Answered step by step

Verified Expert Solution

Question

1 Approved Answer

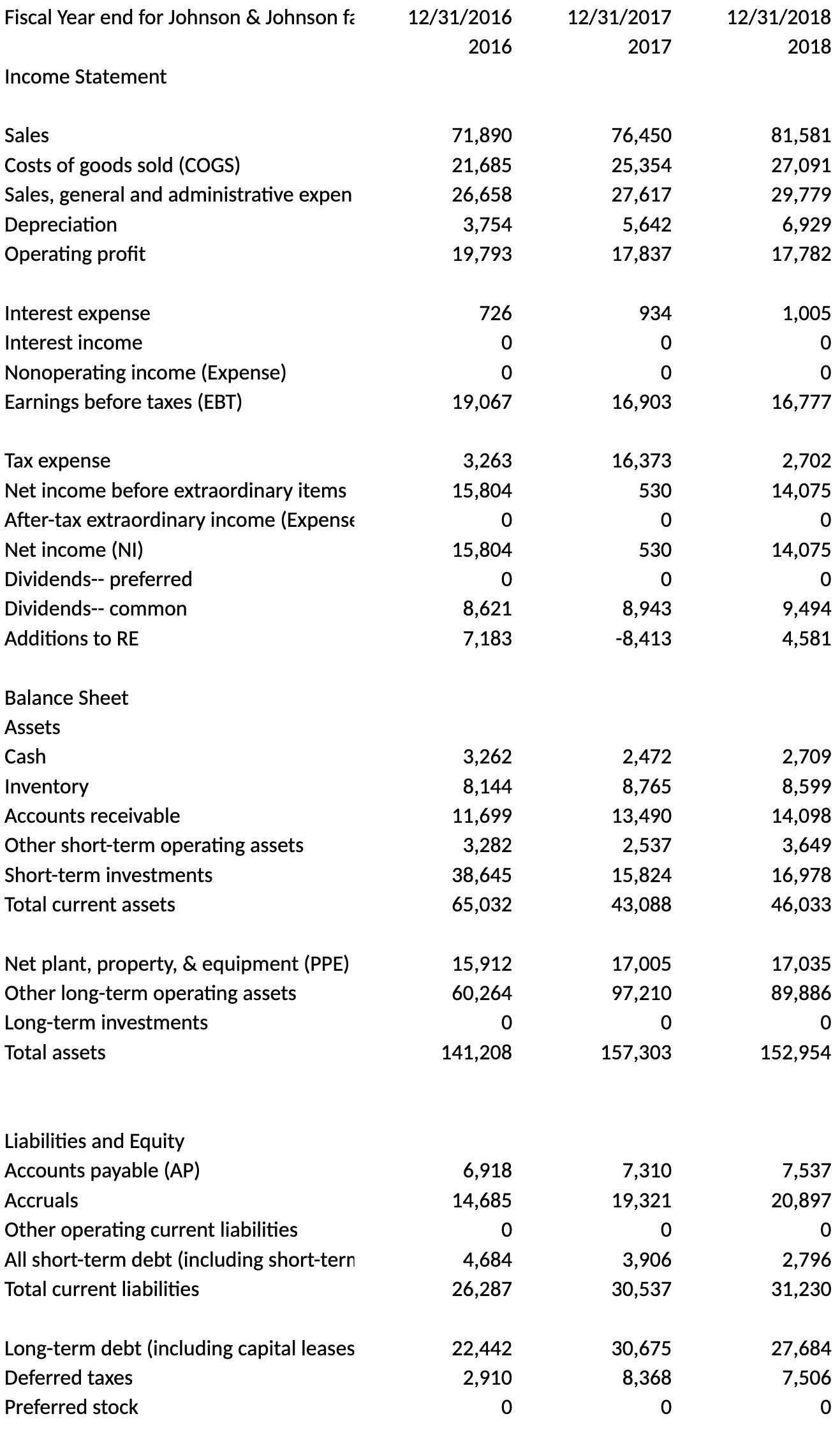

How to calculate WACC in this report Fiscal Year end for Johnson & Johnson fa 12/31/2016 2016 Income Statement 12/31/2017 12/31/2018 2017 2018 Sales 71,890

How to calculate WACC in this report

Fiscal Year end for Johnson & Johnson fa 12/31/2016 2016 Income Statement 12/31/2017 12/31/2018 2017 2018 Sales 71,890 76,450 81,581 Costs of goods sold (COGS) 21,685 25,354 27,091 Sales, general and administrative expen 26,658 27,617 29,779 Depreciation 3,754 5,642 6,929 Operating profit 19,793 17,837 17,782 Interest expense 726 934 1,005 Interest income 0 0 Nonoperating income (Expense) 0 0 0 Earnings before taxes (EBT) 19,067 16,903 16,777 Tax expense 3,263 16,373 2,702 Net income before extraordinary items 15,804 530 14,075 After-tax extraordinary income (Expense 0 0 0 Net income (NI) 15,804 530 14,075 Dividends--preferred 0 0 0 Dividends-- common 8,621 8,943 9,494 Additions to RE 7,183 -8,413 4,581 Balance Sheet Assets Cash 3,262 2,472 2,709 Inventory 8,144 8,765 8,599 Accounts receivable 11,699 13,490 14,098 Other short-term operating assets 3,282 2,537 3,649 Short-term investments 38,645 15,824 16,978 Total current assets 65,032 43,088 46,033 Net plant, property, & equipment (PPE) 15,912 17,005 17,035 Other long-term operating assets 60,264 97,210 89,886 Long-term investments 0 0 0 Total assets 141,208 157,303 152,954 Liabilities and Equity Accounts payable (AP) 6,918 Accruals 14,685 7,310 19,321 7,537 20,897 Other operating current liabilities 0 0 0 All short-term debt (including short-tern 4,684 3,906 2,796 Total current liabilities 26,287 30,537 31,230 Long-term debt (including capital leases 22,442 30,675 27,684 Deferred taxes 2,910 8,368 7,506 Preferred stock 0 0 0

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate WACC for Johnson Johnson for fiscal year 2018 based on the informati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started