Answered step by step

Verified Expert Solution

Question

1 Approved Answer

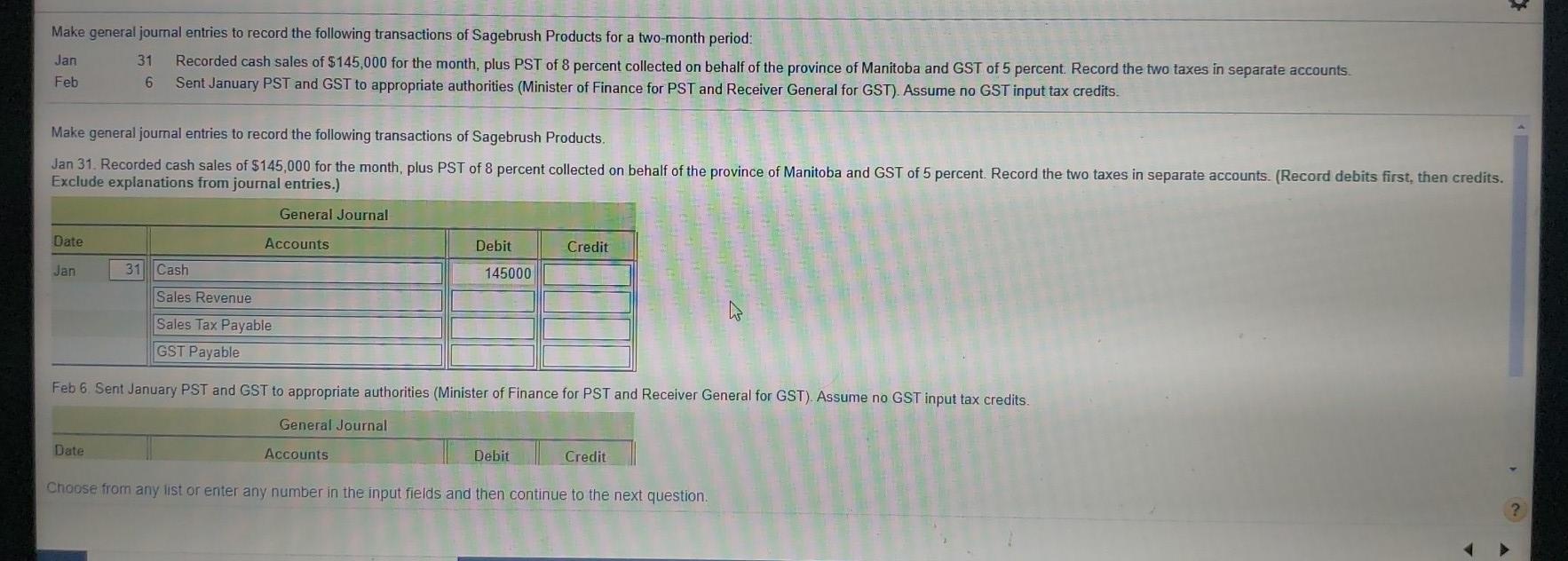

Make general journal entries to record the following transactions of Sagebrush Products for a two-month period: Jan 31 Recorded cash sales of $145,000 for the

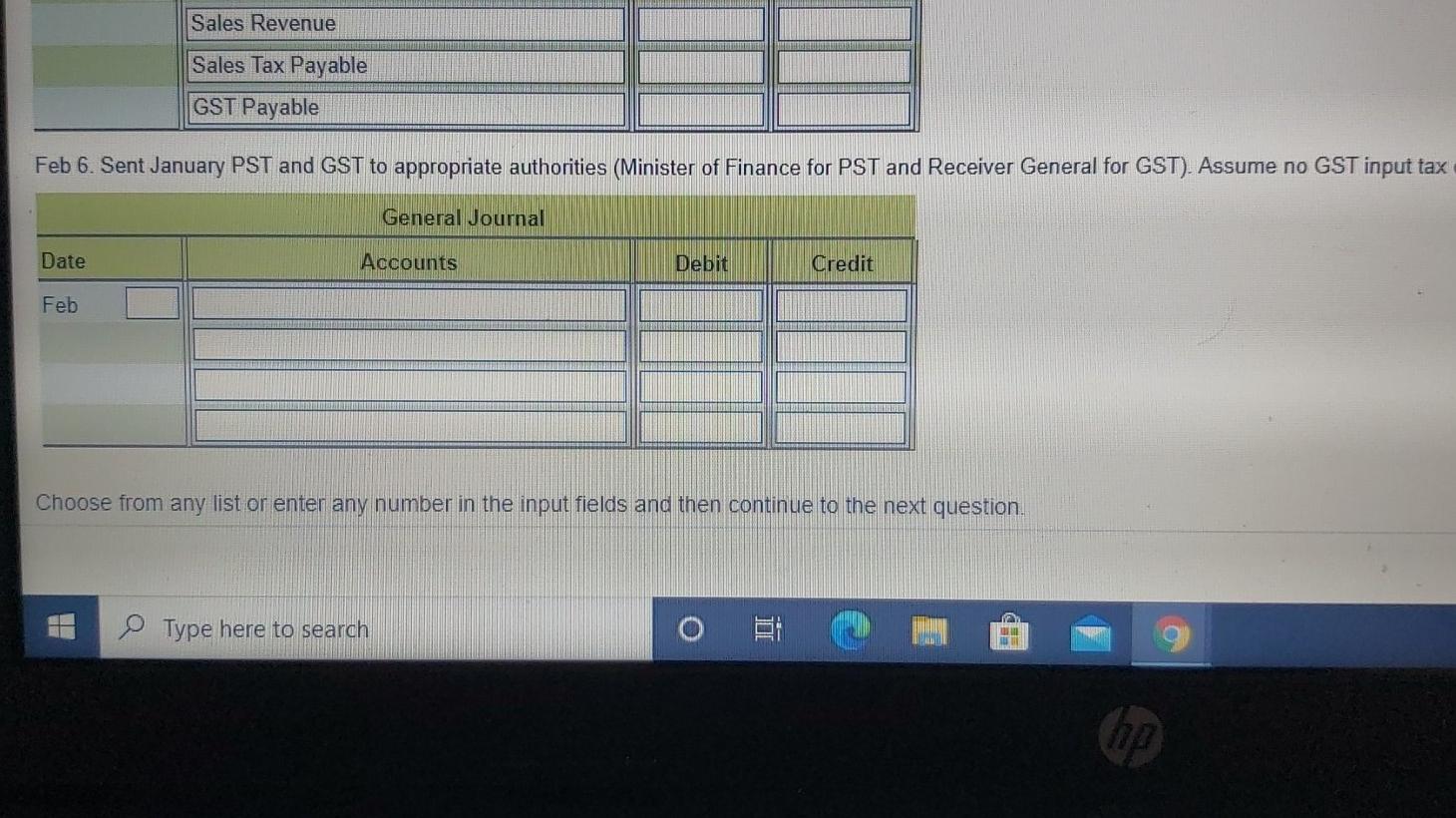

Make general journal entries to record the following transactions of Sagebrush Products for a two-month period: Jan 31 Recorded cash sales of $145,000 for the month, plus PST of 8 percent collected on behalf of the province of Manitoba and GST of 5 percent. Record the two taxes in separate accounts Feb 6 Sent January PST and GST to appropriate authorities (Minister of Finance for PST and Receiver General for GST). Assume no GST input tax credits. Make general journal entries to record the following transactions of Sagebrush Products, Jan 31. Recorded cash sales of $145,000 for the month, plus PST of 8 percent collected on behalf of the province of Manitoba and GST of 5 percent. Record the two taxes in separate accounts. (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Date Accounts Debit Credit Jan 31 Cash 145000 Sales Revenue Sales Tax Payable GST Payable Feb 6 Sent January PST and GST to appropriate authorities (Minister of Finance for PST and Receiver General for GST). Assume no GST input tax credits. General Journal Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question ? A Sales Revenue Sales Tax Payable GST Payable Feb 6. Sent January PST and GST to appropriate authorities (Minister of Finance for PST and Receiver General for GST). Assume no GST input tax General Journal Date Accounts Debit Credit Feb Choose from any list or enter any number in the input fields and then continue to the next question. Type here to search O ji 1242

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started