Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is sufficent information to answer the question. solve for 2018 1. From the company's most recent financial statements, find the company's a. total revenue

This is sufficent information to answer the question.

solve for 2018

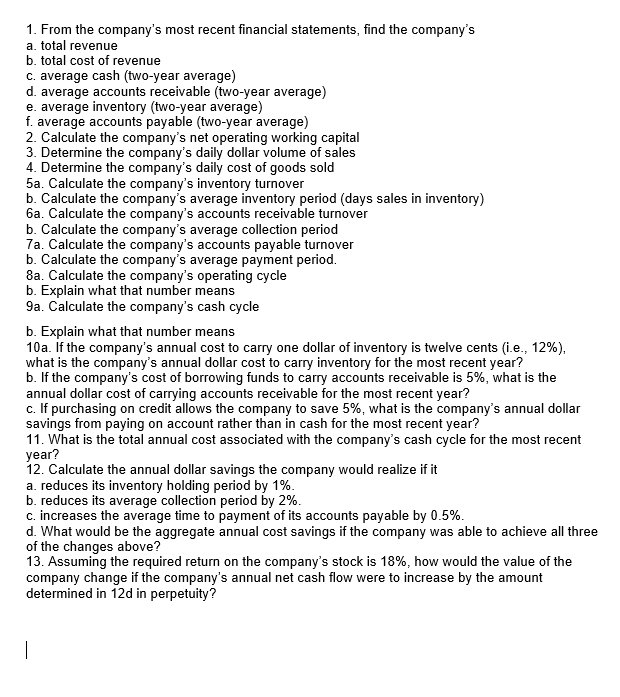

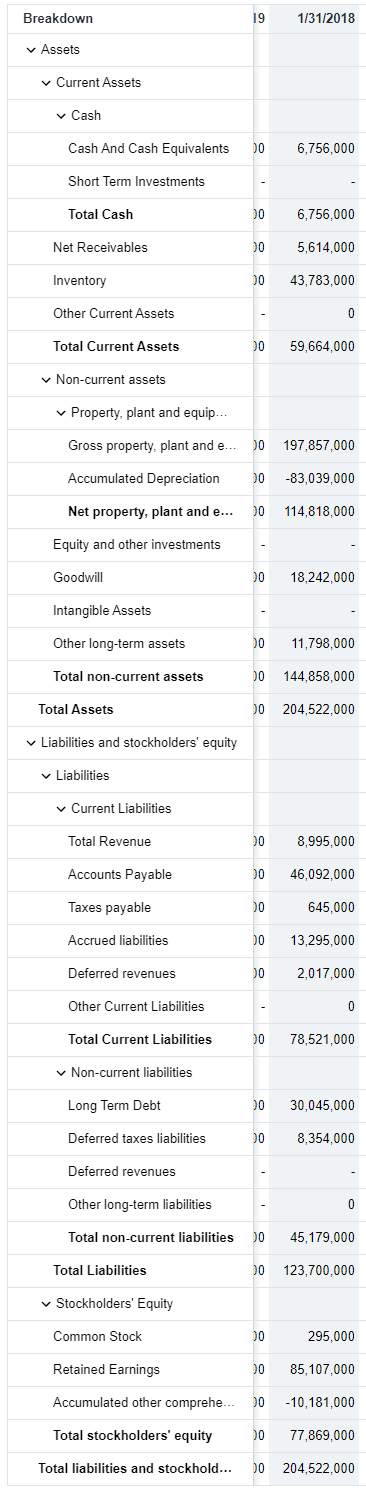

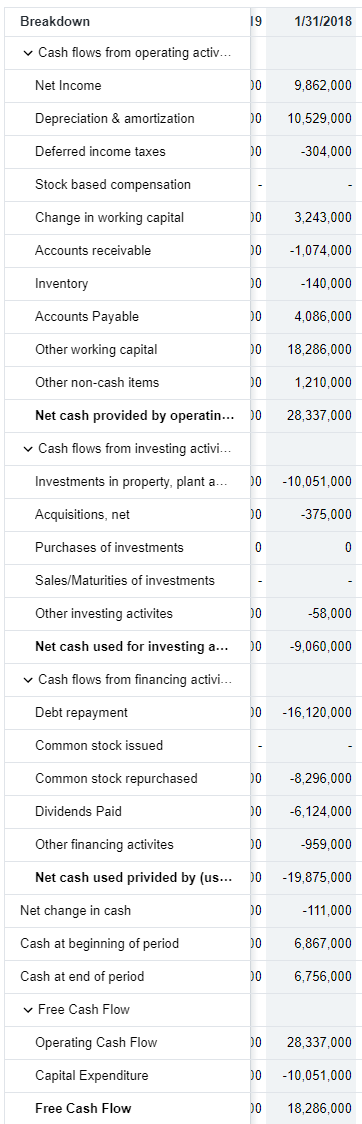

1. From the company's most recent financial statements, find the company's a. total revenue b. total cost of revenue C. average cash (two-year average) d. average accounts receivable (two-year average) e. average inventory (two-year average) f. average accounts payable (two-year average) 2. Calculate the company's net operating working capital 3. Determine the company's daily dollar volume of sales 4. Determine the company's daily cost of goods sold 5a. Calculate the company's inventory turnover b. Calculate the company's average inventory period (days sales in inventory) 6a. Calculate the company's accounts receivable turnover b. Calculate the company's average collection period 7a. Calculate the company's accounts payable turnover b. Calculate the company's average payment period. 8a. Calculate the company's operating cycle b. Explain what that number means 9a. Calculate the company's cash cycle b. Explain what that number means 10 a. If the company's annual cost to carry one dollar of inventory is twelve cents (i.e., 12%), what is the company's annual dollar cost to carry inventory for the most recent year? b. If the company's cost of borrowing funds to carry accounts receivable is 5%, what is the annual dollar cost of carrying accounts receivable for the most recent year? c. If purchasing on credit allows the company to save 5%, what is the company's annual dollar savings from paying on account rather than in cash for the most recent year? 11. What is the total annual cost associated with the company's cash cycle for the most recent year? 12. Calculate the annual dollar savings the company would realize if it a. reduces its inventory holding period by 1%. b. reduces its average collection period by 2%. c. increases the average time to payment of its accounts payable by 0.5%. d. What would be the aggregate annual cost savings if the company was able to achieve all three of the changes above? 13. Assuming the required return on the company's stock is 18%, how would the value of the company change if the company's annual net cash flow were to increase by the amount determined in 12d in perpetuity? Breakdown 19 1/31/2018 Assets Current Assets Cash Cash And Cash Equivalents 0 6,756,000 Short Term Investments Total Cash 6,756,000 Net Receivables DO 5,614,000 Inventory 00 43,783,000 Other Current Assets Total Current Assets DO 59,664,000 Non-current assets Property, plant and equip... Gross property, plant and e... DO Accumulated Depreciation O 197,857,000 -83,039,000 Net property, plant and e... DO 114,818,000 Equity and other investments Goodwill DO 18,242,000 Intangible Assets Other long-term assets DO 11,798,000 Total non-current assets 00 144,858,000 Total Assets 00 204,522,000 Liabilities and stockholders' equity Liabilities Current Liabilities Total Revenue DO 8,995,000 Accounts Payable DO 46,092,000 Taxes payable 10 645,000 Accrued liabilities 13.295,000 Deferred revenues DO 2,017,000 Other Current Liabilities Total Current Liabilities DO 78,521,000 Non-current liabilities Long Term Debt DO 30,045,000 Deferred taxes liabilities DO 8,354,000 Deferred revenues Other long-term liabilities Total non-current liabilities DO 45,179,000 Total Liabilities 00 123,700,000 Stockholders' Equity Common Stock 00 295,000 Retained Earnings 0085,107,000 Accumulated other comprehe... DO -10,181,000 Total stockholders' equity DO 77,869,000 Total liabilities and stockhold... DO 204,522,000 Breakdown 191/31/2018 Cash flows from operating activ... Net Income 00 9,862,000 Depreciation & amortization 00 10,529,000 Deferred income taxes 00 -304,000 Stock based compensation Change in working capital DO 3,243,000 Accounts receivable 00 -1,074,000 Inventory -140,000 Accounts Payable DO 4,086,000 Other working capital 00 18,286,000 Other non-cash items 1,210,000 Net cash provided by operatin... 0 28,337,000 vCash flows from investing activi... Investments in property, plant a... 0 -10,051,000 Acquisitions, net DO -375,000 Purchases of investments 0 Sales/Maturities of investments Other investing activites DO -58,000 Net cash used for investing a... 0 -9,060,000 Cash flows from financing activi... Debt repayment 0 -16,120,000 Common stock issued Common stock repurchased DO -3,296,000 Dividends Paid DO -6,124,000 Other financing activites DO -959,000 Net cash used privided by (us... DO -19,875,000 Net change in cash 00 - 111,000 Cash at beginning of period 006,867,000 Cash at end of period 00 6,756,000 Free Cash Flow Operating Cash Flow 00 28,337,000 Capital Expenditure 00 -10,051,000 Free Cash Flow 00 18,286,000 Breakdown 19 1/31/2018 Total Revenue 10 500,343,000 Cost of Revenue 0 373,396,000 Gross Profit 10 126,947,000 Operating Expenses Research Development Selling General and Administrative DO 106,510,000 Total Operating Expenses DO 106,510,000 Operating Income or Loss 20 20,437,000 Interest Expense 20 2,330,000 Total Other Income/Expenses Net DO -3,136,000 Income Before Tax 15,123,000 Income Tax Expense 4,600,000 Income from Continuing Operations O 10,523,000 Net Income 9,862,000 Net Income available to common s... DO 9,862,000 Reported EPS Basic 3.29 Diluted 26 3.28 Weighted average shares outst... Basic 00 2,995,000 Diluted 00 3,010,000 EBITDA 00 27,982,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started