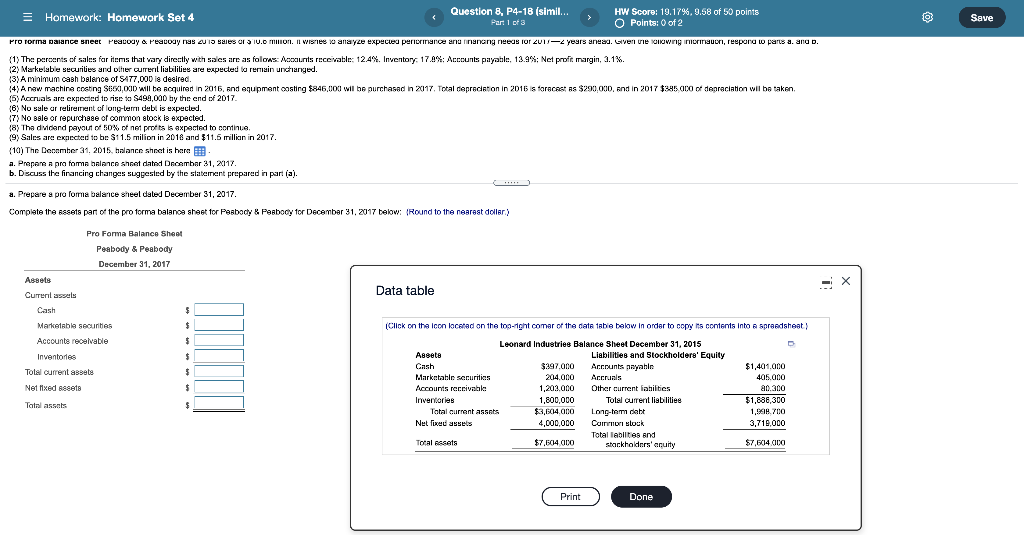

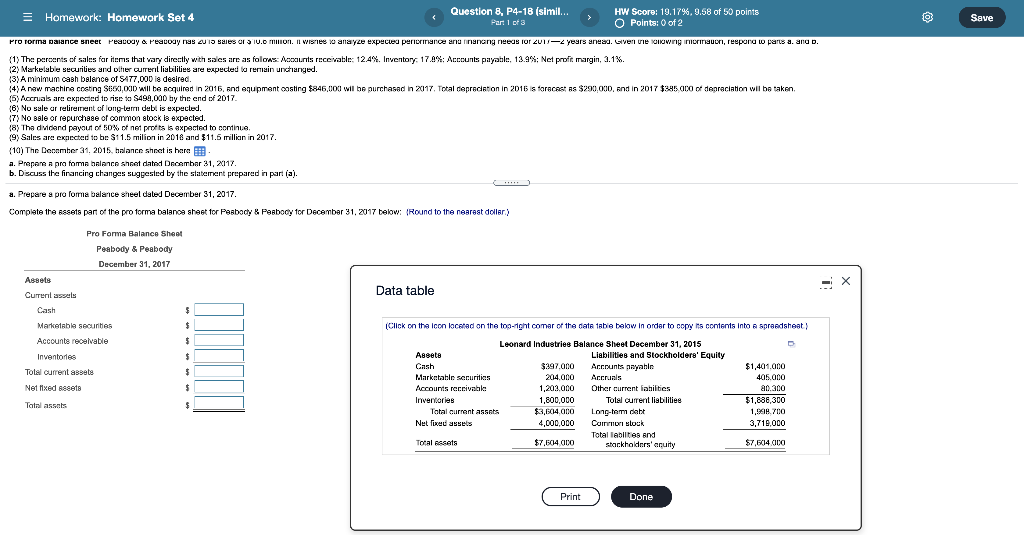

Homework: Homework Set 4 Question 8, P4-18 (simil... Part 1 of 3 HW Score: 19.17%, 9.58 of 50 points O Points: 0 of 2 O Save Pro rorma balance sneet Peavouy a Peavoay nas u 10 sales or s U.O MITO. I wishes to anayze expected perriance and renang needs for 20112 years anual. Given viewing inbringubri, respura w parts a. and D. (1) The percent of sales far items that vary directly with sales are as follows: Accounts receivable: 12.4%. Inventory: 17.04: Accounts payable, 13.9%: Net profit margin, 3.1%. (2) Markelable securities and other curreril liabilities are expected to remain unchanged. (3) A minimum cash balance of $177,000 is desired. 4) A new machine coating Sex,OCID will be acquired in 2016, and equipment costing $846.000 will be purchased in 2017. Total depreciation in 2016 is forecast as $290,000, and in 2017 $345.CCO of depreciation wil be taken 6) Accruals are expected to rise to $490,000 by the end of 2017 (6) No sale or relirement of long-term deb is expected. (7) No sale or repurchase of common stock is expected. 18) The dividend payout of 50% of net ports is expected to continue 19, Sales are crnected to be $11.5 milion in 2018 and $11.5 million in 2017. (101) The Denember 31, 2015, balance sheet is here B a. Prepam a pra forma balance shet dated December 31, 20117 b. Discuss the financing changes suggested by the statement prepared in part (a). a. Prepare a pro forma balance sheel dated December 31, 2017. Complete the assets part of the proforma balance sheet for Peabody & Peabody for December 31, 2017 below: Round to the nearest dollar) Pro Forma Balance Sheet Peabody & Peabody December 31, 2017 Data table $ Assets Currenlassels Cash Marketable securities Accounts receivable Inventories Tolel current assets Net nxed Assets $ $ 5 $ $ (Click on the Icon located on the top-right comer of the date table below In order to copy its contents into a spreadsheet Leonard Industries Balance Sheet December 31, 2015 D Assete Liabilities and Stockholders' Equity Cash $297.000 Accounts nayahin $1,401.000 Marketable securities 204.000 Accruals 405.000 Accounts receivabla 1,203.000 Other current abilities 20.300 Inventories 1,800,000 Tolal current liabilities $1,888,300 Tatal current assets $3,504.000 Long-hom dat 1,998.700 Net Tixuu assets 4,000,000 LITTILL Book 3,719,000 Total labilities and Total des $7,504 CICO stockholders' acuity $7,50J4CIDO Total assets Print Done Homework: Homework Set 4 Question 8, P4-18 (simil... Part 1 of 3 HW Score: 19.17%, 9.58 of 50 points O Points: 0 of 2 O Save Pro rorma balance sneet Peavouy a Peavoay nas u 10 sales or s U.O MITO. I wishes to anayze expected perriance and renang needs for 20112 years anual. Given viewing inbringubri, respura w parts a. and D. (1) The percent of sales far items that vary directly with sales are as follows: Accounts receivable: 12.4%. Inventory: 17.04: Accounts payable, 13.9%: Net profit margin, 3.1%. (2) Markelable securities and other curreril liabilities are expected to remain unchanged. (3) A minimum cash balance of $177,000 is desired. 4) A new machine coating Sex,OCID will be acquired in 2016, and equipment costing $846.000 will be purchased in 2017. Total depreciation in 2016 is forecast as $290,000, and in 2017 $345.CCO of depreciation wil be taken 6) Accruals are expected to rise to $490,000 by the end of 2017 (6) No sale or relirement of long-term deb is expected. (7) No sale or repurchase of common stock is expected. 18) The dividend payout of 50% of net ports is expected to continue 19, Sales are crnected to be $11.5 milion in 2018 and $11.5 million in 2017. (101) The Denember 31, 2015, balance sheet is here B a. Prepam a pra forma balance shet dated December 31, 20117 b. Discuss the financing changes suggested by the statement prepared in part (a). a. Prepare a pro forma balance sheel dated December 31, 2017. Complete the assets part of the proforma balance sheet for Peabody & Peabody for December 31, 2017 below: Round to the nearest dollar) Pro Forma Balance Sheet Peabody & Peabody December 31, 2017 Data table $ Assets Currenlassels Cash Marketable securities Accounts receivable Inventories Tolel current assets Net nxed Assets $ $ 5 $ $ (Click on the Icon located on the top-right comer of the date table below In order to copy its contents into a spreadsheet Leonard Industries Balance Sheet December 31, 2015 D Assete Liabilities and Stockholders' Equity Cash $297.000 Accounts nayahin $1,401.000 Marketable securities 204.000 Accruals 405.000 Accounts receivabla 1,203.000 Other current abilities 20.300 Inventories 1,800,000 Tolal current liabilities $1,888,300 Tatal current assets $3,504.000 Long-hom dat 1,998.700 Net Tixuu assets 4,000,000 LITTILL Book 3,719,000 Total labilities and Total des $7,504 CICO stockholders' acuity $7,50J4CIDO Total assets Print Done