Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve according to malaysian university finance standard formula QUESTION 3 LunaTech Inc. is currently utilizing the Astra processor, acquired 9 years ago with

How to solve according to malaysian university finance standard formula

QUESTION

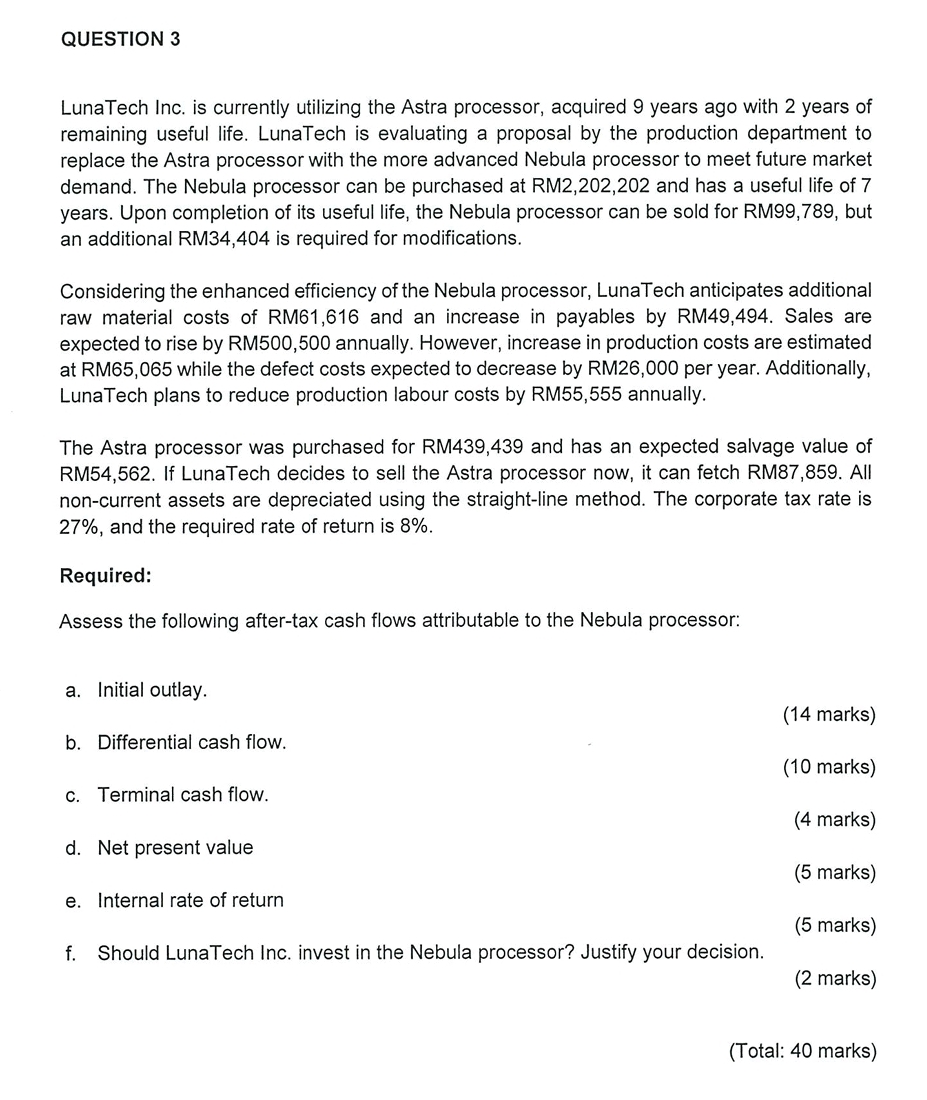

LunaTech Inc. is currently utilizing the Astra processor, acquired years ago with years of

remaining useful life. LunaTech is evaluating a proposal by the production department to

replace the Astra processor with the more advanced Nebula processor to meet future market

demand. The Nebula processor can be purchased at RM and has a useful life of

years. Upon completion of its useful life, the Nebula processor can be sold for RM but

an additional RM is required for modifications.

Considering the enhanced efficiency of the Nebula processor, LunaTech anticipates additional

raw material costs of RM and an increase in payables by RM Sales are

expected to rise by RM annually. However, increase in production costs are estimated

at RM while the defect costs expected to decrease by RM per year. Additionally,

LunaTech plans to reduce production labour costs by RM annually.

The Astra processor was purchased for RM and has an expected salvage value of

RM If LunaTech decides to sell the Astra processor now, it can fetch RM All

noncurrent assets are depreciated using the straightline method. The corporate tax rate is

and the required rate of return is

Required:

Assess the following aftertax cash flows attributable to the Nebula processor:

a Initial outlay.

marks

b Differential cash flow.

marks

c Terminal cash flow.

marks

d Net present value

marks

e Internal rate of return

marks

f Should LunaTech Inc. invest in the Nebula processor? Justify your decision.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started