Question: Homework: Wek #7 Chapter # 13 Homework Save HW Score: 63.78 % , 26.79 of 42 pts Score: 1.79 of 5 pts 24 of 25

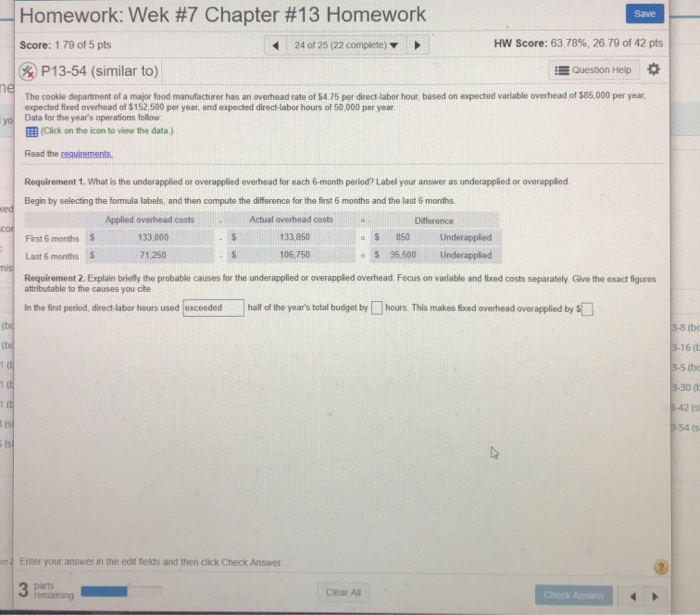

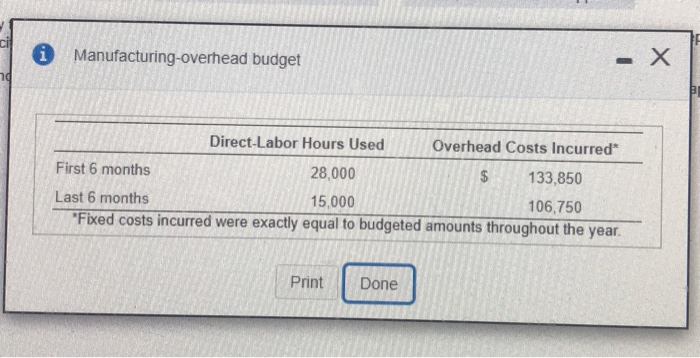

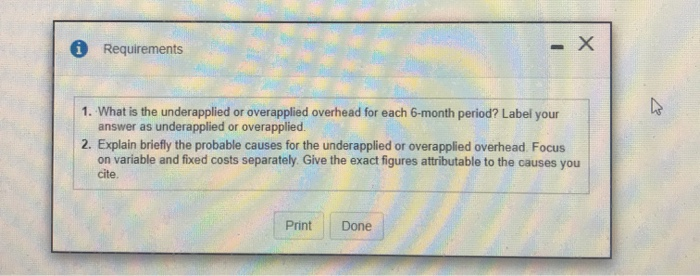

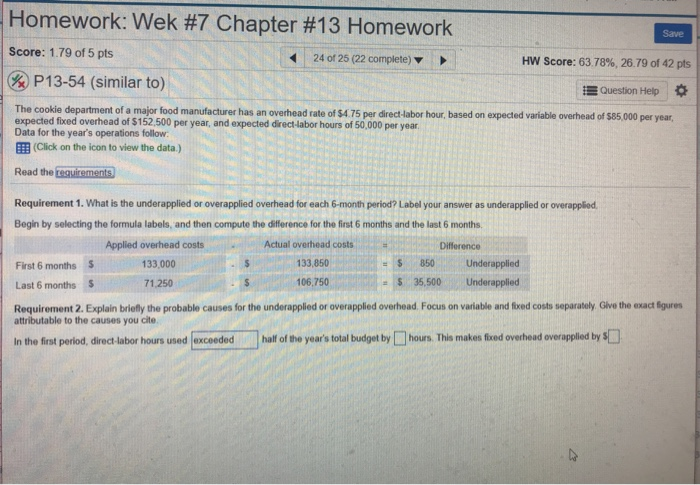

Homework: Wek #7 Chapter # 13 Homework Save HW Score: 63.78 % , 26.79 of 42 pts Score: 1.79 of 5 pts 24 of 25 (22 complete) P13-54 (similar to) Question Help ne The cookie department of a major food manufacturer has an overhead rate of $4.75 per direct-labor hour, based on expected variable overhead of $85,000 per year expected fixed overhead of $152,500 per year, and expected direct-labor hours of 50,000 per year. Data for the year's operations follow yo (Click on the icon to view the data) Read the requirements Requirement 1. What is the underapplied or overapplied overhead for each 6-month period? Label your answer as underapplied or overapplied Begin by selecting the formula labels, and then compute the difference for the first 6 months and the last 6 months ced Applied overhead costs Actual overhead costs Difference cor First 6 months S 133.000 133,850 850 Underapplied S 35,500 Last 6 months S mis Requirement 2. Explain briefly the probable causes for the underapplied or overapplied overhead Focus on variable and fixed costs separately Give the exact fiqures attributable to the causes you cite 71,250 106,750 Underapplied hours This makes fixed overhead overapplied by S In the first period, direct-labor hours used exceeded half of the year's total budget by (bd 3-8 (bc (bd 3-16 (b 1 (t 3-5 (bc 1 (B 3-30 (E 1 (b 8-42 (si (si B-54 (s (si ct 2 Enter your answer in the edit fields and then click Check Answer 3 parts remaining Clear All Check Answer X ci i Manufacturing-overhead budget Overhead Costs Incurred Direct-Labor Hours Used First 6 months $ 133,850 28,000 Last 6 months 15,000 106,750 Fixed costs incurred were exactly equal to budgeted amounts throughout the year Print Done - X Requirements 1. What is the underapplied or overapplied overhead for each 6-month period? Label your underapplied or overapplied answer as 2. Explain briefly the probable causes for the underapplied or overapplied overhead. Focus on variable and fixed costs separately. Give the exact figures attributable to the causes you cite. Print Done Homework: Wek # 7 Chapter # 13 Homework Save Score: 1.79 of 5 pts 24 of 25 (22 complete) HW Score: 63 78%, 26.79 of 42 pts P13-54 (similar to Question Help The cookie department of a major food manufacturer has an overhead rate of $4.75 per direct-labor hour, based on expected variable overhead of $85,000 per year, expected fixed overhead of $152,500 per year, and expected direct-labor hours of 50,000 per year Data for the year's operations follow EE(Click on the icon to view the data.) Read the requirements Requirement 1. What is the underapplied or overapplied overhead for each 6-month period? Label your answer as underapplied or overapplied Begin by selecting the formula labels, and then compute the difference for the first 6 months and the last 6 months. Actual overhead costs Applied overhead costs Difference 133,000 133,850 850 Underapplied First 6 months S 106.750 35,500 Underapplied S 71,250 $ Last 6 months Requirement 2. Explain briefly the probable causes for the underapplied or overapplied overhead. Focus on variable and fixed costs separately Give the exact igures attributable to the causes you cite. half of the year's total budget by hours. This makes fixed overhead overapplied by S In the first period, direct-labor hours used exceeded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts