Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How were these numbers calculated? Please show all work! Requirements 1. 2. Should TechHelp upgrade its production line or replace it? Show your calculations Now

How were these numbers calculated? Please show all work!

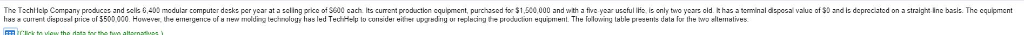

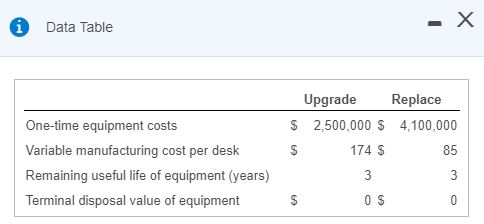

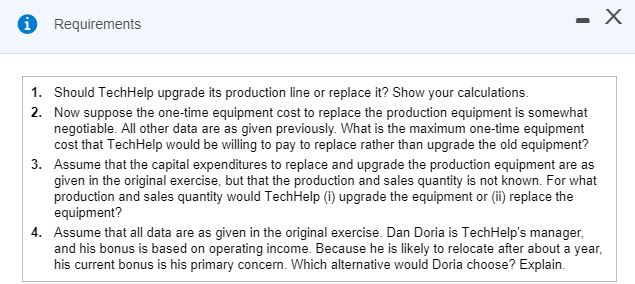

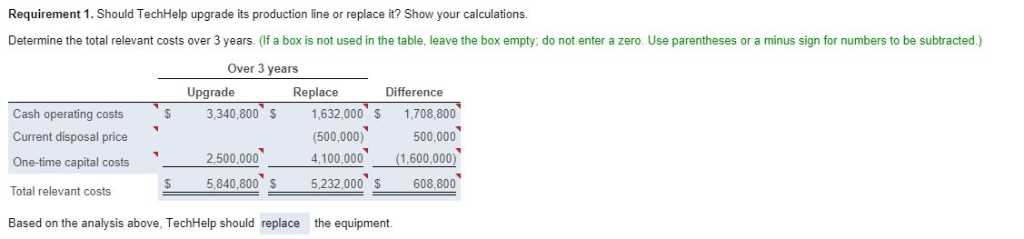

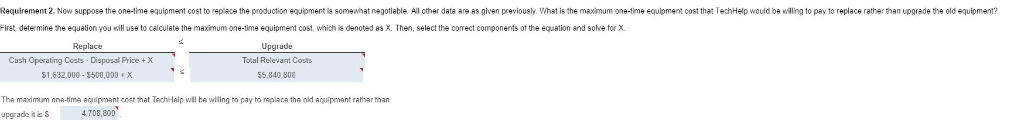

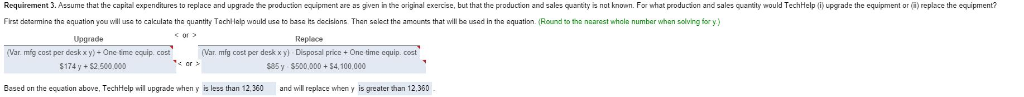

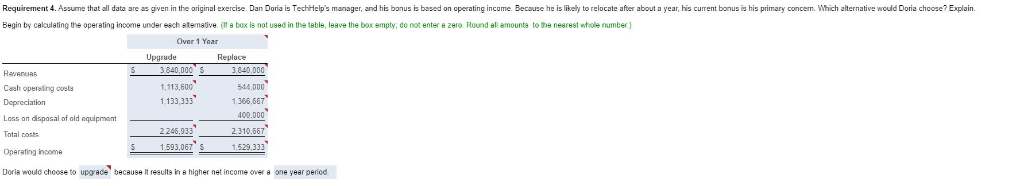

Requirements 1. 2. Should TechHelp upgrade its production line or replace it? Show your calculations Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable. All other data are as given previously. What is the maximum one-time equipment cost that TechHelp would be willing to pay to replace rather than upgrade the old equipment? Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that the production and sales quantity is not known. For what production and sales quantity would TechHelp () upgrade the equipment or (ii) replace the equipment? Assume that all data are as given in the original exercise. Dan Doria is TechHelp's manager, and his bonus is based on operating income. Because he is likely to relocate after about a year his current bonus is his primary concern. Which alternative would Doria choose? Explain. 3. 4. bs willing to pay to replace rather than upgrad Requirement 2. Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable All other data are as given previously. What is the maximum one-time equipment cost that TechHelp would be willing to pay to replace rather than upgrade the old equipment? -irst, determine the equation you will use to calculste the maximum one-time equipment cost, which is denoted asX. Then, select the come equation nd solve tor X ect components of the which is Replace Upgrade Total Relevant Costs 55,840,800 Cash Operating Costs Disposal Price +X $1,532 000-5500,000 X Tha maxdmum one-time qlpmant cost that TechHalp will be wiling to pay to raplaca the old aquipmant rathar than upgrade ii S 4.708,800 Requirement 3. Aesume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercse,but that the production and sales quantity is not knowm. For what producaion and sales quantity would TechHelpupgrade the equipment or )replace the equipment? Frst datarmina tha equation you will uso to calculate tha quantity TachHalp would use to basa hs decisions Than salect the amcunts that will be used in tha equation. (Round so tha naarest whala number whan solving fory or Upgrade Var mig cost per deskxy) One tme ccuip cos Replece Var. mfg cost per desk x y) Disposal price+Onc time equip. cost $174 y $2.500 000 385y 3500,000+$4,100,000 Based on the equation above, TechHelp wil upgrade when y is les than 12, 360and will replace when y is greater than 12,360 Requirement 4. Assume that all data are as given in the original exese. Dan Doria is TechHelp's manager, and his bonus i based on operating income. Becouse he is likely to relocate after about a year, his current bonus is his primary concerm. Which alternative would Doria choose? Explain Begin by caiculsting the operating income under eech atemaive. if box is not used in the 1eble, leave the box empty, de not enter zero. Round all amounts to the nearest whole number) Over 1 Year Upgrade Replace Revenuas Cash operaling costs Depreciation Loss on disposal of old equipmant Total cost Operating income Doria would choose to upgrade' because it reeults in e higher net income over a one yeer period 1,113,600 544,000 1.133,333 366.667 2 246,933 593,067 S to upgrade one year in s higherStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started