Answered step by step

Verified Expert Solution

Question

1 Approved Answer

https://www.alsglobal.com/en#undefined https://au.finance.yahoo.com/quote/ALQ.AX/financials?p=ALQ.AX https://www2.asx.com.au/markets/company/ALQ Assume it is now March 2021. You are working in an investment banking company called XYZ as an equity research analyst. A

https://www.alsglobal.com/en#undefined

https://au.finance.yahoo.com/quote/ALQ.AX/financials?p=ALQ.AX https://www2.asx.com.au/markets/company/ALQ

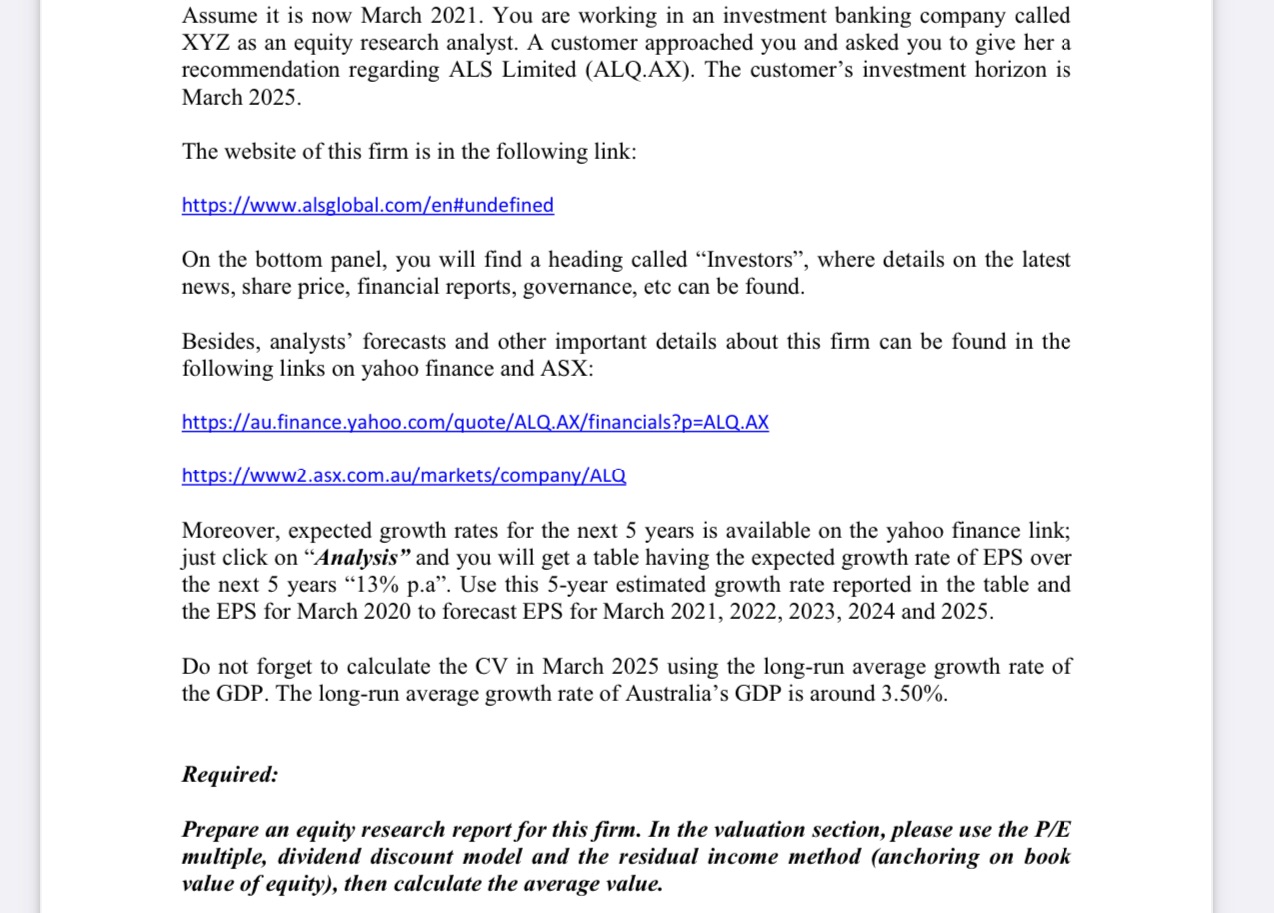

Assume it is now March 2021. You are working in an investment banking company called XYZ as an equity research analyst. A customer approached you and asked you to give her a recommendation regarding ALS Limited (ALQ.AX). The customer's investment horizon is March 2025. The website of this firm is in the following link: https://www.alsglobal.com/en#undefined On the bottom panel, you will find a heading called "Investors", where details on the latest news, share price, financial reports, governance, etc can be found. Besides, analysts' forecasts and other important details about this firm can be found in the following links on yahoo finance and ASX: https://au.finance.yahoo.com/quote/ALQ.AX/financials?p=ALQ.AX https://www2.asx.com.au/markets/company/ALQ Moreover, expected growth rates for the next 5 years is available on the yahoo finance link; just click on "Analysis" and you will get a table having the expected growth rate of EPS over the next 5 years "13% p.a". Use this 5-year estimated growth rate reported in the table and the EPS for March 2020 to forecast EPS for March 2021, 2022, 2023, 2024 and 2025. Do not forget to calculate the CV in March 2025 using the long-run average growth rate of the GDP. The long-run average growth rate of Australia's GDP is around 3.50%. Required: Prepare an equity research report for this firm. In the valuation section, please use the P/E multiple, dividend discount model and the residual income method (anchoring on book value of equity), then calculate the average value.

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Your Name Equity Research Analyst XYZ Investment Banking Date Current Date Subject Equity Research Report ALS Limited ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started