Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Honda is considering increasing production after unexpected strong demand for its new motorbike. To evaluate the proposal, the company needs to calculate its cost

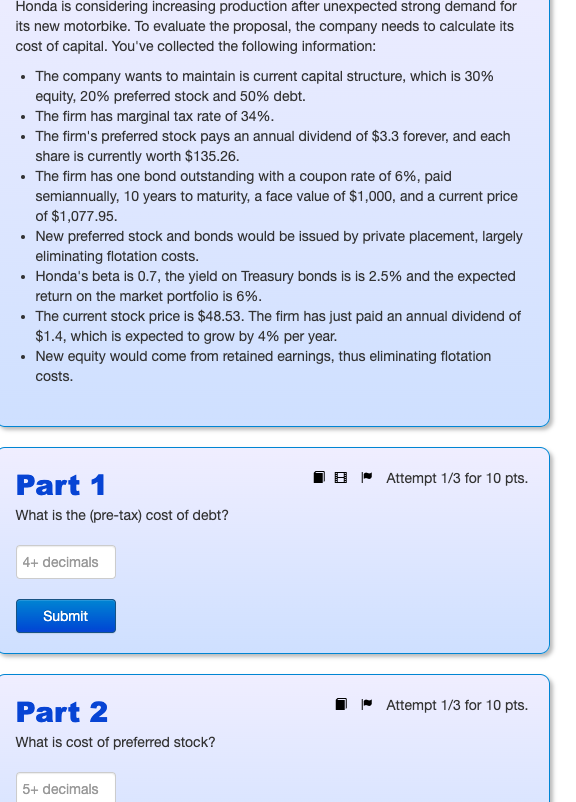

Honda is considering increasing production after unexpected strong demand for its new motorbike. To evaluate the proposal, the company needs to calculate its cost of capital. You've collected the following information: . The company wants to maintain is current capital structure, which is 30% equity, 20% preferred stock and 50% debt. The firm has marginal tax rate of 34%. The firm's preferred stock pays an annual dividend of $3.3 forever, and each share is currently worth $135.26. The firm has one bond outstanding with a coupon rate of 6%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,077.95. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. Honda's beta is 0.7, the yield on Treasury bonds is is 2.5% and the expected return on the market portfolio is 6%. The current stock price is $48.53. The firm has just paid an annual dividend of $1.4, which is expected to grow by 4% per year. New equity would come from retained earnings, thus eliminating flotation costs. Part 1 What is the (pre-tax) cost of debt? 4+ decimals Submit Attempt 1/3 for 10 pts. Part 2 What is cost of preferred stock? 5+ decimals Attempt 1/3 for 10 pts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started